A large calendar this week should spark high demand, according to Amy Raymond, fixed income manager at Cumberland Advisors, who noted that a large influx of taxable municipal paper is adding to investors palettes.

Primary market

The city and county of San Francisco, California, (Aa1/AA+/AA) sold $252 million of green certificates of participation. Citigroup won the COPs with a true interest cost of 3.0716%.

The financial advisors are KNN Public Finance and Ross Financial. The bond counsel are Norton Rose Fulbright and Curls Bartling. Proceeds will be used for the acquisition, demolition, construction and installation of improvements for the 49 South Van Ness building project.

In the negotiated sector, Siebert Cisneros Shank priced the District of Columbia Water and Sewer Authority’s (Aa2/AA+/AA) $159.255 million of Series 2019A public utility subordinate lien green revenue bonds and Series 2019B public utility subordinate lien revenue bonds. Siebert also priced $345.5 million of taxable bonds for the authority.

The deal was oversubscribed. The tax-exempts received $1 billion of orders, according to Matt Brown, D.C. Water's chief financial offer, while the taxables saw $844 million of orders.

"The estimated present-value savings from the sale today is about $50.8 million and $77 million of budget savings," Brown said.

Taxable muni deals — and specifically taxable refundings of tax-exempt debt — have been becoming more popular due to the ripple effects of 2017's tax reform law, which eliminated advance refundings.

"We refunded $300 million of 2013 bonds as taxable because of the loss of advance refundings," Brown said. "This was a great time to go to the market both for new-money and the taxable refunding. We’re also looking forward to our upcoming issuance of $100 million of variable-rate debt."

Since 2009, the authority has sold about $4 billion of bonds, with the most issuance occurring in 2014 when it sold $828 million. It did not come to market in 2011.

Morgan Stanley priced California Health Facilities Financing Authority’s (Aa3/AA-/AA-) $324.105 million of Series 2019C revenue term-rate bonds for Providence St. Joseph Health.

Morgan Stanley priced Oregon’s (Aa1/AA+/AA+) $191.38 million of Series 2019 K, M, N and O GO’s.

Goldman Sachs priced Hamilton County, Ohio’s (Aa2/AA/NR) $135.585 million of Series 2019CC hospital facilities revenue bonds for the Cincinnati Children's Hospital Medical Center.

Citi priced the Kentucky State Property and Buildings Commission’s (A1/NR/A+/A+) $331.155 million of Revenue Bonds, Project No. 122 Series A and revenue refunding bonds, Project No. 122 Series B; revenue refunding bonds, Project No. 122 Series C (forward delivery); and taxable revenue refunding bonds, Project No. 122 Series D.

Citi priced the Stockton Public Financing Authority, Calif.’s (NR/A/NR) $118.8 million of Series 2019 wastewater bond anticipation notes.

Raymond James priced the Santa Monica-Malibu Unified School District, Calif.’s (Aaa/AA+/NR) $105.915 million of taxable GO refunding bonds.

The Lexington County School District No. 1, South Carolina, (Aa1/AA/NR) sold $165 million of Series 2019B GOs. BofA Securities won the deal with a TIC of 2.5298%. Compass Municipal Advisors was the financial advisor; Haynsworth Sinkler was the bond counsel. Proceeds will be used for capital improvements.

Suffolk County, N.Y., sold $180.945 million in notes and bonds on Tuesday. Three groups won the $100 million of Series 2019I tax anticipation notes while Morgan Stanley won the $80.945 million of Series 2019B public improvement GOs which were insured by Assured Guaranty Municipal. Capital Markets Advisors was the financial advisor; Harris Beach was the bond counsel. Bond proceeds will be used to finance various capital improvements and buy vehicles and equipment.

Tuesday’s bond sales

Technicals provide direction

Municipal technicals are providing directional influence to the asset class as a key driver of performance, according to a report from Jeffrey Lipton, managing director of credit research at Oppenheimer & Co. Inc.

“We are now seeing a very different supply backdrop as compared to the dearth of new issuance during earlier months,” Lipton wrote in a Monday report.

“Double-digit weekly calendars have returned and we think that issuers are seeking to lock in compelling borrowing terms before year end as bedrock projects require long-term financing,” he added.

Lipton said he is not necessarily supportive of further easing by the Federal Reserve Board, the firm believes rates have the potential to move lower with or without additional cuts.

“Slowing economic momentum with benign inflationary pressure and geopolitical events support this thesis and we think that issuers will continue to have attractive entry points throughout Q4.”

In the near-term, BlackRock sees continued unease in the market.

“Considering expectations for continued interest-rate volatility and seasonal weakness in the muni market, we maintain an overall neutral stance on duration (interest-rate risk) via a barbell yield curve strategy with concentrations in maturities of zero to 5-years and 20-years+. We continue to hold a favorable view on credit and prefer revenue bonds, lower rated investment grade credits, and issues in high tax states,” Tuesday’s report said.

The firm’s municipal market update was written by Peter Hayes, head of the municipal bonds group, along with James Schwartz, head of municipal credit Research and Sean Carney, head of municipal strategy.

“After 10 consecutive months of positive performance, the muni market’s winning streak came to an end in September amid persistent interest rate volatility. The S&P Municipal Bond Index declined 0.65% over the month, putting the year-to-date return at 6.57%,” they wrote. “Although the Fed cut its target range in mid-September, interest rates ended the month higher given a backdrop of moderate economic growth, slightly higher inflation and some easing in trade tensions. (Bond prices fall when rates rise.) Compared to Treasury bonds, municipals modestly underperformed across the curve; however, this helped reset relative valuations to more attractive levels, particularly in the front and intermediate part of the curve.”

They added that while rate volatility caused demand to wane, net flows into municipal bond funds remained positive.

“We expect rate volatility will continue as geopolitical uncertainties remain significant. Additionally, muni market dynamics typically turn less favorable at this time of year as issuance picks up after a quiet period in the summer,” they wrote. “Historically, October has experienced a 39% month-over month increase in supply and has been the second worst performing month of the year on average. Long-term investors should keep in mind that seasonal cyclicality is a natural characteristic of the municipal market.”

Secondary market

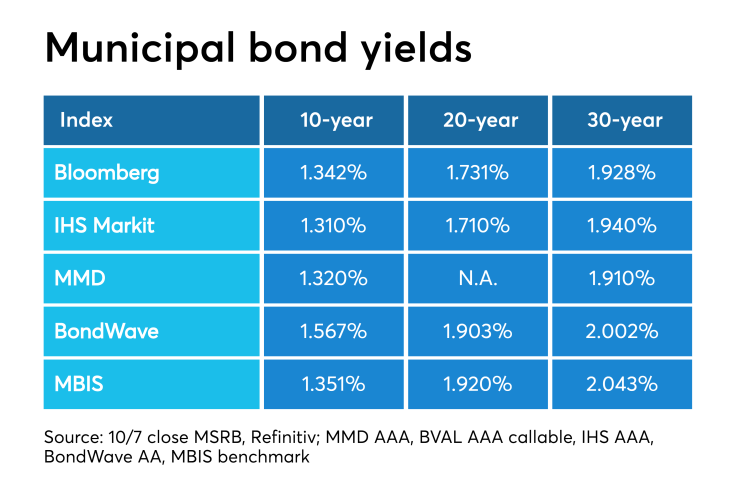

Munis were stronger on the MBIS benchmark scale, with yields falling by less than one basis point in the 10-year maturity and by one basis point in the 30-year maturity. High-grades were also better, with yields on MBIS AAA scale falling by less than one basis point in the 10-year maturity and by two basis points in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10- and 30-year GOs fell by three basis points to 1.29% and 1.88%, respectively.

“The ICE muni yield curve is three basis points lower,” ICE Data Services said in a Tuesday market comment. “High-yield and tobaccos are down one basis point with very quiet trading. Taxables are down three basis points and and Puerto Rico is unchanged.”

The 10-year muni-to-Treasury ratio was calculated at 83.2% while the 30-year muni-to-Treasury ratio stood at 91.7%, according to MMD.

Stocks were lower as Treasuries were little changed. The Treasury three-month was yielding 1.705%, the two-year was yielding 1.452%, the five-year was yielding 1.3%, the 10-year was yielding 1.554% and the 30-year was yielding 2.053%.

Previous session's activity

The MSRB reported 28,217 trades Monday on volume of $7.23 billion. The 30-day average trade summary showed on a par amount basis of $11.05 million that customers bought $5.91 million, customers sold $3.26 million and interdealer trades totaled $1.88 million.

California, New York and Texas were most traded, with the Golden State taking 14.722% of the market, the Empire State taking 12.217% and the Lone Star State taking 10.285%.

The most actively traded securities were the New Jersey Tobacco Settlement Financing Corp. Series 2018A 5.25s of 2046, which traded seven times on volume of $33.1 million.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.