The municipal bond market will be focused on transportation on Thursday as the San Francisco County Transportation Authority sells $249 million of bonds.

Secondary market

U.S. Treasuries were stronger on Thursday. The yield on the two-year Treasury dipped to 1.55% from 1.56%, the 10-year Treasury yield declined to 2.31% from 2.34% and yield on the 30-year Treasury bond decreased to 2.82% from 2.85%.

Municipal bonds finished mixed in active trading on Wednesday. The yield on the 10-year benchmark muni general obligation was unchanged from 1.93% on Tuesday, while the 30-year GO yield rose two basis points to 2.69% from 2.67%, according to the final read of Municipal Market Data's triple-A scale.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 82.5% compared with 84.1% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 94.4% versus 96.3%, according to MMD.

AP-MBIS 10-year muni at 2.273%, 30-year at 2.817%

The Associated Press-MBIS 10-year municipal benchmark 5% general obligation was at 2.273% early Thursday, compared to the final read of 2.276% on Wednesday, according to

The AP-MBIS index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 37,567 trades on Wednesday on volume of $13.20 billion.

Primary market

The calendar dwindles to its last major issue on Thursday.

The San Francisco T.A. is selling $248.54 million of Series 2017 limited tax senior sales tax revenue bonds.

The deal is rated AA-plus by S&P Global Ratings and AAA by Fitch Ratings.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $1.88 billion to $10.59 billion on Thursday. The total is comprised of $2.62 billion of competitive sales and $7.97 billion of negotiated deals.

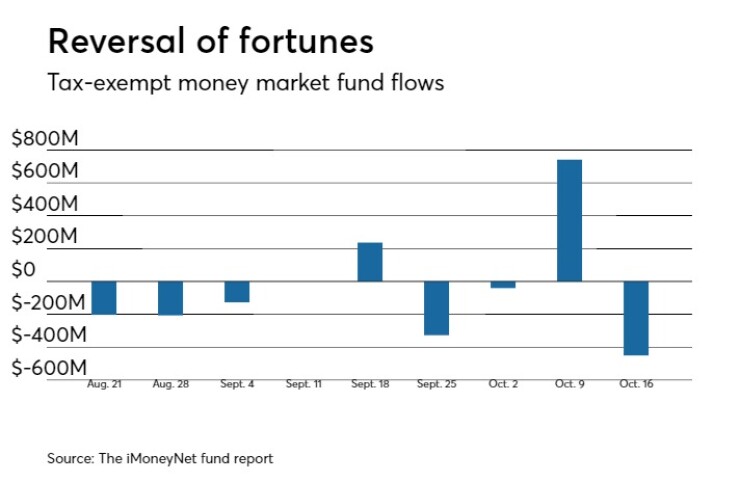

Tax-exempt money market funds see outflows

Tax-exempt money market funds experienced outflows of $450.3 million, dropping total net assets to $128.16 billion in the week ended Oct. 16, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an inflow of $741.4 million to $128.61 billion in the previous week.

The average, seven-day simple yield for the 218 weekly reporting tax-exempt funds slid to 0.44% from 0.45% the previous week.

The total net assets of the 830 weekly reporting taxable money funds increased $12.79 billion to $2.586 trillion in the week ended Oct. 17, after an outflow of $11.30 billion to $2.573 trillion the week before.

The average, seven-day simple yield for the taxable money funds was steady at 0.69% from the prior week.

Overall, the combined total net assets of the 1,048 weekly reporting money funds increased $12.34 billion to $2.714 trillion in the week ended Oct. 17, after outflows of $10.55 million to $2.702 trillion in the prior week.

Data appearing in this article from Municipal Bond Information Services, including the AP-MBIS municipal bond index, is available on the Bond Buyer Data Workstation.