Market turmoil continued to shake up the league tables during the third quarter, with more changes likely on the way thanks to recent shifts in the market landscape.

Citi remained the top senior manager through the end of September, working on 424 deals with a par value of $49.3 billion this year compared to 471 deals with a par value of $45.8 billion at this point in 2007, according to preliminary Thomson Reuters data. But the rankings below that have changed from prior periods as a result of the unprecedented number of exits, acquisitions, and other changes to firms in the market.

UBS Securities LLC, for instance, stopped working on negotiated deals when it shuttered its public finance unit in June. As a result, its ranking as an underwriter for the first three quarters of the year fell to seventh from fourth at this time last year - with a further drop on the way. It has acted as the senior manager of $17.1 billion in deals this year, but just $889.7 million during the third quarter, in which ranked 18th.

After purchasing Bear, Stearns & Co., JPMorgan jumped to second as a senior manager through the first half of the year with deals from both firms considered in the total. Since Bear Stearns has stopped working as the senior manager on its own deals, the firm has fallen to third, credited with working on 265 deals with a par value of $28.4 billion through the first three quarters of the year.

JPMorgan ranked fifth among underwriters in the third quarter, acting as the senior manager on 69 issues with a par value of $6.9 billion. In 2007, when not credited with the work of Bear Stearns, JPMorgan ranked sixth as a senior manager through all of the year.

Other firms at the top of the rankings have seen their market share increase in the face of broader market turmoil. Fourth-ranked Morgan Stanley has worked as the senior manager on $26.98 billion in deals for a market share of 8.5% through three quarters this year, compared to $18.9 billion in deals and a market share of 5.9% last year.

Fifth-ranked Goldman, Sachs & Co. worked as senior manager on $26 billion in deals for a market share of 8.2% through three quarters this year, compared to $20.8 billion for a market share of 6.5% last year.

Ironically, number six Lehman Brothers saw its market share grow to 7.3% this year from 6% last year through three quarters. Its market share during the third quarter, though, fell to 4.6% from 8.3% during the first half of the year. Its parent, Lehman Brothers Holdings Inc., sold the broker-dealer to Barclays Capital after declaring for Chapter 11 bankruptcy Sept. 15.

And the shifts in the rankings don't end there. Bank of America Corp. - parent of No. 8 Banc of America Securities LLC - agreed last month to buy Merrill Lynch & Co., which ranked second as a senior manager through the third quarter, working on 273 deals with a par value of $31.3 billion. Top-ranked Citi will purchase the banking operations of Wachovia, including its investment bank, later this year.

The changes at the top of the charts could also provide an opportunity for regional players to increase their market share. In addition, a number of regional banks have already capitalized on the opportunities to hire bankers from Wall Street firms.

"We're going through a reorganization of who the players are on the underwriting side," said Richard Ciccarone, managing director and chief research officer of McDonnell Investment Management LLC. "There seems to be a shift that continues to happen to move to a smaller number of national firms and more regional firms that are taking part in the bond market and underwriting process."

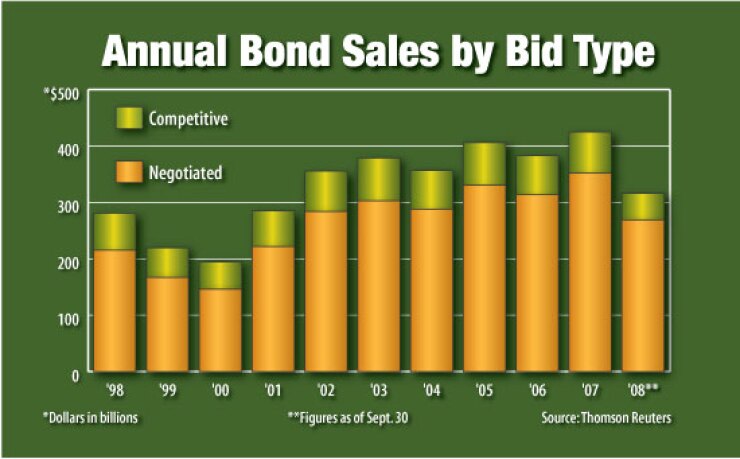

The number of negotiated deals completed through the first three quarters has risen despite a fall in total volume, in part due to restructuring of auction-rate debt. A total of $269.3 billion in negotiated deals came to the market during the first three quarters of the year compared to $267.3 billion at this point last year.

Competitive underwriting fell to $47.1 billion through three quarters this year from $54 billion at that point last year. Although the rankings of the top three managers - Merrill Lynch, Citi, and Lehman Brothers - remained the same, each worked on fewer deals totaling a lower par value this year. Robert W. Baird & Co. has shot to fourth from 24th, though, acting as the senior manager on 121 deals with a par value of $2.6 billion through the third quarter, compared to 38 deals with a par value of $209.3 million at this point last year.

Morgan Keegan & Co. Inc. took the top spot on small issues, acting as the senior manager on 196 deals with a par value $1.16 billion. It beat out RBC Capital Markets, which placed second, working on 188 issues with a par value of $1.04 billion.

In the financial adviser rankings, Public Financial Management Inc. again took top honors, working on 564 deals with a par value $34.9 billion. Despite advising on fewer deals than any of the other financial advisers in the top five, Public Resources Advisory Group ranked second by working on larger deals. In the first three quarters of 2008 it was adviser on 98 issues with a par value $18.04 billion.