CHICAGO — The University of Minnesota Regents on Wednesday will sell about $82 million of debt, in a mix of taxable general obligation bonds and tax-exempt special purpose revenue bonds backed by a state appropriation, to provide financing for facilities in its Biomedical Discovery District.

Barclays Capital is the senior manager and Dorsey & Whitney LLP is bond counsel.

A $22 million taxable GO piece represents the university’s required 25% match for the biomedical research projects while the state is covering 75% of the $292 million price tag for the various facilities, according to university debt manager Carole Fleck.

This week’s deal includes $60 million of revenue bonds backed by a state pledge.

The university will forgo a tax-exemption on the GO tranche coming to market this week.

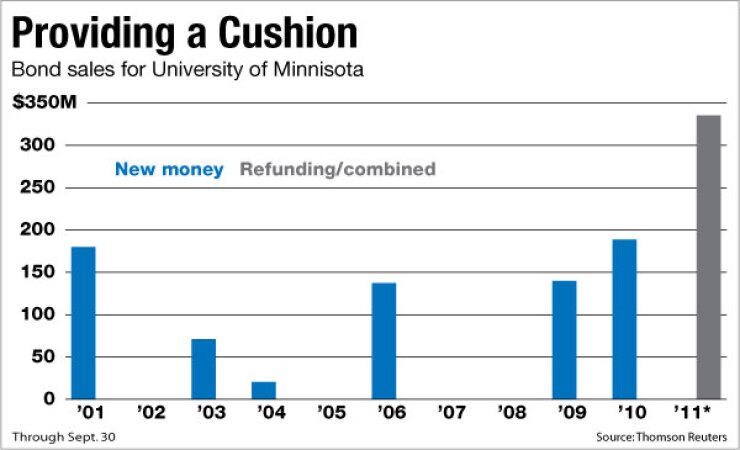

“We are providing a cushion to remain flexible on private use because it is research facilities and it’s hard to predict how some of the facilities will be used over the next 25 years,” Fleck said.

The university expects to return to the market as soon as next year to wrap financing for the biomedical science projects, and expects to hit the market later this year or early next year with about $60 million in GO issuance to finance routine capital needs.

Construction has begun on a new 280,000-square-foot cancer research building in the district.

The university is also expanding its Center for Magnetic Resonance Research, which has the distinction of being home to the world’s largest imaging magnet.

The university is one of the country’s top research schools, with research expenses of $632 million in fiscal 2010, up from $600 million in 2009. The biomedical projects are a central part of the school’s strategy in building its research base.

Ahead of the issue, Moody’s Investors Service affirmed the university’s Aa1 rating and assigned its Aa2 rating to the $60 million tax-exempt tranche backed by state appropriations.

“The Aa1 rating reflects the university’s strong student and research market positions, overall favorable resources cushioning debt, and favorable operating performance offset by declining state demographics and modest liquidity,” Moody’s wrote.

Standard & Poor’s affirmed the university’s AA rating and assigned a AA to the state appropriation piece.

Both state appropriation-supported ratings are one notch below the agencies’ rating of state GOs.

S&P recently downgraded Minnesota to AA-plus from AAA and Moody’s assigned a negative outlook to its Aa1 Minnesota GO rating. The university has $1.2 billion of rated debt.

The school is the state’s flagship research public university and a Big Ten member with enrollment of more than 61,000.

Its balance sheet is supported by total financial resources of $3 billion.

The credit’s challenges include relatively low monthly liquidity levels of $684 million, which covers 92 days of cash needs, and a debt structure with 25% in a floating-rate mode that faces market exposure.

Dwindling state operating support also poses a challenge as the university will see a 7.8% reduction of $46 million of aid in fiscal 2012.

Moody’s noted that the school will offset the drop with increased tuition and gift revenue.

Minnesota’s budgetary struggles have also prompted the state in recent years to delay subsidies to the university, but delays have been limited to operating subsidies, reducing the risk that repayment of the appropriation-backed bonds could be affected.

The appropriation that supports the bonds is a standing one and the Legislature would have to take a formal action to actually rescind it.