Municipal CUSIP requests surged in August, CUSIP Global Services reported on Wednesday, an indication of rising supply in the near-term.

The total identifier requests for all municipal securities, which includes bonds, long-term and short-term notes, and commercial paper, rose 12% to 1,221 last month from 1,090 in July.

Breaking the August data down, there were 972 requests for municipal bonds, 75 for long-term muni notes, 130 for short-term muni notes and 44 for other types of municipal securities.

“Issuers of new securities ignored the summer doldrums in August, driving a significant month-over-month surge in CUSIP request volume in every major asset class,” said Gerard Faulkner, the company’s director of operations. “The fact that this volume was so robust at a time when — seasonally speaking — we tend to see slower request volume for new CUSIPs suggests that there is a great deal of pent-up demand for new securities issuance across corporate debt and equity issuers and municipalities.”

On a year-over-year basis, however, total municipal identifier request volume is still down 14.7% through August. This is reflection of the slowdown in request volume during the first quarter. So far this year, there have been 8,601 CUSIP requests, compared with 10,083 in the same period in 2017.

Among state issuers, CUSIPs for scheduled public finance offerings from New York, Texas, and New Jersey were the most active in August.

Primary market

Municipals remained weaker on Wednesday as the market saw several new issues sell in the primary, led by deals from issuers in North and South Carolina and California.

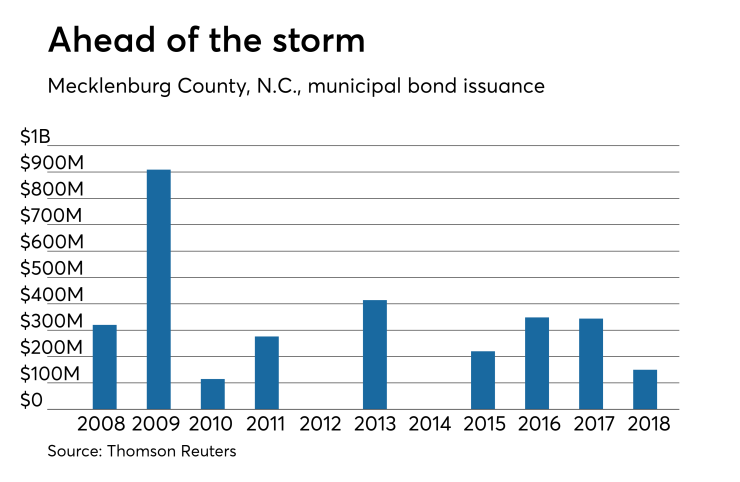

In the competitive arena, Mecklenburg County, N.C., sold $150 million of Series 2018 general obligation public improvement bonds.

Morgan Stanley won the bonds with a true interest cost of 3.0978%.

The financial advisor is Hilltop Securities; the bond counsel is Robinson Bradshaw. The deal is rated triple-A by Moody’s Investors Service, S&P Global Ratings and Fitch Ratings.

Since 2008, the county has sold about $3 billion of debt, with the most issuance occurring in 2009 when it offered $909.1 million. It did not come to market in 2012 or 2014.

The Greenville County School District, S.C., sold $105.675 million of Series 2018C general obligation bonds due June 1, 2019.

Bank of America Merrill Lynch won the bonds with a TIC of 1.868%.

The financial advisor is Compass Municipal Advisors; the bond counsel is Pope Flynn.

The deal is rated Aa1 by Moody’s and A1-plus by S&P.

The Santa Clara County Financing Authority, Calif., sold $163.3 million of Series 2018A county facilities lease revenue bonds.

Morgan Stanley won the bonds with a TIC of 3.4198%. Proceeds will be used to reimburse the county for costs related to the acquisition of the Champion Point project. The financial advisor is KNN Public Finance; the bond counsel is Orrick Herrington.

The deal is rated AA-plus by S&P and AA by Fitch.

In the negotiated sector, JPMorgan Securities priced Indianapolis’ $357.995 million of Series 2018A water system first lien refunding revenue bonds on Wednesday.

The deal is rated Aa3 by Moody’s, AA by S&P and A-plus by Fitch.

JPMorgan also priced the Sarasota County Public Hospital District, Fla.’s $350 million of Series 2018 fixed-rate hospital revenue bonds for the Sarasota Memorial Hospital.

The deal is rated A1 by Moody’s and AA-minus by Fitch.

Bank of America Merrill Lynch priced Ohio’s $117.925 million of Series 2018C and Series 2018D serial bond interest rate hospital revenue bonds.

The deal is rated A2 by Moody’s and A by S&P.

JPMorgan Securities received the written award in the Ohio Housing Finance Agency’s $140 million of Series 2018A residential mortgage revenue bonds not subject to the alternative minimum tax under the mortgage-backed securities program and the $3.332 million of Series 2018B taxables.

The deal is rated Aaa by Moody’s.

On Thursday, RBC Capital Markets is set to price the Las Vegas Convention and Visitors Authority’s $500 million Series 2018B convention center expansion revenue bonds.

Bond proceeds from will partly fund the authority's $860 million Phase Two expansion project. JNA Consulting Group and Montague DeRose are co-financial advisors while Stradling is bond counsel. The deal is rated Aa3 by Moody’s and A-plus by S&P.

Wednesday’s bond sales

North Carolina

South Carolina

California

Indiana

Florida

Ohio

Bond Buyer 30-day visible supply at $9.69B

The Bond Buyer's 30-day visible supply calendar decreased $1.55 billion to $9.69 billion for Wednesday. The total is comprised of $2.87 billion of competitive sales and $6.82 billion of negotiated deals.

Secondary market

Municipal bonds were weaker on Wednesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields rose as much as one basis point in the one- to 30-year maturities, with the exception of the six-year maturity where yields fell less than a basis point.

High-grade munis were also weaker, with yields calculated on MBIS' AAA scale rising as much as one basis point in the one- to 30-year maturities except in the six-year maturity where yields fell less than a basis point.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the yield on 30-year muni maturity rising one basis point.

Treasury bonds were stronger as stock prices traded slightly lower.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 85.4% while the 30-year muni-to-Treasury ratio stood at 101.1%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Cautious and anxious was the tone felt by some in the municipal market on Wednesday as investors and market participants saw the continuation of price weakness amid relatively light supply ahead of the upcoming Federal Open Market Committee meeting later this month, according to a New York trader.

“Uncertainty is what is prevalent right now in the market,” he said in an interview Wednesday. “It’s been a tough market, and very quiet,” he added, indicating that activity slowed due to Monday’s Rosh Hashanah holiday and Tuesday’s Sept. 11 memorial observances.

“September has a tendency to be on the weak side” with regard to supply following the summer doldrums, he said. “There’s not a bunch of supply, and the Fed meeting is slowing up the market,” adding that investors are feeling “a little cautious” in advance of the Sept. 25 and 26 planned meeting.

“If there’s any reason not to do anything, then that’s what they do -- whether it be a Friday for unemployment numbers or a Fed meeting, or geopolitical stuff,” he said of investors. “Flows have been very quiet.”

At the same time, he said the new issues that have come to market this week and last have done well. On the other hand, “the secondary market struggles,” as a result of the richness on the short-end, he added.

“We see the municipal market as clearly having a better tone than yesterday,” Michael Pietronico, chief executive officer at Miller Tabak Asset Management, said on Wednesday afternoon. “Prices for the most part are unchanged and our firm has started shopping again for bonds on the short end of the market as the correction to higher yields and relative value to Treasuries has run its course in our view,” he added.

Previous session's activity

The Municipal Securities Rulemaking Board reported 40,516 trades on Tuesday on volume of $9.82 billion.

California, Texas and New York were the municipalities with the most trades, with Golden State taking 14.352% of the market, the Lone Star State taking 13.435% and the Empire State taking 11.478%.

Treasury sells $23B re-opened 10-year notes

The Treasury Department auctioned $23 billion of 9-year 11-month notes with a 2 7/8% coupon at a 2.957% high yield, a price of 99.296918. The bid-to-cover ratio was 2.58.

Tenders at the high yield were allotted 19.38%. All competitive tenders at lower yields were accepted in full.

The median yield was 2.916%. The low yield was 2.800%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.