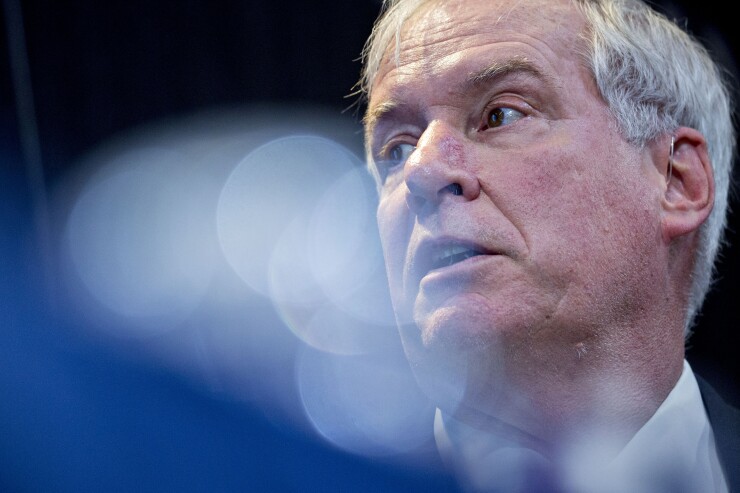

Given the pessimism in the financial markets, the Fed should hold rates until economic trends clarify, Federal Reserve Bank of Boston President Eric Rosengren said Wednesday.

“[I]f the pessimism evident in financial markets eventually shows through to economic outcomes, there would be less need (and perhaps no need) for further increases in interest rates,” Rosengren told the Boston Economic Club, according to prepared text release by the Fed. “However, my current expectation is that the more optimistic view will prevail, with economic outcomes consistent with the more upbeat forecasts (and stock markets perhaps rebounding). Yet given the reduced certainty I have about my forecast — in light of the slowing abroad and volatile financial markets — in my view, the appropriate stance for monetary policy is, for now, to not have a bias on moving policy in either direction until there is greater clarity around economic trends here and abroad. The Federal Reserve’s current monetary policy seems appropriate for now, and can patiently observe future economic developments.”

Personally, Rosengren said, he believes the outlook is not as dismal as financial markets suggest. “I expect real growth over 2019 to remain solid enough to tighten the U.S. labor market somewhat,” he said. “My views are therefore closer to the optimism reflected by many professional forecasters and the FOMC members of late, than they are to the recent pessimism in financial markets.”

But the perception of greater risk suggested by the market volatility, when combined with worries about “global growth, international trade, and geopolitical upheaval,” must be considered “and serve as a prudent warning that actual economic outcomes could diverge significantly from what is being forecast.”

And, the chasm between the pessimism in the markets and optimistic economic forecast “highlights why monetary policy should not be on a set course, but rather should take into account and reflect how real economic data unfold.”

Rosengren said monetary policy should “be both flexible and patient” and it is “appropriately balancing risks” presently.

If the risks come to fruition and the economy slows, “which is not my baseline forecast,” he said, policymakers would have to shift their views. “But at this juncture, with two very different scenarios — economic slowdown implied by financial markets; or growth somewhat above potential GDP growth, consistent with economic forecasts — I believe we can wait for greater clarity before adjusting policy.”

He stressed the importance of policy being data dependent, with “no particular bias toward raising or lowering rates until the data more clearly indicate the path for domestic and international economic growth.”