CHICAGO — The board of Wayne County, Mich., Thursday voted to enter into a consent agreement with the state to handle its financial emergency and avoid insolvency.

The county and state Treasurer Nick Khouri now have 30 days to negotiate a draft of the agreement.

The consent agreement was one of four options that the county was allowed to choose from after Gov. Rick Snyder declared it to be in a state of financial emergency on July 22.

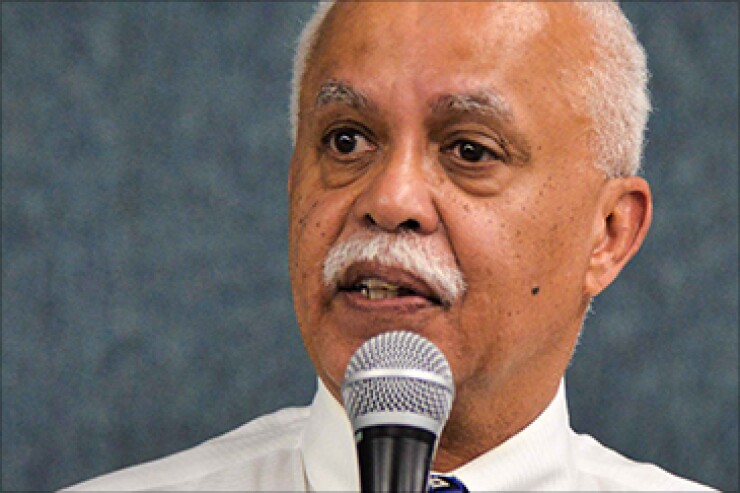

It will broaden the county's powers over labor contracts and allow the county to continue to have local control over its restructuring, argued County Executive Warren Evans, who has pushed for state intervention and the consent decree since June.

"Today Wayne County continues on its road to financial recovery," Evans said in a statement after the board's 12-2 vote, with one commissioner abstaining. "We have already made significant strides towards getting Wayne County back on the right fiscal path. The consent agreement will ensure our ability to fully implement our recovery plan and stabilize the county for the future."

The county and state will now begin to negotiate the terms of the consent agreement.

The move allows the county to impose conditions on labor contracts, a "hammer" that Evans told the board on Aug. 5 that he wants but will not necessarily use.

Expenses tied to labor contracts make up the biggest chunk of the county's remaining structural deficit, according to Evans.

Eliminating that structural deficit will be a main condition of any consent agreement.

"As we finalize the term so the consent agreement with the state treasurer, we will continue in our commitment to negotiate in good faith with our unions," Evans said. "Although a consent agreement will eventually give the county the ability to set the terms of employment, our preference is to reach agreements at the bargaining table."

The consent agreement will also likely require the county to deal with the future of a bond-funded and abandoned jail in downtown Detroit.

The Wayne County Building Authority in 2010 sold $200 million of limited-tax general obligation federally taxable recovery zone economic development bonds to finance the jail project.

Wayne broke ground on the $300 million, 2,000-bed project in 2011 and halted it by summer of 2013 amid climbing costs. The county's former chief financial officer and two others connected to the project were indicted by a grand jury in 2014 for misconduct in office and willful neglect of duty tied to the jail financing.

The state wants to see a plan for the jail — which could mean selling the site — by the end of January, according to Evans.

Detroit, which is Wayne's largest city, entered into its consent agreement with the state in April 2012, a little more than a year before it filed for bankruptcy.

In the city's case, the state appointed a financial advisory board to oversee fiscal matters, while formally leaving control in local hands.

The decree required the city fill certain positions, such as a chief financial officer, set three-year spending plans, hold revenue-estimating conferences and to eliminate its deficit within five years. The decree also required the city to nullify recently negotiated union contracts and negotiate new ones with steeper concessions.

The Detroit consent decree drew heavy political opposition from the beginning.

The mayor at the time, Dave Bing, rejected the first two drafts before agreeing to final terms.

The decree was the target of several lawsuits, including one from the city's corporation counsel, and sparked months of criticism and anger from the Detroit City Council.

By the end of 2012, roughly eight months after the agreement was signed, the state declared a fresh financial emergency.

In March 2013, Gov. Rick Snyder declared a full state takeover, followed a few weeks later with the appointment of corporate restructuring attorney Kevyn Orr as emergency manager.

Orr took the city into Chapter 9 bankruptcy in July 2013.