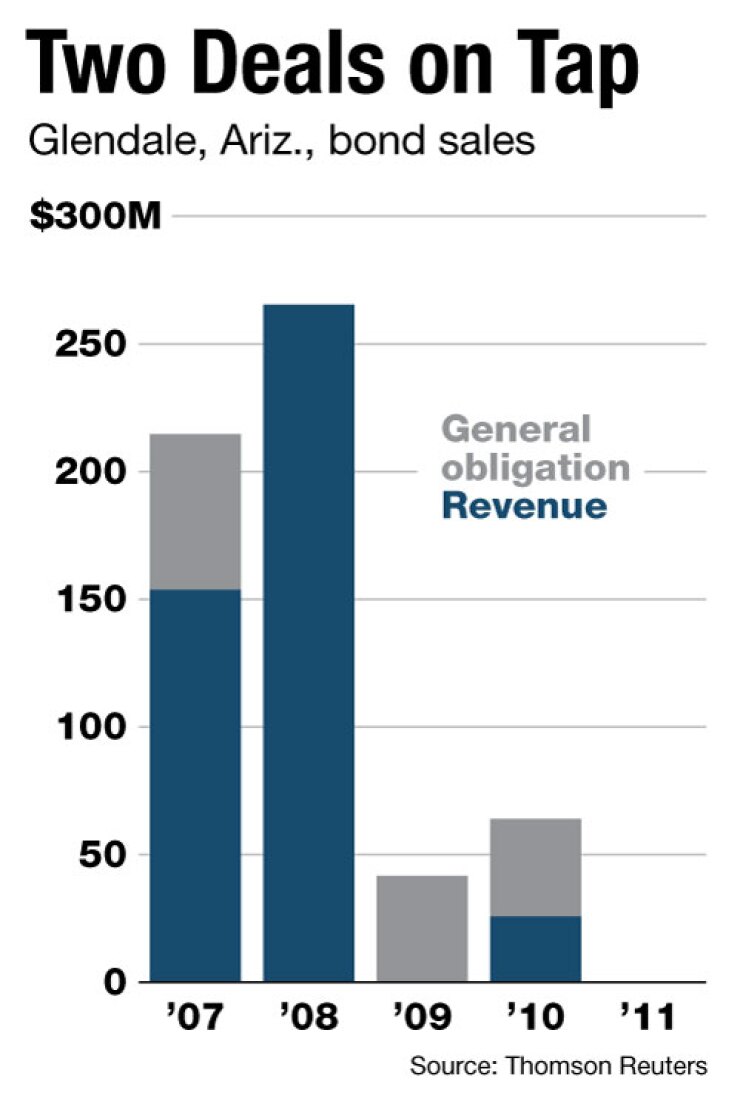

DALLAS – Glendale, Ariz., the once and future Super Bowl site that staked its future on professional sports, has taken a downgrade as it prepares to refund about $145 million of debt.

The Phoenix suburb is scheduled to price two deals this week, starting with $86.2 million of senior-lien water and sewer refunding bonds Tuesday and $58.6 million of senior-lien excise tax revenue refunding bonds on Wednesday’s calendar. Robert W. Baird is lead manager, with JNA Consulting as financial advisor.

While a record low interest-rate environment is expected to prove rewarding for Glendale, a downgrade from Moody’s Investors Service and a continuing negative outlook cloud the picture.

Citing the $50 million the city has paid over the last two year to keep the local hockey team from moving, Moody’s last week lowered the city’s unlimited tax general obligation bond rating to Aa3 from Aa2, affecting $201.7 million of debt. The senior-lien rating on same 201/7? $201.7 million of revenue bonds used to build a city-owned arena for the Phoenix Coyotes of the National Hockey League fell to A1 from Aa3. Those bonds, issued through the conduit Glendale Municipal Property Corp., are backed by city sales tax revenue.

“The downgrade primarily reflects the city’s strained financial position following a significant payment to the National Hockey League for operating losses of the Phoenix Coyotes that led to a significant decline in general fund reserves in fiscal 2011,” Moody’s analyst Patrick Liberatore said in a statement. “The city also has a high debt burden that includes significant leveraging of excise tax revenues, which are also the general fund’s largest resource.”

At the same time, Standard & Poor’s lowered its outlook on the senior-lien excise tax revenue refunding bonds to negative from stable while affirming their AA-plus rating. S&P maintained its AA rating on the third-lien excise-tax revenue bonds.

“We base the outlook revision on continued declines in pledged revenue as well as general fund pressures that have contributed to a restructuring of senior-lien maximum annual debt service and reduced pro forma coverage,” said Standard & Poor’s credit analyst Sussan Corson. “Should revenue trends fail to stabilize in the next two years or if debt issuance or restructuring materially weakens maximum annual debt service coverage, we could lower the ratings.”

The third-lien excise tax revenue bonds, issued for Glendale, are payable from rental payments by the city under a lease agreement with its Western Loop 101 Public Facility Corp. The rental payments are secured by a third-lien on the city’s unrestricted excise tax revenue. The lease agreements require Glendale, as lessee, to make monthly lease payments equal to one-sixth and one-twelfth of the next interest and principal payment, respectively, directly to the trustee.

After the recession hit Arizona particularly hard, Glendale’s finances declined substantially in fiscal 2011, according to analysts. In an attempt to keep the Coyotes playing in the $180 million city-owned Jobing.com arena, the city agreed to pay the NHL $25 million to cover operating losses of the team. The league now owns the team, which it bought in bankruptcy court in 2009.

The payment to the NHL in late fiscal 2011 was accounted for as a special below-the-line item in the city’s audited financial statements and financed with $25 million borrowed from the city’s landfill and sanitation enterprise funds, to be repaid over a 25-year period.

For fiscal 2012, the city agreed to another $25 million Coyotes payment to the NHL for the Coyotes’ operating losses, budgeting for the payment and placing $20 million in an escrow account that will be released to the NHL for repayment of operating losses if the team is not sold. The escrow is funded with $15 million of interfund borrowing from the city’s water and sewer enterprise fund and $5 million that was previously reserved within the city’s general fund, according to Moody’s. The city anticipates that the water and sewer enterprise would be reimbursed over a long-term horizon.

As the city was seeking a new owner for the team and looking for ways to cover its losses, general fund reserves declined from a “healthy” $38.8 million or 27.6% of revenues in fiscal 2010 to a “thin” $11.7 million or 7.9% of revenues in fiscal 2011, according to Moody’s.

The Coyotes were nearly sold in 2011, but the sale did not close amid a threat of lawsuits from the Goldwater Institute over the city’s plan to issue bonds to finance the deal. Two potential buyers are currently in negotiations with the NHL, and neither would expect to relocate the team, according to city officials.

“The city’s financial position is also challenged by continued declines in economically-sensitive excise tax revenues,” Moody’s added, noting that excise revenues declined between 8.7% and 5.4% annually in the last three consecutive years.

“The city’s financial position is expected to remain narrow as general fund reserves remain well below the sound levels of prior years, including average reserve levels of 34.6% of revenues for fiscal years 2007 through 2010,” Liberatore wrote. “Looking forward, management anticipates that the city faces significant budgetary challenges.”

For fiscal 2012, the city’s budget projects that general fund reserves will narrow further to 5.6% of revenues or $10.2 million, which Moody’s notes is near the bottom of the city’s policy to maintain general fund reserves of 5% to 10% of revenues.

With a 2010 population of 226,721, Glendale enjoys economic stability from nearby Luke Air Force Base, along with government and health-care employers. As a city in the West Valley area of Phoenix, Glendale sought to compete with the East Valley cities of Tempe and Mesa with the development of sports tourism.

Glendale won the Arizona Cardinals stadium after voters threatened to reject it in Mesa and the site proposed in Tempe was considered too close to Phoenix’s Sky Harbor Airport. Completed at a cost of about $455 million in August 2006, the multi-purpose facility now named University of Phoenix Stadium, was financed in part with bonds from the Arizona Sports Tourism Authority, a state agency.

The National Football League stadium hosted the 2008 Super Bowl and will host the 2015 game. The stadium also hosts the annual Fiesta Bowl featuring highly-ranked college football teams.