DALLAS — Municipal bond issuance in the Southwest bond volume fell to a five-year low of $61.5 billion in 2018, according to the data collection firm Refinitiv, but industry experts saw a silver lining in the 21% growth of new money volume.

“The dominant cause of this drop was the elimination of advance refundings, which have not been this low since 2002,” said David Medanich, head of public finance at Hilltop Securities. The federal tax law adopted in late 2017 eliminated advance refundings.

“However, 2020 should see growth as a significant number of deals become refundable," Medanich said. "Last year was a solid year for bond elections once again, and with long-term interest rates still very low, new money issuance should be strong.”

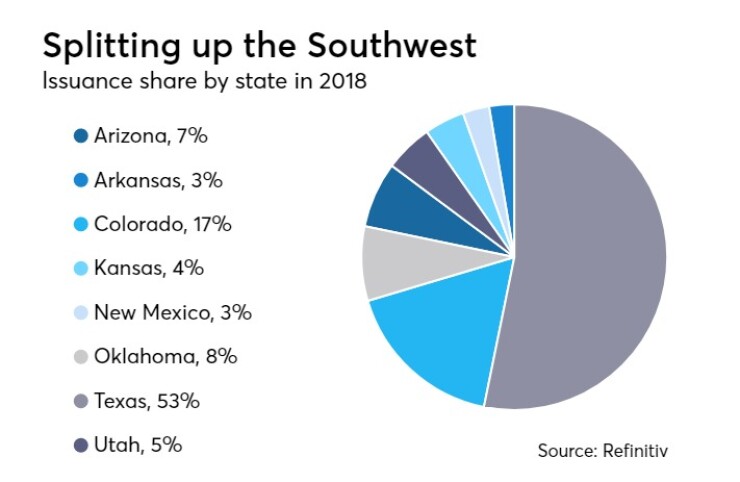

Among The Bond Buyer’s five regions, the Southwest ranked third in volume behind the Northeast and Far West. While all regions experienced major declines, on a percentage basis, the Southwest’s 20% drop was the smallest.

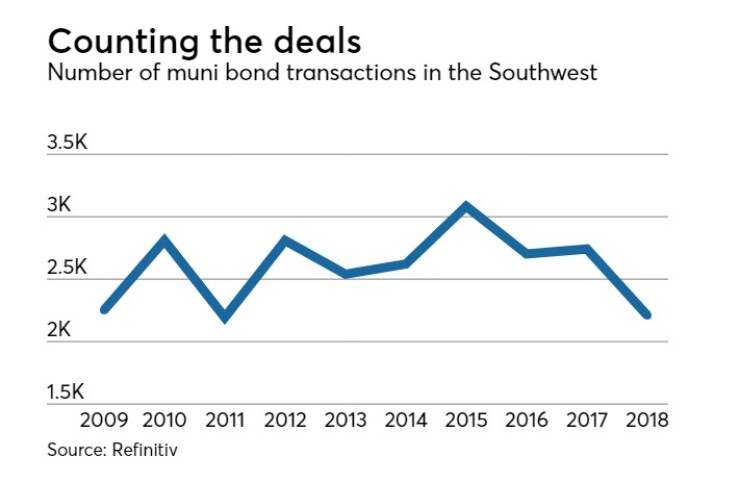

The number of issues across the eight-state region was the lowest in seven years at 2,210. The Southwest had 1,833 new-money deals in 2018, 122 more than in 2017, for a dollar volume of $44.25 billion.

But a 52% year-over-year drop in refunding and 65% decline in combined new money and refunding deals dragged volume down in every quarter but the third. Fourth quarter volume plummeted 51% year over year, a reflection of the rush to market in 2017 with advance refundings and private activity bonds, both targeted for elimination by the Republican-controlled Congress. When President Trump signed the tax bill three days before Christmas, only the advance refundings were outlawed.

“We’ve all just seen about a third of our business go away with advance refundings,” Derrick Mitchell, partner at the firm Holland & Knight, told The Bond Buyer’s Texas Public Finance Conference on Feb. 11. “I’m not sure where we’re going to go except for just plain meat and potatoes refunds.”

The Federal Reserve hiked interest rates four times during 2018, placing upward pressure on the yield curve and reducing the attractiveness of some financing opportunities.

Medanich noted that 2019 interest rate expectations changed dramatically in late 2018.

“Experts predicted additional increases in the federal funds rate, but now forecast none,” he said. “Some experts think we may even see rates decline in 2019.”

Robert Dye, chief economist for Comerica Bank in Dallas, said that, despite the Fed’s moves in 2018, the “new normal” might be low interest rates, low growth and low inflation.

“I’ve got one more rate hike in my forecast, and that’s it,” Dye told the Texas Public Finance Conference.

“Lower volume means greater demand across the credit spectrum on the buy side,” said Tripp Davenport, director at FMS Bonds in Dallas. “Despite the fear of a rising rate environment, demand among other things are keeping rates down.”

Aside from a bill that would reauthorize a $3 billion cancer bond program in Texas, no major bond proposals have surfaced in the region's state legislatures this year. Even if passed, the Texas cancer bonds would require voter approval.

One of the anomalies in the region was a 90% drop in volume of debt issued by colleges and universities. Only 23 such deals were recorded in 2018, for $767 million, down from $7.6 billion the year before in 75 transactions.

While education, including K-12 public schools, remained the largest sector, volume for those issuers fell 42% to $18.1 billion.

“The general market was in a malaise,” Davenport said. “My space, special districts, did great so I didn’t have the same perception.”

Tax-exempt bond issuance was down 22% to $53.2 billion while taxable volume fell 55% to $3.1 billion.

Bonds subject to the alternative minimum tax were up 140%, thanks in large part to Denver International Airport’s $2.5 billion issue, the largest in the region. That Aug. 14 deal helped lift the third quarter into positive territory.

Citi ranked first among book runners, credited by Refinitiv with 94 deals worth $6.6 billion. Bank of America Merrill Lynch’s $6.35 billion ranked second, followed by JP Morgan with $6.08 billion, RBC Capital Markets with $4.29 billion, and Wells Fargo with $3.73 billion.

Hilltop Securities retained top spot among financial advisors with 338 deals valued at $14 billion, more than the rest of top five combined. Estrada Hinojosa’s $3.85 billion in 57 deals ranked second, followed by PFM Financial Advisors with $3.48 billion, RBC Capital Markets with $2.82 billion, and Frasca & Associates with $2.75 billion.

Perennial bond counsel leader McCall Parkhurst & Horton retained its position with 251 deals valued at $10.37 billion, followed by Bracewell with $6.04 billion, Norton Rose Fulbright with $5.75 billion, Kutak Rock with $4.17 billion and Gilmore & Bell with $3.45 billion.

With its large airport sale, the city and county of Denver was the top bond issuer for 2018 with nine deals valued at $3.32 billion. The Texas Water Development Board’s $3.13 billion ranked second, followed by the city of Houston with $1.9 billion, the Grand Parkway Transportation Corp. with $1.48 billion, and the Oklahoma Development Finance Authority’s $1.18 billion.

In 2018, every state in the Southwest region saw declining volume except Oklahoma, which registered growth of 7.5%. Countering the national trend, the Sooner State saw a 69% increase in first-quarter volume, enough to overcome declining second and fourth quarters and a flat third quarter.

For the year, Oklahoma’s new money volume grew 89%, enough to overcome a 94% drop in refunding.

The Oklahoma Development Finance Authority had the largest issue in the state and the third-largest individual deal in the region at $1.16 billion. The March 6 sale accounted for a quarter of the state’s annual volume and made book runner Bank of America Merrill Lynch & Co. the state’s leading underwriter.

“A few new money projects are expected to be funded with bond proceeds in 2019, including ongoing renovation of the Oklahoma State Capitol Building, construction of a public health lab for the State Department of Health, and construction of new facilities for the Office of Juvenile Affairs and Department of Veteran Affairs,” State Bond Advisor Andrew Messer said. “In 2018, three series of tax-supported bonds were redeemed, freeing up more than $60 million in annual debt service payments.”

Arizona’s $4.27 billion of bonds represented a 36% drop from 2017 after declines in every quarter. That was the steepest drop on a percentage basis among the eight states. Phoenix was the largest issuer with $443.8 million of bonds. JP Morgan led underwriters with $871 million of bonds, and RBC topped financial advisors with $773.8 million. Gust Rosenfeld’s $941 million was tops among bond counsel.

The $1.63 billion of deals from Arkansas, the regions lowest volume total, was off 4% from 2017. Benton County was the state’s largest issuer with $198 million. Stephens Inc.’s $488 million topped senior managers, and Crews and Associates was the top financial advisor with $372 million. Friday Eldridge led bond counsel with $1.34 billion of deals.

Even with the Denver airport deal, Colorado saw volume fall 7% to $10.56 billion. Bank of America Merrill Lynch & Co. led senior managers with $2.21 billion, and the airport’s financial advisor Frasca & Associates ranked first among advisors with $2.53 billion. Kutak Rock led bond counsel with $2.7 billion.

Kansas’s $2.63 billion volume was down 21% from 2017. The Kansas Department of Transportation was the top issuer with $320 million. Piper Jaffray led senior managers with $429.8 million. Springsted was top advisor with $688.9 million, and GilmoreBell dominated the bond counsel ranks with $2.05 billion.

New Mexico’s 46 deals were the fewest of any state, accounting for $1.72 billion, down 2% from 2017. Seven deals valued at $723 million made the New Mexico Finance Authority the top issuer. Morgan Stanley led senior managers with $456.9 million, and PFM ranked first among financial advisors with the NMFA's $723 million. The Rodey Law Firm’s $518 million led bond counsel.

Bank of America Merrill Lynch led senior managers in Oklahoma with $1.35 billion of deals and KeyBanc Capital Markets topped financial advisors with $1.16 billion. Norton Rose Fulbright was top bond counsel with $1.16 billion.

Texas’ $32.69 billion of bonds accounted for more than half the region’s issuance but the volume was down 24% from the previous year. The Texas Water Development Authority was the state’s top issuer with $3.13 billion of bonds. Citi topped senior managers with $4.32 billion of deals. Hilltop retained top rank among financial advisors with $11.28 billion of business, and McCall Parkhurst & Horton held its perennial top rank among bond counsel with $10.27 billion.

Utah’s $3.12 billion represented a 34% decline, the second steepest behind Arizona's. Salt Lake City was top issuer with $850 million of bonds, making Goldman Sachs top senior manager on the strength of the state capital's two deals. Zions Bank was top advisor with $871 million, and GilmoreBell led bond counsel with $999 million.