Wells Fargo & Co. received a slap from the Office of the Comptroller of the Currency over its phony accounts scandal, as the bank was downgraded in its most recent Community Reinvestment Act performance evaluation.

Wells Fargo disclosed earlier this week that the OCC cut the bank's grade in its CRA performance evaluation two notches to "needs to improve" from "outstanding," even though the bank received "outstanding" ratings on aspects of the exam related to performance. The evaluation covers the years 2009-2012.

"The grade of needs-improve is at odds with our performance, but we wanted to get out in front of this," said Mike Rizer, executive vice president and head of community relations at Wells, in a telephone interview. "It's important to our customers and communities. We want them to know we are committed to this and that we will continue to be. We believe we were downgraded for reasons unrelated to our performance."

Established by Congress in 1977, the CRA encourages banks to meet the credit needs of all segments of the communities where and with whom they do business, including low- and moderate-income populations and individuals. This is the first time since 1994, when exam results began being publicly disclosed, that Wells Fargo Bank, N.A.'s final rating has been anything other than "outstanding," the highest overall CRA rating.

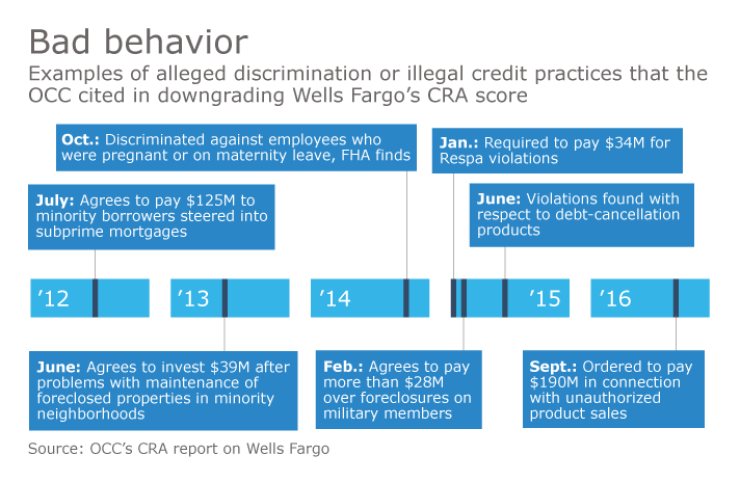

The OCC doesn't typically comment on CRA Performance Evaluations beyond what is said in the report, according to a spokesperson. The report cited factors including allegations that minority borrowers were steered into subprime mortgages, and a finding of discrimination against employees who were pregnant or on maternity leave.

It also referred to the phony-accounts sales scandal last year, in which Wells Fargo was fined $185 million by the Consumer Financial Protection Bureau and more than 5,000 employees were fired over business practices that drove employees to create more than two million new accounts without customers' knowledge or authorization, in order to generate new fee revenue. Since then, major municipal bond issuers such as California, Chicago, Illinois, and Ohio have suspended the firm from doing state and state agency bond and financial services business. Wells has stressed the separation between its commercial bank and government services groups.

"We will continue to take our work in communities very seriously," Rizer said. "You can't have a strong bank in a weak community. Frankly, we go above and beyond what is required. Our message is going to be that we are going to continue to do this, being local and responsive is what sets us apart as in institution."

On the performance aspects of this exam, the OCC rated Wells Fargo as "outstanding." The bank received an "outstanding" on the lending test that makes up 50 percent of the exam.

Wells also was graded as "outstanding" on the investment test, and "high satisfactory" on the service test. Wells Fargo's efforts were also rated a minimum of "satisfactory" across all 54 states and multi-state metropolitan areas reviewed by the OCC for the timeframe concluding in 2012, according to Wells senior vice president, communications manager Gabe Boehmer.

"We are disappointed with this rating given Wells Fargo's strong track record of lending to, investing in and providing service to low- and moderate-income communities. However, we are committed to addressing the OCC's concerns because restoring trust in Wells Fargo and building a better bank for our customers and our communities is our top priority," said Tim Sloan, CEO and president of the bank in a press release. "Wells Fargo is deeply committed to economic growth, sustainable homeownership and neighborhood stability in low- and moderate-income communities and will continue to invest above and beyond what is required by CRA."

Despite their decision to downgrade the final rating, the OCC in its performance evaluation cited Wells Fargo's work on CRA-related activities during the exam period, including lending levels that reflected "excellent responsiveness to the credit needs in the majority" of the LMI assessment areas. It also found that Wells Fargo demonstrated leadership in providing community development services, including efforts by the bank's team members to provide financial education seminars and participate on boards for organizations that serve LMI populations.

The OCC noted in particular that community contacts indicated that Wells Fargo was particularly responsive to the needs of those in LMI areas, citing a number of examples, including a $14.75 million investment in Orlando, Fla., that allowed a food bank to take in more than 3 million additional pounds of food annually; a $450 million loan to refinance a 1,689-unit Section 8 affordable housing complex in New York City; and having approximately 40% of Wells Fargo's retail bank branches located within or directly bordering LMI communities.

Wells Fargo also plans to make community investments of more than $100 million by 2020 to advance causes such as social inclusion, and development of women and diverse leaders as part of its new Corporate Social Responsibility goals.

"With more than four years having passed since the end of our last CRA evaluation period, Wells Fargo intends to ask the OCC to accelerate the timing of its next exam so that we may continue to serve most effectively the low- and moderate-income communities in which we operate," said Sloan.