Municipal volume is set to jump higher in the coming week, boosted by competitive deals.

Bond volume for the week is estimated by Ipreo at $8.84 billion, up from $5.33 billion in the previous week, according to revised data from Thomson Reuters. The upcoming slate is composed of $5.85 billion of negotiated bond deals and $2.99 billion of competitive bond sales.

Including notes, more than $5.09 billion will go out for competitive bid. Negotiated bond and note volume will total $6.02 billion, Ipreo said.

"I'm not surprised that we are seeing a pickup in issuance," said Dan Heckman, senior fixed income strategist at U.S. Bank Wealth Management. "Issuers are feeling very strong about this market right now."

Heckman sees a continued rise in issuance over the next month or two, as issuers revel in a tight spread, low interest rate environment.

"Any issue that is priced attractively gets bought up aggressively," he said. "There is still a lot of cash out there on the sidelines."

Topping the list of competitive sales for the week is the state of Massachusetts, which is coming to market with over $2 billion of bonds and notes.

The Bay State will competitively sell $1.5 billion of revenue anticipation notes in three separate sales on Wednesday and about $835 million of general obligation bonds on Thursday in two separate sales.

So far in 2016, Massachusetts has come to market with $2.64 of bond sales.

"This is going to be a very busy year," State Treasurer Deborah Goldberg said during an investor presentation. "And I can tell you that Treasury's financing schedule just hasn't slowed down."

Massachusetts' RANs are rated MIG1 by Moody's Investors Service and F1-plus while the bonds are rated Aa1 by Moody's and AA-plus by Fitch.

Illinois will be coming to market on Thursday with three separate competitive sales of sale tax revenue bonds totaling about $573 million offered under the Build Illinois Bond program.

The bonds will finance various capital projects, refund certain of the state's outstanding Build Illinois Bonds for savings, and pay costs of issuance, a state spokeswoman said. The sale is the first under the Build Illinois credit since 2014.

The deal is rated triple-A by S&P Global Ratings and AA-plus by Fitch.

Portland, Ore., will competitively sell $321 million of first and second lien sewer system revenue refunding bonds in two separate sales on Wednesday. The first lien bonds are rated Aa2 by Moody's and AA by S&P while the second lien bonds are rated AA3 by Moody's and AA-minus by S&P.

The Pennsylvania Higher Educational Facilities Authority will be selling $273 million of revenue bonds in two separate sales on Thursday. The deals are rated Aa3 by Moody's and AA-minus by Fitch.

The biggest deals on the negotiated slate are from the California Health Facilities Financing Authority.

Bank of America Merrill Lynch is expected to price the authority's $498 million of revenue bonds for Providence St. Joseph Health on Tuesday. The deal is rated AA-minus by S&P and Fitch.

And on Thursday, Ziegler is set to price the HFFA's $271 million of refunding revenue bonds for the Adventist Health System/West. The deal is rated A by Fitch.

The Waterworks Board of Birmingham, Ala., will be coming to market with $424 million of water revenue refunding bonds, broken into tax-exempt and taxables series. Goldman Sachs is expected to price the issue on Tuesday. The deal is rated Aa3 by Moody's and AA-minus by S&P.

Secondary Market

Top shelf municipal bonds ended flat on Friday in sleepy summer activity. The yield on the 10-year benchmark muni general obligation was unchanged from 1.40% on Thursday, while the yield on the 30-year muni was steady from 2.12%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were weaker late on Friday. The yield on the two-year Treasury rose to 0.74% from 0.71% on Thursday, the 10-year Treasury yield gained to 1.58% from 1.54% and the yield on the 30-year Treasury bond increased to 2.29% from 2.26%.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 35,266 trades on Thursday on volume of $14.72 billion.

Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended Aug. 19 were from Kentucky, New York and Illinois issuers, according to

In the GO bond sector, the Louisville and Jefferson County, Ky., Visitors and Convention Center 3 1/8s of 2041 were traded 22 times. In the revenue bond sector, the Brooklyn Arena Local Development Corp.'s Barclays Center 5s of 2042 were traded 129 times. And in the taxable bond sector, the Illinois 5.1s of 2033 were traded 66 times.

Week's Most Actively Quoted Issues

California, Pennsylvania and Illinois issues were among the most actively quoted names in the week ended Aug. 19, according to Markit.

On the bid side, the California taxable 7.55s of 2039 were quoted by 11 unique dealers. On the ask side, the Pennsylvania GO 3s of 2036 were quoted by 17 unique dealers. And among two-sided quotes, the Illinois taxable 5.1s of 2033 were quoted by 11 unique dealers.

Lipper: Muni Bond Funds See Inflows

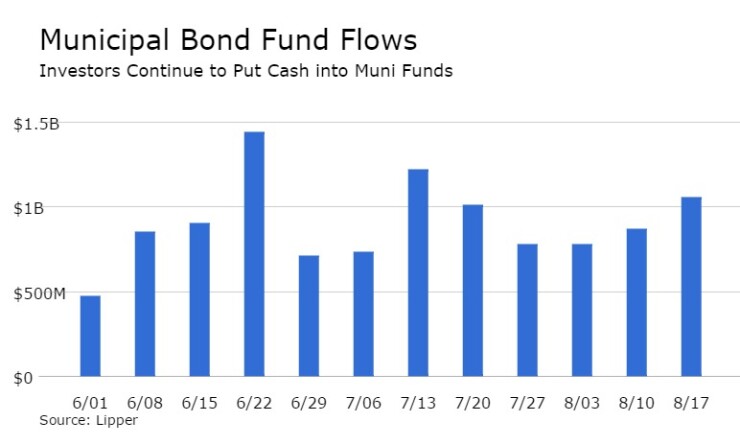

For the 46th straight week, municipal bond funds reported inflows, according to Lipper data released on Thursday.

The weekly reporters saw $1.059 billion of inflows in the week ended Aug. 17, after inflows of $871.013 million in the previous week, Lipper said.

The four-week moving average remained positive at $874.145 billion after being in the green at $862.893 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds experienced inflows, gaining $650.811 million in the latest week after inflows of $582.341 million in the previous week. Intermediate-term funds had inflows of $147.707 million after inflows of $124.228 million in the prior week.

National funds had inflows of $879.368 million on top of inflows of $754.059 million in the previous week. High-yield muni funds reported inflows of $253.987 million in the latest reporting week, after inflows of $287.447 million the previous week.

Exchange traded funds saw inflows of $125.347 million, after inflows of $90.117 million in the previous week.