DALLAS — Trustees of the Harlandale Independent School District in San Antonio have launched a probe into work financed with bonds authorized by voters in 2006 and 2009 to determine if costs are appropriate.

The 14-square-mile district on San Antonio's south side is also investigating its bond project manager, Jasmine Engineering.

A report by district superintendent Robert Jaklich said the engineering firm had possibly provided bogus references for architectural firms being considered for bond-financed projects.

The San Antonio Express-News obtained a copy of Jaklich's confidential report to the board through a Freedom of Information Act request.

The board voted 5 to 2 to audit the vendors but rejected a trustee's motion to suspend or terminate the district's legal counsel, Escamilla, Poneck & Cruz. The majority of the trustees said the suggested suspension could be seen as an attempt to curtail the firm's inquiry of Jasmine Engineering.

Trustees will meet in special session Monday to consider whether to terminate the firm's bond project oversight contract. Escamilla Poneck has submitted recommendations to the board on how to proceed with the inquiry, but declined to disclose its advice.

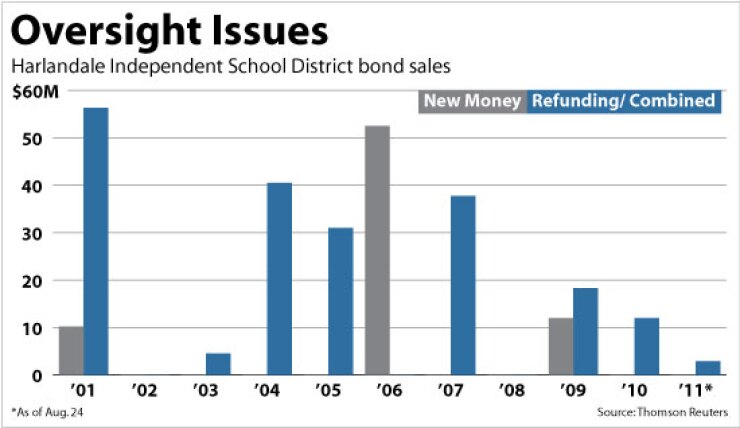

Work has been completed on most of the projects financed by a $53 million general obligation bond package approved by voters in 2006. However, progress has been slow on renovation and expansion projects included in a $13 million authorization from 2009.

Jasmine received its first contract from Harlandale ISD in August 2007 for work on some of the 2006 bond projects. Jasmine was named project manager for the later authorization in December 2009. The district said it has paid Jasmine $2.5 million under the management contract, and will pay it another $375,236 when work is completed.

In his report, Jaklich said 21 architectural firms submitted qualifications for bond projects and four finalists were selected.

Jaklich said Jasmine seems to have provided incorrect reference information on three finalists from officials at three nearby school districts.

He said Jorge Cabello, senior director of construction planning and design at North East Independent School District, "stated emphatically that these references are totally untrue and fabricated."

"Mr. Cabello also stated he could not have given a reference check on these architect firms, due to the fact that none of these firms have worked on or participated in any of the bond projects that he has worked on," Jaklich said.

In the references submitted to the district in 2010 by Jasmine, Cabello's alleged responses gave poor marks to three of the four finalists.

Cabello told Jaklich that one of the four finalists had done work for Northeast ISD, but Jasmine Engineering did not seek his opinion of that firm.

In a written response included in the report, Jasmine chief executive officer Jasmine Azima denied fabricating the references. She suggested that Cabello did not recall a February 2010 conversation in which she sought the references.

Harlandale ISD's $208.3 million of outstanding debt has underlying ratings of A1 from Moody's Investors Service, AA-minus by Fitch Ratings, and A-plus by Standard & Poor's. The debt is enhanced to triple-A with coverage from the Texas Permanent School Fund.

Harlandale ISD has no authorized but unissued debt, and no current plans for a bond election.