As lawmakers worked over the details of tax legislation that may bar private-activity bonds and advance refundings, municipal market participants prepared for what may be a record-setting week for issuance.

Ipreo estimates volume will catapult to $17.39 billion from the revised total of $9.32 billion sold in the past week, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $15.51 billion of negotiated deals and $1.88 billion in competitive sales.

“There has not been any slack in demand and with still a lot of money on the sidelines, I expect the market will have no problem digesting the issuance,” said Dan Heckman, senior fixed income strategist at U.S. Bank Wealth Management. “Will the issuers have to price in concessions to make sure they can get the deal done? Some, perhaps. But the main takeaway is that buyers are realizing that a lot of 2018 issuance is getting pulled forward, so they are going to put the money to work now.”

Secondary market

The MBIS municipal non-callable 5% GO benchmark scale was stronger in trading through the market close on Friday.

The 10-year muni benchmark yield fell to 2.355% on Friday from the final read of 2.424% on Thursday, according to

The MBIS benchmark index is updated hourly on the

Top-rated municipals were stronger to close out Friday. The yield on the 10-year benchmark muni general obligation was eight basis points lower to 2.07% from 2.15% on Thursday, while the 30-year GO yield was down 11 basis points to 2.68% from 2.79%, according to a final read of MMD’s triple-A scale.

U.S. Treasuries were stronger on Friday at the market close. The yield on the two-year Treasury fell to 1.77% from 1.78%, the 10-year Treasury yield slid to 2.36% from 2.41% and the yield on the 30-year Treasury dropped to 2.76% from 2.83%.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 87.6% compared with 89.1% on Wednesday, while the 30-year muni-to-Treasury ratio stood at 97.1% versus 98.6%, according to MMD.

Primary market

Heckman also noted that the new paper party in the muni market won’t begin and end with this mega week ahead.

“It certainly won’t be the last big week before year end,” he said. “It will be tough to top the volume of this week but I think the new few weeks will see double digit volumes, buyers are bracing and want to buy on weakness and I am surprised by the resiliency of muni market.”

The market was volatile in the past week, as yields surged higher for the first three days and then plunged during the last two days, and Heckman said we should expect more of the same.

“Expect more volatility, more periods of weakness because of supply congestion,” he said

Stifel is scheduled to price the San Jose Successor Agency to the Redevelopment Agency’s $1.67 billion of senior taxable and tax-exempt allocation refunding bonds in two separate sales on Wednesday, with the larger sale expected to be $1.34 billion. The larger deal carries ratings of AA by S&P Global Ratings and Fitch Ratings, while the other has ratings of AA-minus by S&P and Fitch.

According to a spokesperson from the issuer, the deal does include a tiny portion of advance refunding but the vast majority is a regular refunding, which has been planned for a long time.

Wells Fargo is expected to price Miami-Dade County’s $958.74 million of water and sewer system revenue and refunding bonds on Thursday after a one-day retail order period.

County officials’ hope that the deal that will save ratepayers millions in debt service on its

Bank of America Merrill Lynch is slated to price Trinity Health Credit Group’s $900 million of tax-exempt bonds on Tuesday after a one-day retail order period. Roughly $775 million will be offered through the Michigan Finance Authority, $43 million will be issued through the Idaho Health Facilities Authority, and $75 million will be issued via Franklin County, Ohio. The deal is rated Aa3 by Moody’s Investors Service and AA-minus by Fitch.

The group conceded that it accelerated the offering to beat the

Ramirez is slated to price New York City’s $850 million of general obligation bonds on Tuesday. The deal is rated Aa2 by Moody’s and AA by S&P and Fitch.

Heckman said U.S. Bank is more bullish on tax reform as it relates to the municipal market, if it does indeed get enacted.

“Short term pain, long term gain should be attitude of investors,” he said. “It is going to be a delicate balancing act from here on out, you have to approach the market and be a buyer on those weak days and then cautious on those other days. There is a lot to chew on, and we need to think about how all of this is going to reshape volume in 2018 and beyond, but if levels cheapen and we have all this volume, I think you could say that is an early Christmas present for the muni market.”

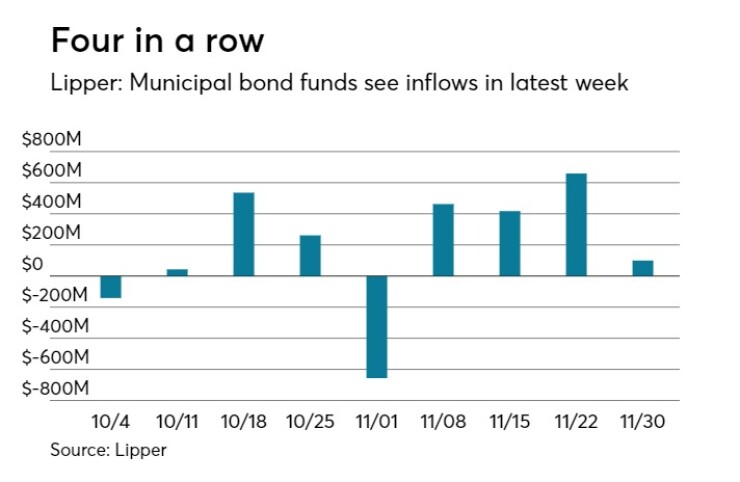

Lipper: Muni bond funds saw inflows

Investors in municipal bond funds continued to put cash into funds in the latest week, according to Lipper data released on Friday.

The weekly reporters saw $100.434 million of inflows in the week of Nov. 30, after inflows of $659.237 million in the previous week.

Exchange traded funds reported inflows of $61.076 million, after inflows of $83.606 million in the previous week. Ex-ETFs, muni funds saw $39.358 million of inflows, after inflows of $575.631 million in the previous week.

The four-week moving average was positive at $410.109 million, after being in the green at $221.250 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $185.461 million in the latest week after inflows of $434.368 million in the previous week. Intermediate-term funds had inflows of $18.641 million after inflows of $112.175 million in the prior week.

National funds had inflows of $136.295 million after inflows of $642.814 million in the previous week.

High-yield muni funds reported inflows of $71.670 million in the latest week, after inflows of $177.142 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.

Shelly Sigo and Nora Colomer contributed to this report.