CHICAGO - Bolstered by a ratings upgrade, Springfield, Ill., will enter the market next week with about $104 million of senior-lien electric utility revenue bonds to raise the funds to complete a new coal-fired generating plant, finance other projects, and refund its $28 million of auction-rate securities.

The fixed-rate sale is slated to price next Wednesday. Citi is the senior manager, with Merrill Lynch & Co. serving as co-manager and Chapman and Cutler LLP as bond counsel, said finance director Craig Burns.

Ahead of the sale, Moody's Investors Service affirmed the system's Aa3 credit on a total of $646 million of senior-lien debt, including the new issue, and Standard & Poor's raised its rating to AA-minus from A-plus. The bonds are secured by net operating revenues of the electric system that come from customer payments.

About $45 million from the transaction will provide the final leg of financing for the Dallman Unit 4 generating facility - a $522 million, 200-megawatt pulverized coal electric plant that is currently on budget. With about 75% of construction completed, the plant is scheduled to open in January 2010.

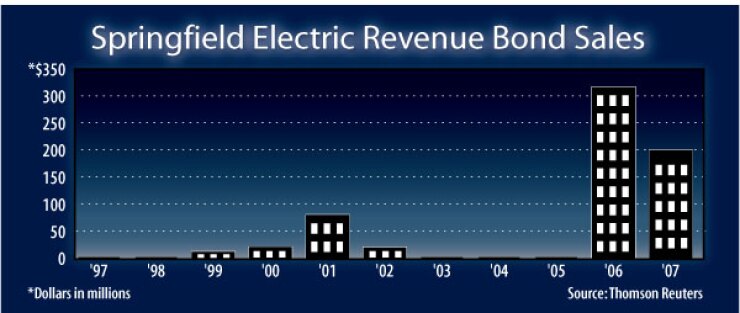

Springfield's retail electric system operates through its City Water, Light & Power department, which has generation, transmission, and distribution capabilities. It sold $200 million in debt last year for the plant and $276 million in 2006.

Another $25 million of the coming deal will finance other improvements to the system's generation and transmission facilities. About $5 million from the transaction will cover the uninsured costs incurred by the utility related to an explosion in November last year in a turbine generator that knocked the utility's Dallman Unit 1 offline.

The Dallman station contains three coal-fired generating units; Unit 1 was the smallest at 80 MW. The explosion forced the system to turn to the open wholesale market to purchase power - a fact rating agencies noted poses some fiscal risk to the utility. But the utility, which previously generated a surplus of power that was in turn sold in the wholesale market, expects to reopen Dallman Unit 1 in March.

Burns favors a conservative debt management style, limiting variable-rate exposure and opting against the use of swaps. Burns had, however, initially envisioned using an auction-rate structure for the final leg of the coal plant project financing because of the flexibility it would provide in retiring some debt early in the event surplus revenues become available or grant funds were received.

The utility potentially could capture roughly $35 million from state incentives to use Illinois coal. The utility taps coal from a mine about 25 miles north of Springfield. Any state funds, however, are on hold because of a legislative impasse on a new capital budget. Gov. Rod Blagojevich recently lowered the state capital plan's size to $25 billion from $34 billion and dropped its reliance for funding in part on a new Chicago casino, but the plan still remains stalled in the General Assembly.

The auction-rate structure was cast aside amid the collapse of that market earlier this year. In an effort to avoid the liquidity costs of using another floating-rate structure while also preserving the ability to retire some of its debt early, the utility is considering including a short call feature in the upcoming transaction, according to Burns.

"It really caused us to rethink what we could do with this deal," he said.

In this transaction, the system will refund its existing 35-day auction-rate securities that sold in issues in 2000 and 2002 under a subordinate pledge. The utility saw rates spike earlier this year and began experiencing failed auctions in February when the ARS market collapsed amid a credit crunch stemming from subprime mortgage losses and insurer downgrades.

The utility saw rates hit a high of 8.7%. Bond documents cap the rates at 10% or an indexed percentage. Rates have fallen into the 5% range in the most recent auctions. The rates are well above those paid before the market's collapse, but overall the utility feels the use of the auction-rate structure resulted in interest rate savings over a fixed-rate structure.

"We've paid an overall average of 2.6 % even with the bigger numbers we picked up over the last six months," Burns said.

Officials looked at converting the ARS to a fixed-rate, but the original bond covenants were restrictive, so with a new money sale scheduled for this year, officials opted to wait and include a refunding in the new money deal.

The upgrade into the double-A category by Standard & Poor's - while always welcome news - was especially timely for the utility as it pondered the use of insurance that's grown much more expensive given the dramatically shrunken market of triple-A insurers.

Without the upgrade, "it would have been a close call" as to whether the utility would have sought coverage, Burns said. "Now, we just don't see the need."

The system's credit benefits from rates that are competitive with investor-owned utilities, a schedule of retail rate increases enacted by the city council prior to the financings and sound bondholder protections. Moody's described the utility's ability to service its debt absent revenue from its sale of surplus power as an "important credit consideration." Based on the rate increases, management forecasts debt service coverage of 1.5 times to 2 times over the next several years. The utility covers a 70-square-mile area with 134,000 residents. Its largest customer is the state as the capitol is located in Springfield.

"The upgrade reflects sustained strong financial performance and an improved competitive position," Standard & Poor's analyst Peter Murphy wrote.

The new unit also is viewed favorably on several fronts. Because the plant is locally operated, uses local coal, and will operate more efficiently than older plants, various transmission, market, and transportation risks are minimized.

The utility also benefits from its timing, launching the new coal project several years ahead of projects from other municipal utilities and joint power agencies. Amid growing labor and material costs, the utility had previously locked in its costs with its contractor, Burns said, so its projections remain on target and affordable.

The plant also has escaped much of the criticism that has stalled some other projects amid heightened attention to global climate issues that have prompted some political leaders to raise questions over the construction of new coal power plants. Those concerns have also prompted environmental groups like the Sierra Club to mount challenges nationally to force more stringent greenhouse gas emission controls because of coal's contributions to global warming.

The Sierra Club did initially challenge Springfield's air permits approved by the Illinois Environmental Protection Agency. The city utility had promoted the new plant as more efficient and environmentally friendly than its existing two coal-fired plants that are to be retired, but the Sierra Club wanted the utility to adhere to a stricter emission standard and to agree to other environmental measures.

Avoiding costly delays, the city agreed to a settlement with the Sierra Club that added $37 million to the original cost of the project. The utility agreed to reduce greenhouse gas emissions to a level sufficient to meet the most stringent proposed standards.

The utility will reduce carbon dioxide emissions overall by purchasing wind capacity, will reduce emissions from existing coal plants by closing down it oldest ones and improving the efficiency of the Dallman 3 plant, and a portion of the revenues from the sale of surplus energy the new plant generates will go to finance customer conservation efforts.