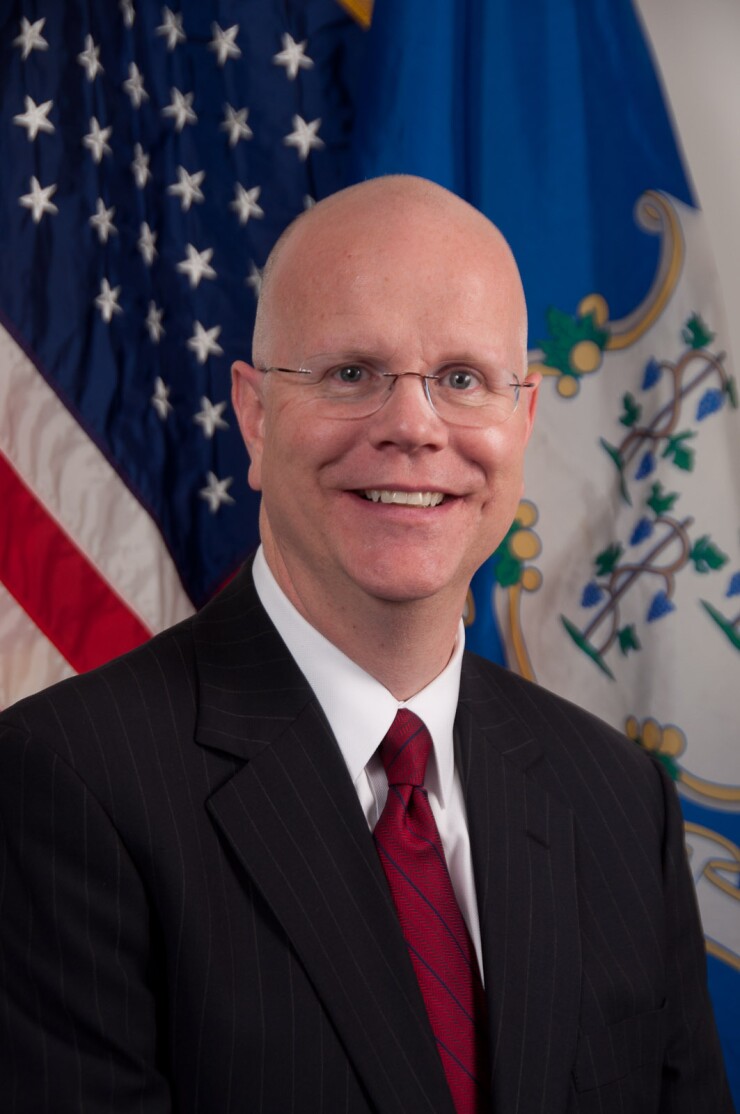

Connecticut Comptroller Kevin Lembo is the latest to warn the state to pass a budget or face more consequences from the capital markets.

“The inability to pass a budget will slow Connecticut’s economic growth and will ultimately lead to the state and its municipalities receiving downgrades in credit ratings that will cost taxpayers even more,” Lembo

Lembo said Connecticut, which has operated under Malloy's executive orders since the fiscal year began on July 1, is on track for a $93.9 million deficit for fiscal 2018.

“Connecticut's economy continues to post mixed results across an array of key economic indicators,” said Lembo. “These results do not indicate that the state can grow its way out of the current revenue stagnation.”

Malloy and the General Assembly remain gridlocked on a biennial budget with cities and towns accusing the governor of

The state Senate is split between Democrats and Republicans, 18-18, with Democratic Lt. Gov. Nancy Wyman voting to break a tie. Democrats hold a slim 79-72 edge in the House of Representatives.

Only Connecticut and Wisconsin have not enacted budgets. Pennsylvania Gov. Tom Wolf let a $32 billion spending plan become law, but the commonwealth has yet to balance it with a revenue package.

The state received three downgrades within a week in May. Moody’s Investors Service rates Connecticut’s general obligation bonds A1, while S&P Global Ratings and Fitch Ratings assign A-plus ratings. Kroll Bond Rating Agency rates them AA-minus.

Moody’s called Malloy's Aug. 26 modified executive order a credit negative for local governments because it reduces total aid to municipalities by $928 million, or 38%, from 2017 funding levels and roughly $244 million from the governor’s June 26 order.

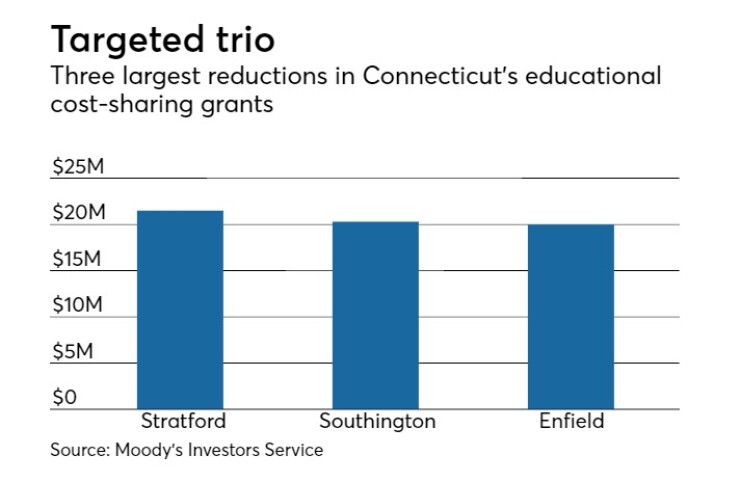

The August executive order reduces the largest source of state municipal aid, the state’s education cost sharing, or ECS grants, by $557 million relative to the fiscal 2017 disbursement. According to Moody's, the largest ECS reductions are to Stratford, by $21.5 million; Southington, by $21.5 million; and Enfield, by $20 million.

Lembo said lack of a budget worsens Connecticut’s already shaky finances.

“This problem is exacerbated each month as potential sources of additional revenue are foregone due to the absence of the necessary changes to the revenue structure,” Lembo said.

Lembo said that expenditures through July – the first month of the fiscal year – were 10.1% higher than last year and reflect the problems Connecticut will face throughout the year. The double-digit increase is due to rising fixed costs, including debt and retirement costs, he said.

He projects the transportation fund to end fiscal 2018 with a $135.3 million balance.

Meanwhile, the state continues to experience a fluctuating pattern of job gains and losses.

According to Lembo,

June’s original preliminary job gain of 7,000 was revised down by 1,400 to an employment gain of 5,600, he said. Over the 12-month period ending in July, the state has posted 11,600 new payroll jobs, said Lembo.

During the last period of economic recovery, employment growth averaged over 16,000 annually. Connecticut's unemployment rate for July was unchanged from last month now at 5.0 percent. Nationally, the unemployment rate was 4.3 percent in July.

A June 27 report from the Bureau of Economic Analysis showed Connecticut personal income increasing at an annualized rate of 3.7% in the first quarter of 2017. This ranked Connecticut 37th nationally in personal income growth.