Municipal bond insurer analysts are rechecking their estimates of potential losses in Puerto Rico after the federal control board approved a 10-year plan that assumes less than 24% of debt coming due will be repaid.

The plan approved March 13 assumed a reduction in payments compared with earlier estimates, including the 35% estimated in Gov. Ricardo Rosselló's first fiscal plan submitted at the end of February. Most uninsured Puerto Rico bonds trade at about 63.5 cents on the dollar, based on figures from Markit.

The board's plan applied to general obligation debt, but not the debt of the Puerto Rico Electric Power Authority, the Puerto Rico Aqueduct and Sewer Authority and other public corporations. And it referred to payments due in the 10-year period, as opposed to the repayment over the life of bonds, which may be greater.

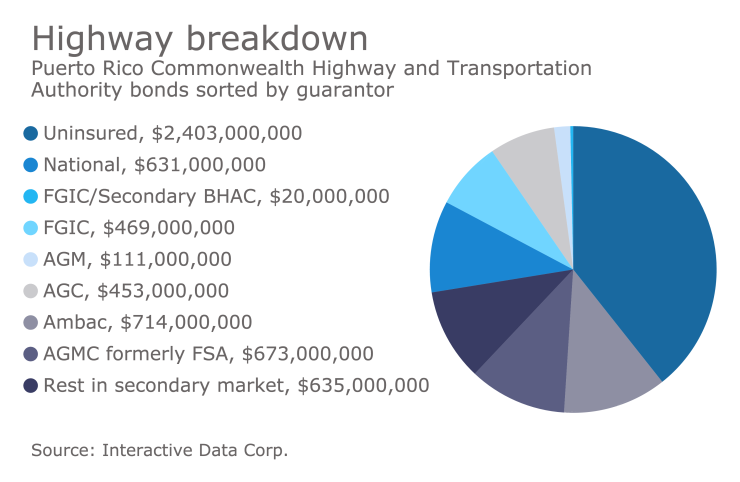

Bond insurers Assured Guaranty and National Public Finance Guarantee face a key test in Puerto Rico as they attempt a comeback after the fiscal crisis, and try to build business with AA ratings instead of triple-A. Analysts remain confident that the two are adequately capitalized to survive a worst-case scenario, though they are taking a closer look at trouble spots including the GO debt, Puerto Rico Electric Power Authority, and the PR Commonwealth Highway and Transportation Authority.

As of Dec. 31, Assured Guaranty's gross par outstanding of Puerto Rico bonds insured was $4.786 billion, while National Public Finance Guarantee's was $3.6 billion.

"If the losses reached 55% of Assured's exposure to issuers in Puerto Rico and 45% for National's, then each company's rating would come under pressure," said David Veno, director at S&P Global Ratings. "Another scenario that would be a concern for us would be, if they haven't finalized negotiations on PREPA and the bond insurers had to pay a large loss on the GO and highway bonds."

S&P's concern with the Puerto Rico Highways and Transportation Authority relates to the redirecting of toll road revenue, Veno said.

The Puerto Rico Commonwealth's general obligation bonds continue to slide following the board's approval of the plan. According to data from Markit, the 8s of 2025 yielded 13.606% on April 3, compared with 12.82% on March 16, according to Markit's evaluated price and yields to maturity. This bond had an original yield of 8.727%.

The PR Sales Tax Financing Corp. revenue 5s of 2040 bonds had a yield of 8.499% on April 3, which compared to a yield of 7.98% on March 16. According to EMMA, this bond had an initial offering price/yield of 103.823.

The Assured insured PR public improvement refunding GO 5s of 2035 bond had a yield of 4.15% on April 3, compared to 4.463% on Feb. 16. The National insured PR public improvement refunding GO 6s of 2027 bond had a yield of 3.208% on April 3, compared to 4.595% on Feb. 16.

Paul Kwiatkoski, managing director at Kroll Bond Rating Agency, said Kroll has anticipated Puerto Rico being costly for the bond insurers and that the rating service incorporated that potential outcome in their analysis going back more than several years.

"We stick by our stress case for the losses," Kwiatkowski said. "It is a pretty severe stress test, but it is hard to compare apples to apples to the fiscal plan, as that goes out 10 years but our stress case goes until the end of the life of the bonds. By in large, we are looking at a developing situation. No one knows the ultimate outcome of the situation but we feel strong about our stress case scenario."

Veno said the bond insurers' capital positions have strengthened in the past year due to the run off of insured exposure, and that forecasting the final settlement of Puerto Rico's bonds is difficult.

National declined to comment.

Robert Tucker, head of investor relations and communications at Assured said that in general, the initial recovery levels proposed by distressed issuers are materially lower than the final recovery levels reached through consensual settlements or litigation. He said past experience in distressed situations has shown Assured Guaranty's ability to achieve resolutions that not only provide higher recoveries but also provide assistance to the distressed issuer in regaining capital market access.

"In order for Puerto Rico to emerge from its financial distress, it needs to grow its economy, and to do that successfully, it needs to restore its credibility with creditors," Tucker said. "That means it must show a willingness to meet its obligations to the greatest extent possible, and deal fairly with creditors based on the priorities and liens protected by its constitution and laws. A failure to respect its own Constitution and contracts, a drive towards meeting as few of its obligations as possible, and a misuse of tools such as Title III under PROMESA, will lead to a long term inability to access capital to fund growth and infrastructure."

Tucker said the Federal government can also help by fixing laws that disadvantage Puerto Rico.

"Treating the island unfairly with regard to its basic healthcare needs or access to diversified shipping channels exacerbates the economic and fiscal problems of the island. But Puerto Rico cannot expect the Federal government to act swiftly with new legislation, if its Government and the Oversight Board fail to respect the rule of law or rein in existing expenses," Tucker said.

Kwiatkoski said KBRA is following the situation closely and are taking a look at the fiscal plan for Puerto Rico that the PROMESA board has approved as the rating service continues to review the bond insurers with exposure.

Tucker also noted that unlike other distressed jurisdictions, Puerto Rico benefits from current revenues that are approximately at an all-time high, according to an Ernst and Young financial bridge analysis on the financial oversight and management board for Puerto Rico that was published on March 7. The report stated that the adjusted governmental fund revenue has been increasing. In 2014 it was $17.09 billion, then it went up to $17.29 billion the next year and in 2016 it reached $17.50 billion.

Tucker said that the recently certified fiscal plan is an impediment to reaching consensual agreements because it fails to respect lawful liens and priorities and ignores the underlying purposes of PROMESA. The plan can be improved by, among other things, distinguishing what are truly "essential" government services. A plan that does not reduce costs from last year's budget has rightfully invited suspicion and is likely to result in legal challenges, he said.

"This is a matter of national interest, because without a satisfactory consensual restructuring, protracted and expensive litigation will ensue and the reverberation will most likely raise the cost of borrowing and limit the ability to access the capital markets for many municipalities throughout the United States, particularly issuers on the lower end of the credit spectrum," said Tucker.

"We are confident of our legal rights in any judicial proceeding but stand ready, and much prefer, to work with all parties to reach a consensual solution. Of course, no matter how the situation develops, we will shield investors in our insured bonds from any scheduled losses of principal or interest in accordance with the terms of our insurance policies," Tucker said.

When asked about the likelihood of downgrade of one or both bond insurers in the event of a "doomsday scenario," Kwiatkoski declined to discuss hypotheticals and said the risk the insurers face right now is well incorporated within Kroll's stress case.

"That being said, we monitor the situation, and we adjust the stress and make other changes as needed once new developments have been made," he said.