Municipal supply began to trickle into the marketplace on Tuesday with bond issuance set to turn into a tsunami of supply on Wednesday and Thursday.

Morgan Stanley: Record supply, still doesn't matter

While the municipal bond supply in October was the third largest on record — and wave of new issues could continue — this shouldn't worry investors concerned about yield, Morgan Stanley said in a Tuesday research report. Municipal issuance accelerated in October to $52.19 billion, with taxable bonds accounting for about a quarter of the month's supply. October volume this year is 38.2% higher than last year and is the highest volume for the same month since 2016 when the market produced $53.45 billion, right before the presidential election led to a spike in muni yields and a drop in issuance. It was the busiest month for municipals since December of 2017, when the market saw $69.83 billion as issuers were rushing to market before the new tax laws came into effect.

“Supply isn't useful in forecasting returns,” Strategists Mark Schmidt and Michael Zezas wrote. “Although munis' best 2019 performance is likely behind us, current valuations provide a good entry point for incremental purchases.”

They said that while supply matters, it doesn’t correlate to performance.

“Although supply is consequential to deciding when and where to invest client inflows, we do not think supply data matters when it comes to forecasting municipal bond returns,” they said. “October's market performance was a case in point."

They said that amid record supply, munis managed to post flat excess returns for both taxable and tax-exempt bonds.

“The muni market held up well in spite of heavy new-issue volume. The 10-year ratio was unchanged on the month and the 30-year ratio tightened slightly,” they wrote.

They added that munis still offer investors a better entry point than has been seen for most of the year. And they said ratios are in line with long-run averages back to 1990.

Looking ahead, Municipal Market Analytics said it generally sides with an emerging industry expectation for a jump in new-issue supply in 2020.

“Specifically, our projection is for $425 billion,” said MMA’s Matt Fabian. “This is a 10% increase versus our full year 2019 estimate of $380 billion, led by a 14% rise in new-money issuance (to $285B), 3% in refundings.”

Additionally, MMA said its annual issuance projections do not drop below $400 billion in any of the next five years.

“Away from an unexpected, material rise in interest rates, we expect there is more upside than down to these numbers, particularly in the out years as more state and local issuers sell bonds for water and transportation projects and to address local economic vulnerabilities from climate change,” MMA said.

Primary market

Morgan Stanley priced the Illinois State Toll Highway Authority’s (A1/AA-/AA-NR) $225.245 million of Series 2019B toll highway senior revenue refunding bonds.

Citigroup priced the American Municipal Power Inc.’s (A1/A/NAF/NAF) $212.415 million of Prairie State Energy Campus project revenue refunding bonds.

Loop Capital Markets priced the Ohio Water Development Authority’s (Aaa/AAA/NR/NR) $150 million of water development revenue bonds.

Goldman Sachs priced Garland, Texas’ (NR/A+/AA-/NR) $141.36 million of new Series 2019A electric utility system revenue refunding bonds.

Citi took indications of interest on the Michigan Finance Authority’s (Aa2/AA+/NR/NR) $200.78 million of Series 2019B taxable school loan revolving fund term rate revenue refunding bonds.

Jefferies took indications of interest on Broward County, Florida’s (Aa1/AA+/AA+/NR) $111.405 million of Series 2019B taxable water and sewer utility revenue refunding bonds.

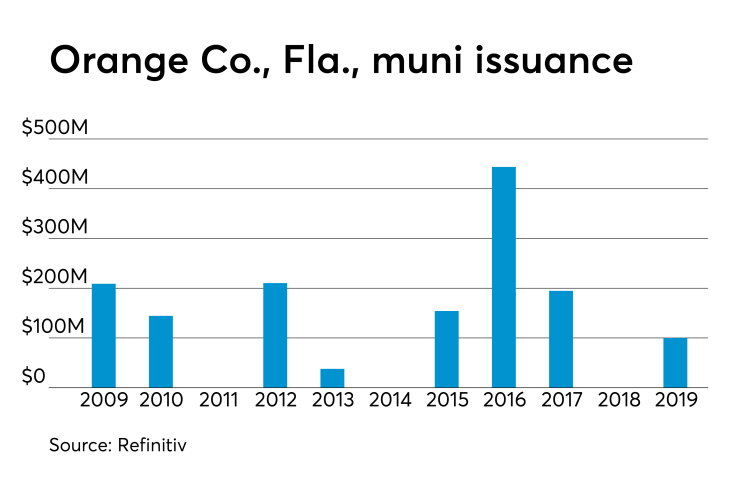

In the competitive arena, Orange County, Fla., (Aa1/AA+/AAA/AAA) sold $103.615 million of Series 2019 taxable sales tax revenue refunding bonds.

Wells Fargo Securities won the issue with a true interest cost of 2.5898%. PFM Financial Advisors is the financial advisor. Nabors Giblin and Ruye H. Hawkins is the bond counsel. Proceeds will be used to refund outstanding debt.

Since 2009, the county has sold about $1.4 billion of debt with the most issuance occurring in 2016 when if offered $444 million of securities. It didn’t come to market in 2011, 2014 or 2018.

On Wednesday, Illinois (Baa3/BBB-/BBB) is selling $$750 million of general obligation bonds in three offerings.

The sales consist of $300 million of Series of November 2019B GOs, $300 million of Series of November 2019A GOs and $150 million of Series of November 2019C GOs.

PFM Financial Advisors is the financial advisor. Chapman and Cutler and the Hardwick Law Firm are the bond counsel. Proceeds will be used to finance capital projects.

Ohio (NA/NA/AA+) is selling $249 million of GOs in two offerings.

The deals consist of $149 million of Series 2019A infrastructure improvement GOs and $100 million of taxable Series 2019B Third Frontier Research and Development GOs.

Acacia Financial Group is the financial advisor. Thompson Hine and Squire Patton are the bond counsel. Proceeds of the Series 2019A will be used to pay for public infrastructure capital improvement projects while proceeds of the Series 2019B bonds will pay for research and development projects in support of industry, commerce and business.

Tuesday’s muni supply

Secondary market

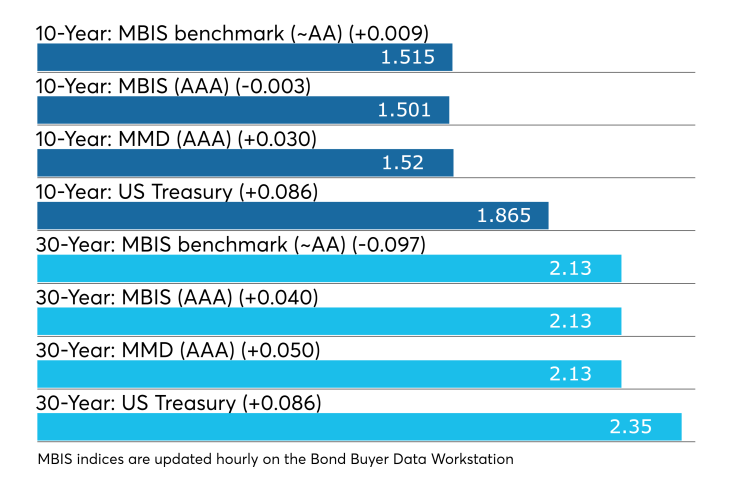

Munis were weaker on the MBIS benchmark scale, with yields rising by less than one basis points in the 10-year maturity and by nine basis points in the 30-year maturity. High-grades were mixed, with yields on MBIS AAA scale falling by less than one basis point in the 10-year maturity and rising by four basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO rose three basis points to 1.52% while the 30-year rose five basis points to 2.13%.

“The sell-off in Treasuries has moved the ICE muni yield curve up one to four basis points,” ICE Data Services said in a market comment. “High-yield and tobaccos are also weaker with yields up two basis points across the board. Puerto Rico is unchanged.”

The 10-year muni-to-Treasury ratio was calculated at 81.5% while the 30-year muni-to-Treasury ratio stood at 90.7%, according to MMD.

Stocks were trading mostly higher as Treasuries strengthened. U.S. equities neared all-time highs as the latest earnings reports and economic data lifted spirits. The Dow Jones Industrial Average was up about 0.3% in late trading as the S&P 500 Index was flat while the Nasdaq gained almost 0.2%.

The Treasury three-month was yielding 1.554%, the two-year was yielding 1.637%, the five-year was yielding 1.667%, the 10-year was yielding 1.865% and the 30-year was yielding 2.350%.

Previous session's activity

The MSRB reported 32,134 trades Monday on volume of $8.58 billion. The 30-day average trade summary showed on a par amount basis of $10.68 million that customers bought $5.88 million, customers sold $2.91 million and interdealer trades totaled $1.89 million.

New York, California and Texas were most traded, with the Golden State taking 13.371% of the market, the Empire State taking 11.205% and the Lone Star State taking 10.024%.

The most actively traded securities were the Miami-Dade County, Florida, airport Series 2017B water and sewer revenue 3.125s of 2039, which traded eight times on volume of $32 million.

Treasury to sell $55B 4-week bills

The Treasury Department said it will sell $55 billion of four-week discount bills Thursday. There are currently $40.017 billion of four-week bills outstanding.

Treasury also said it will sell $40 billion of eight-week bills Thursday.

Treasury auctions notes, bills

The Treasury Department auctioned $38 billion of three-year notes with a 1 5/8% coupon at a 1.630% high yield, a price of 99.985419. The bid-to-cover ratio was 2.60. Tenders at the high yield were allotted 42.86%. All competitive tenders at lower yields were accepted in full. The median yield was 1.600%. The low yield was 1.530%.

Treasury also auctioned $27 billion of 364-day bills at a 1.565% high yield, a price of 98.417611. The coupon equivalent was 1.610%. The bid-to-cover ratio was 2.84. Tenders at the high rate were allotted 85.83%. The median yield was 1.540%. The low yield was 1.500%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.