Wisconsin will take two bond rating upgrades into its upcoming bond sale.

Kroll Bond Rating Agency upgraded Wisconsin’s general obligation bonds to AAA from AA-plus and S&P Global Ratings raised its long-term rating on the state’s GOs to AA-plus from AA.

"This is obviously exciting news for the state of Wisconsin, right up there with the Milwaukee Bucks winning the NBA championship," Capital Finance Director David Erdman told The Bond Buyer. "The rating upgrades reflect the commitment the state has made to improve its credit profile coupled with a growing and improving economy."

About $7.1 billion of outstanding GOs are affected.

The state has a $283.6 million taxable GO refunding lined up next week.

Kroll, in its Tuesday action, revised its outlook to stable from positive at the higher rating. S&P, which acted Wednesday, maintains a stable outlook.

The state

“The upgrade to AAA reflects the state’s substantial liquidity, evidenced by a near tripling of budget reserves over the past three years; continuing, healthy revenue growth, despite substantial tax cuts; and an ongoing, post-COVID-19 recovery, fueled by a mature and expanding economy, and favorable business climate,” Kroll said in a release.

S&P analyst Thomas Zemetis said the upgrade reflected the state's sustained financial improvement over the past two biennia and budget surpluses in four of the last five fiscal years.

"The rating action also reflects our view that Wisconsin has well-embedded statutory procedures in place that reinforce a commitment to preserve considerable reserve flexibility in its budget stabilization fund over the longer-term to mitigate fiscal volatility in future economic recessions," Zemetis said in a statement. "It also incorporates our expectation that Wisconsin will continue to take responsive budgetary measures to maintain structural balance amid lingering pandemic-induced public health and safety risks and a potentially uneven recessionary recovery within segments of its economy."

In connection with the GO upgrade, S&P also raised Wisconsin's appropriation-secured debt to AA from AA-minus; bond backed by the state's moral obligation pledge to AA-minus from AA-plus; and upgraded to A-plus from A Wisconsin Center District appropriation bonds (Milwaukee Arena Project).

It also raised to AAA from AA-plus Wisconsin's transportation revenue bonds outstanding, which are capped at one notch above a GO rating under S&P's priority lien criteria.

S&P said it also viewed Wisconsin's fully funded pension system and relatively low exposure to other post-employment benefit costs as key factors underpinning the state's long-term credit stability.

"Being part of the state’s debt management team since 1994, it's very refreshing to see the rating agencies’ recognition of the state’s substantial reserves and continued attention to structural budget performance," Erdman said.

Kroll said it raised Wisconsin to AAA because of the strength of the state's GO pledge, a trend of conservative budgets and strong financial results that usually come in above projections, a substantial liquidity and reserve position and a fully funded state pension system.

Kroll also upgraded Wisconsin's master lease certificates of participation to AA-plus.

The rating agency noted that some credit challenges remain, citing economic uncertainty related to the COVID-19 pandemic and the Delta variant.

The state's capital plan and operating budget, approved by lawmakers at the end of June, authorizes $1.67 billion of mostly general obligation backed new borrowing that will be completed in the next few years.

Capital Finance also has $2 billion of GO refunding authority that lets the state consider and execute refunding sales as opportunities arise, such as through current refundings, forward deliveries or taxable advance transactions. In the past 2.5 years, the state has saved $274 million in present value interest from refundings.

Next week, Stifel is expected to price the $283.6 million taxable deal, with serials ranging from 2022 to 2037, with a likely 10-year par call. No other details were immediately available. Baker Tilley Municipal Advisors is advisor. Foley & Lardner LLP is bond counsel.

The state's GOs are rated Aa1 with a stable outlook by Moody's Investors Service, affirmed in June, and AA-plus with a stable outlook by Fitch Ratings, affirmed in February

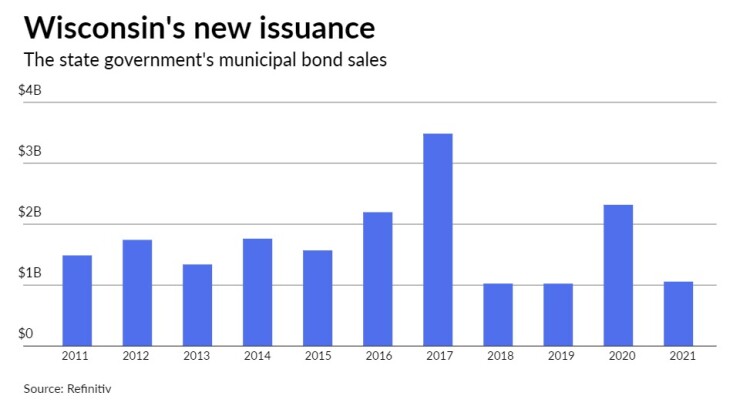

Since 2011, the state has sold more than $20 billion of debt, with the most issuance occurring in 2017 when $3.5 billion of bonds were sold.