The Texas Transportation Commission is preparing to issue $880 million of general obligation refunding bonds as state leaders grapple with a rapidly shifting economic reality.

The deal is in the works, with at least one rating released, but the Texas Department of Transportation said a date has not been set.

Bond market conditions have generally stabilized after upheaval in March and April, but analysts now expect volume to decline for the year.

On the first day of May, high-grade bonds led a muni market rally, with AAA benchmark yields falling 10 to 11 basis points across the curve.

Municipal bond issuance in April fell 15% over the same month last year, and it was the lowest muni volume total for the month since 2011. S&P Global Ratings expects a drop between 3% and 5% in U.S. bond volume for the year.

Nationally, the economy shrank an estimated 4.8% in the first quarter, the first downturn since 2014, which also coincided with collapsing oil prices.

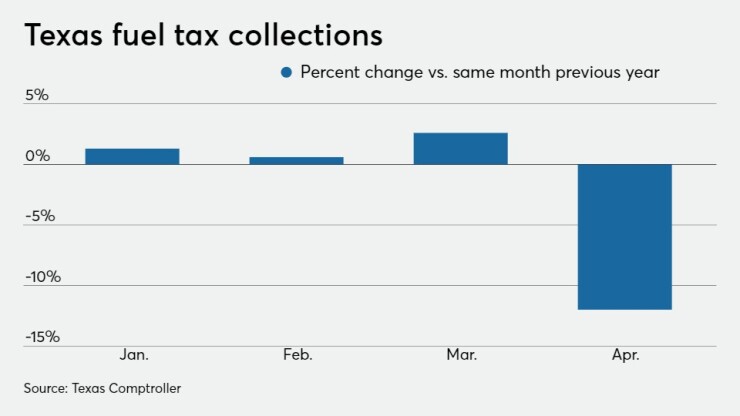

Texas has been hit doubly hard by the COVID-19 pandemic and collapsing oil prices. TxDOT will also see the impact of declining fuel consumption, which is taxed at the pump. Motor fuel taxes collected in March fell 12% year-over-year, according to Texas Comptroller Glenn Hegar.

“Fitch expects the effects of the coronavirus pandemic occurring alongside an unprecedented crude oil market downturn to significantly challenge the state's near-term economic and revenue growth prospects,” analyst Marcy Block wrote April 27, when Fitch affirmed Texas' AAA rating and stable outlook.

“Texas retains ample flexibility to cut spending throughout the economic cycle, an attribute that the state relies on if needed to maintain fiscal equilibrium,” Block added. “Spending pressures from education, Medicaid, transportation, water and other growth-related needs are notable, and litigation has periodically been a source of uncertainty.”

Under the Coronavirus Aid, Relief and Economic Security (CARES) Act enacted on March 27, the U.S. Treasury department will distribute $150 billion to state and local governments within 30 days of enactment under a population-based formula. Texas is eligible for almost $11.2 billion, with the CARES Act allocating at least $6.2 billion to the state and up to $5 billion to local governments with populations of 500,000 or more.

State officials say that about $3 billion has been requested for local governments.

The Federal Reserve's recently announced $500 billion Municipal Liquidity Facility allows purchase of short-term debt issued by states, the District of Columbia and the largest counties and cities.

“Given the program's terms, Fitch estimates that Texas could borrow up to $16.7 billion to address the state's own cash flow needs,” Block noted. “Critical details for this program, including how quickly purchases will begin, are yet to be determined.”

Moody’s Investors Service, which rates Texas Aaa, on Friday shifted its sector outlook for state governments to negative.

“The likely prolonged recovery will lead states to employ a variety of measures to manage their finances which may lead to weaker reserves and increased leverage, which will be affected by state-to-state variation in the speed and pace of recovery,” analysts wrote.

The sector shift does not change the outlook of any individual state; Texas retains a stable outlook from Moody's.

“These measures will take place in an environment of rising fixed costs and potential popular and legislative resistance to some budget-balancing actions. Emergency federal actions so far do not provide funding to help states fill gaps in revenue collections, but additional financial assistance for that purpose would help support state credit quality.”

Texas entered the 2020 recession with a rainy day fund flush with anticipated $9.3 billion by the end of the fiscal year Aug. 31.

The rainy day fund, known officially as the Economic Stabilization Fund, was created by the passage of an amendment to the Texas Constitution in November 1988 after a devastating crash in oil prices.

In November 2014, a constitutional amendment provided at least half of certain severance taxes on oil and gas to the ESF and the remainder to the State Highway Fund. Depending on the balance at the time of the transfer, more than half of the allocated severance taxes could be moved to the ESF to maintain the required balance.

In a sign that TxDOT is looking beyond the immediate financial crisis, the Texas Transportation Commission, which governs the agency, voted Thursday to allocate $3.4 billion toward rebuilding Interstate 35 in Austin, a chronic chokepoint.

Despite pleas from state lawmakers to delay the vote, the TTC voted 3-1 to send the money from its discretionary fund to I-35 in Austin as part of a long-term plan for building Texas highways.

In April, the Capital Metropolitan Planning Organization voted to spend $633 million on the project, whose total cost is estimated at $7.5 billion.

In March, the chairmen of the state Senate and House transportation committees, Sen. Robert Nichols, R-Jacksonville, and Rep. Terry Canales, D-Edinburg, signed a letter to the head of the Texas Transportation Commission urging a delay on the vote on the Unified Transportation Program that commits the spending on road projects for years in the future.

Because funding for such projects comes from oil tax revenue, Nichols and Canales warned that the state will likely suffer a drop in sales tax revenue triggered by layoffs and business closures.

“Simply put, the 10-year UTP is based on estimated revenues over a 10-year time period, and since these estimates were last made, there have been substantial changes that have not yet stabilized,” Nichols and Canales wrote to Texas Transportation Commission Chairman J. Bruce Bugg.

"We believe it is in the interest of all Texans to postpone adoption until more financial certainty is available and the public is able to fully participate in the comment period," they wrote. "This will not delay project delivery, nor will it adversely affect the driving public."

The third component of the project’s funding is about $300 million that TTC will consider when it votes on the 2021 Unified Transportation Program in August. Gov. Greg Abbott backed the plan in late February, before the impact of the COVID-19 pandemic was recognized.

“Chairman Bruce Bugg and the Texas Transportation Commission have made tremendous progress to fully fund and deliver the I-35 Capital Express Project as a non-tolled project,” Abbott said. “This project will relieve traffic congestion for all those who travel on I-35 through Austin, while helping our capital city meet the needs of a growing population.

“In recent years, I-35 through Austin has repeatedly been one of the worst chokepoints for drivers in Austin and Texas and the source for understandable frustration,” Bugg said. “The I-35 Capital Express Project is a statewide strategic priority project, not just for Austin, but the State of Texas.”