CHICAGO - Indiana-based Sisters of St. Francis Health Services Inc. hopes to try again soon to get a long-postponed new-money deal sold, possibly by next week.

The system is planning a $280 million bond issue that will include $125 million in new money.

The system postponed the borrowing this year as it sought to refinance auction-rate and insured variable-rate debt. It restructured some auction-rate debt following that market's collapse early this year and then turned to restructuring its floating-rate debt that carried insurance from downgraded bond insurers.

The system was forced this week to again delay the planned transaction due to market turmoil that has driven up interest rates.

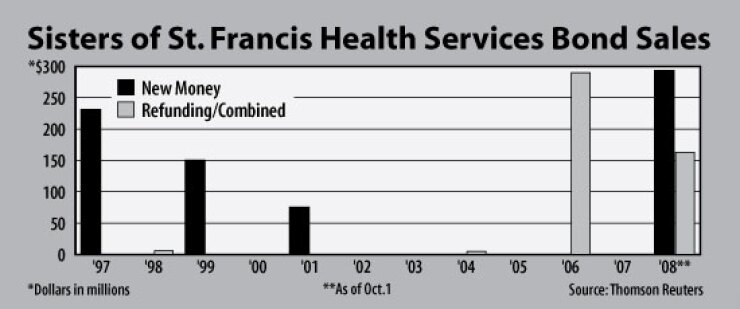

The issue comes a few weeks after the system converted $300 million of insured variable-rate debt into a fixed-rate mode capturing an interest rate of 5.34%. In April, SSFHS was one of the first health care issuers to take out a swath of its troubled auction-rate debt when it refunded roughly $326 million.

"Our team in January was meeting weekly, planning to do something in April, and then everything got disjointed in the market," said Jennifer Marion, chief financial officer of SSFHS,which operates 12 facilities largely located between Chicago and Indianapolis. "So then we decided to focus on fixing the 2006 auction-rate debt, and then our bond insurers went from triple-A to not very highly-rated overnight, so we deferred the new money."

SSFHS had planned to sell the new-money issue along with bonds to refund the system's last auction-rate debt on Monday but opted to postpone the sale.

"We're just seeing if there's a pocket of opportunity this week," said Marion. "Our [official statement] has been out there since last week, and we're ready to go."

The deal includes $279 million in variable-rate debt divided into five series. Roughly $153 million will refund auction-rate debt originally sold in 2003 and insured with Financial Security Assurance Inc., which remains triple-A rated.

The new money would finance construction of a replacement hospital in Lafayette, Ind. The system has a $1.15 billion, four-year capital plan that is expected to be funded with a combination of internal funds and additional borrowing.

Merrill Lynch & Co., which has been acquired by Bank of America Corp., and Citi are underwriting the bonds. Ice Miller LLP is SSFHS's bond counsel, and Kaufman Hall & Associates is its financial adviser.

Bank of America NA. is providing a letter of credit for the $125 million in new money. The Bank of New York Mellon NA. is providing a letter of credit for roughly $90 million, and JPMorgan Chase Bank NA is providing a letter of credit on another $63.6 million.

Despite the market fluctuations throughout the year, Marion said the benefits of issuing variable-rate debt are clear if viewed over the long-term. "If we did have all our portfolio [in fixed rate] for the last 11 years, we would probably have seen $11 million in extra interest costs," she said. "You can't look at it negatively during those years when it doesn't work for you, because there are many years of great dividends. Unfortunately it has been a very long, drawn-out process to get it all remediated, but it will get done."

Fitch Ratings rates the system AA with a stable outlook. Moody's Investors Service rates its Aa3 with a stable outlook. SSFHS had roughly $855 million in outstanding debt as of the end of fiscal 2007.