WASHINGTON – The median net pension liability in the nation’s 15 largest cities jumped 16% on a per capita basis to $2,741 in fiscal 2017 from $2,361 a year earlier, an annual survey by S&P Global Ratings said Wednesday.

The increase suggests “that pension liabilities are growing at a faster rate than debt and contributing to a cost trajectory that will likely tend to favor spending on pensions over debt and, by extension, capital investment,” S&P said.

Twelve of the nation’s 15 largest cities are paying more for pension costs than for debt service.

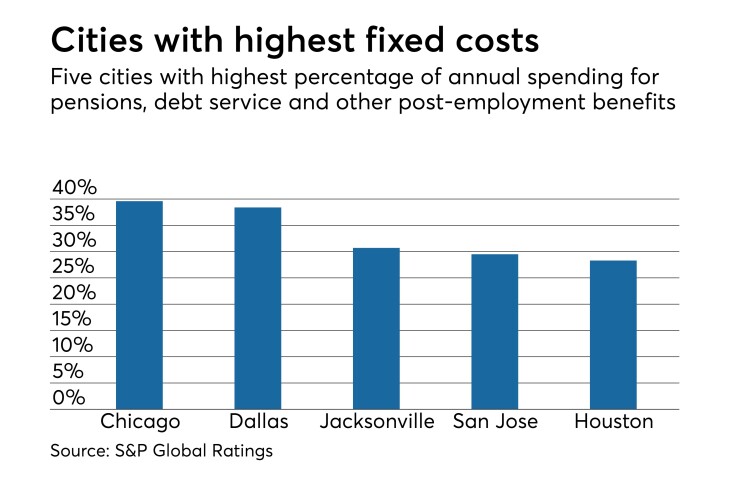

Chicago, Dallas and Jacksonville have fixed costs for pensions, other post-employment benefits and debt service in excess of 30% of their annual budgets while San Jose is just under 30%.

The other 11 cities included in the report are Austin, Columbus, Houston, Indianapolis, Los Angeles, New York, Philadelphia, Phoenix, San Diego, San Antonio and San Francisco.

“Fixed costs for pension and OPEB obligations appear poised to remain a front-and-center credit issue across the municipal sector for the foreseeable future,” the report said.

High fixed costs are putting pressure on the budgeting for public safety and public works for cities that lack revenue growth from tax increases or new sources of revenue, the report said.

“The upshot of all of this is that any of the major cities that currently faces a backlog of deferred capital will only find it more difficult to keep pace with demand for new infrastructure investment, as mounting legacy costs command an ever greater share of budgets,” the report said.

The median funding level for public sector pensions provided by the 15 cities is 69%, which is similar to two years earlier when it was 70%.

Chicago ranked at the bottom because it funds only 26% of its pension liabilities while Indianapolis ranked at the top at a 96% funding level.

“Most municipal pension plans experienced sharp declines in asset values during and after the recession and have since struggled to return to the comparatively strong funding levels that were common in the early 2000s,” S&P said.

Compounding the problem is that many jurisdictions have had to lower their rate-of-return assumptions and retirees are living longer.

Rate-of-return assumptions in most of the nation’s largest cities have been reduced in recent years.

Their average assumed rate of return on pension investments was 7.3% in fiscal 2017, which S&P views favorably, noting in the report that it’s in line with national trends.

The highest assumed investment return was 8% by the Ohio Police and Fire Pension Fund, in which the City of Columbus participates. The next highest was a 7.75% assumed investment return by the Philadelphia Board of Pensions and Retirement.

“Dallas's Police and Fire Combined Pension Plan assumed the lowest 4.12% single blended GASB discount rate as of Jan. 1, 2017 (combining a 7.3% investment rate of return with a municipal bond rate), and results in the lowest reported funded ratio among the largest cities' largest plans at 25.5%, though more recent pension reform will likely yield a stronger funded ratio after 2017,” the report said.

Likewise, Chicago is mandated under law to achieve 90% funding of each of its four public sector pension plans over 40 years and to begin actuarially funding them toward that goal at the end of a five-year ramp up period.

The National Association of State Retirement Administrators released a national survey of 128 state and local plans in February that found the average assumed investment return has dropped to 7.36% from 7.91% in fiscal 2010.

In addition to making these adjustments, many cities have dynamic economies. S&P said the nation’s largest cities “tend to be the economic engines propelling robust regional economies and to that extent have greater revenue-generating capacity.”