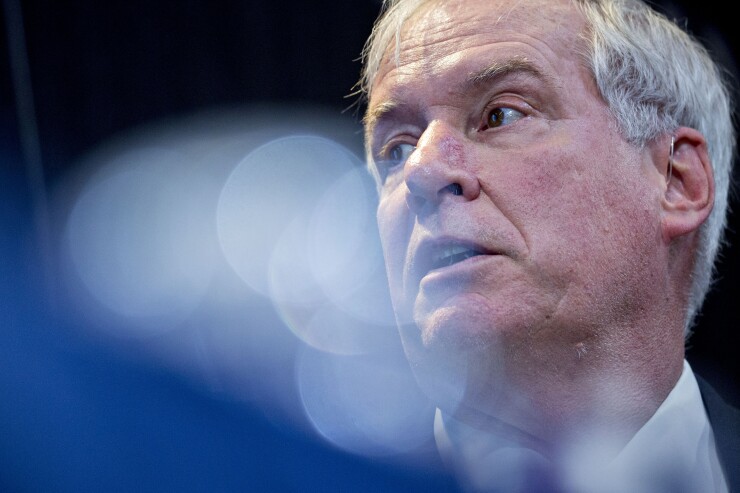

With signs of economic weakness toward the end of 2018 and a rise in downside risks, the Federal Open Market Committee can wait “several meetings” before changing rates, Federal Reserve Bank of Boston President Eric Rosengren said Tuesday.

“It may be several meetings of the Federal Open Market Committee before Fed policymakers have a clearer read on whether the risks are becoming reality – and by how much the economy will slow compared to last year,” Rosengren said in a speech in Boston, according to prepared text released by the Fed. “With less ebullience in financial markets and no immediate signs of inflationary pressures, patiently watching to see how the economy develops is the appropriate policy for now, and represents prudent management of risks to the forecast.”

Inflation should remain near 2%, or “close to target,” with labor markets continuing to tighten, he said. “In my view, current monetary policy needs to balance this relatively benign forecast with the increased downside risks that are reflected in asset prices.”

While equity prices have recovered somewhat, he said, “financial markets overall continue to price in downside risks to the economy.” He pointed to “longer Treasury rates and wider credit spreads, consistent with the ongoing risks posed by slower global growth.”

The partial federal government shutdown had delayed incoming data, but the December retail sales report suggested “the economy may be slowing a bit faster than policymakers anticipated.”

Rosengren said, “It could be that asset-price declines, government shutdowns, and challenges in reaching trade agreements were the source of slowing in the real economy at the end of last year. Or it could be that asset price weakness reflected the perception that the economy was slowing, particularly in the face of rising interest rates. It remains to be seen whether the few signs of weakness at the turn of the year reflect an underlying slowdown in the economy, or a response to a variety of temporary concerns that may fade.”