BRADENTON, Fla. - Just ahead of an $80 million general obligation bond refunding, Standard & Poor's Friday lowered Atlanta's GO rating two notches to A from AA-minus.

Standard & Poor's assigned the A rating to the GO refunding, and said the outlook on the city's GO credit is stable.

The downgrade was the result of operating deficits over the past four fiscal years as well as longer-term pressures associated with the city's underfunded pensions, police overtime, and subsidies to several funds, said Standard & Poor's analyst John Sugden.

Atlanta's general fund was structurally unbalanced in fiscal 2008 and the year-end budget reflected a $112 million shortfall. The city also had a projected $50 million to $60 million deficit in the first quarter of fiscal 2009 that has grown to an estimated $80 million to $90 million with revenues lagging 12% below expectations, according to Sugden.

"At this rating level, we expect the city to manage with very thin levels through the current recession," he said.

While a quick financial recovery could lead to rating improvement within this category, Sugden said a return to the city's previous rating would depend on the ability of management to address long-term pressures and liabilities associated with pensions, police overtime, and subsidies to the sanitation and other funds.

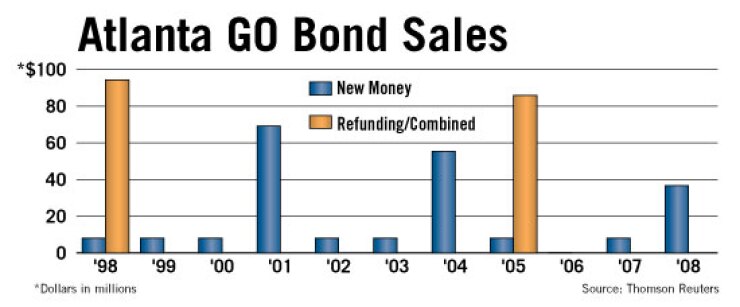

City officials could not be reached for comment about the downgrade, or details about the upcoming refunding sale. According to Standard & Poor's, the city plans to use bond proceeds from the sale to refund Series 1998 GO and GO refunding bonds for net present-value savings of more than $6.9 million to be taken primarily over the first four years for budgetary relief.

Half of the state's population resides in Atlanta, the capital of Georgia and the seat of Fulton County.

The city has put measures in place to generate savings and balance the budget at fiscal year-end, Sugden said.

Cost-cutting measures include a reduction of 222 positions, a hiring freeze, and an unpaid, weekly one-day furlough for all general fund employees, as well as other itemized savings that management estimates will generate approximately $60 million in savings. Atlanta also had a budgeted reserve of $28 million that it planned to use, along with other cost-cutting measures, to close the gap.

"Significant uncertainty remains for fiscal 2010 because the continued economic deterioration could place increased pressure on the city's finances through fiscal year-end 2009 and for fiscal 2010," Sugden said. "Given that the city has posted operating deficits over the past four fiscal years, before the economic downturn, we do not expect economic recovery to translate directly into immediate financial recovery."

As of Jan. 1, 2008, the unfunded liability in the city's three pension funds was $1.23 billion, while the city's unfunded liability for other post-employment benefits was estimated at $1.1 billion at the end of fiscal 2008, according to Sugden's report.

Atlanta's GO bonds are rated Aa3 by Moody's Investors Service. As of yesterday afternoon, Moody's had not released a rating on the upcoming refunding. The city's GO bonds are not rated by Fitch Ratings.

The city had approximately $296.9 million of outstanding GO debt at June 30, 2008, according to its 2008 financial report.