PROVIDENCE, R.I. – Rhode Island's pension fund earned $64.2 million in investment gains in August which brings the fund's value to $8.17 billion, according to state Treasurer Seth Magaziner.

Magaziner cited the “back to basics” strategy his office undertook about a year ago.

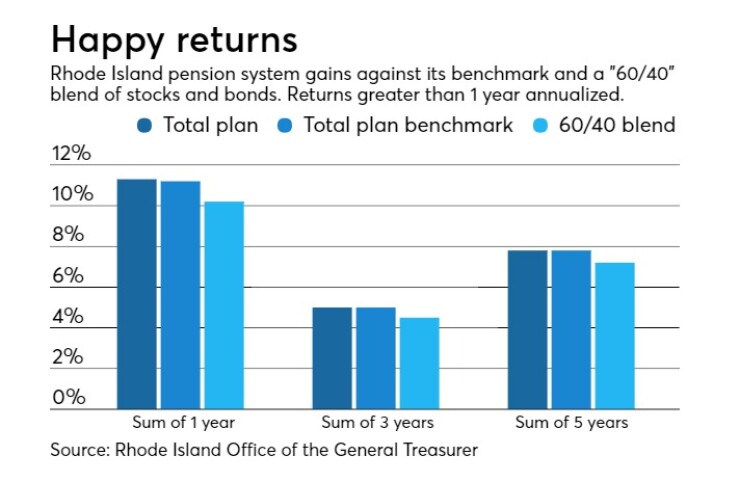

The fund earned 0.79% net of fees in August, outperforming its own 0.77% benchmark and beating a traditional 60% stock-40% bonds portfolio, which would have only delivered a 0.58% return.

Similarly, said Magaziner, the fund's one-year return for the 12-month period ending Aug. 31 is 11.27%, beating the plan's benchmark which stands at 10.95% and ahead of a traditional 60%/40% portfolio, which would have returned 10.21%.

Magaziner announced the new investment strategy in September 2016, which moves the state out of most hedge funds and into more traditional investments that are designed to grow when markets are up and provide stability when markets are down.

“Our main goal is always to maintain and improve the retirement security for our members,” Magaziner said in an interview last Tuesday after his speech at the Rhode Island Infrastructure Bank summit at the Omni hotel in downtown Providence.

Magaziner, just elected vice president of the National Association of State Treasurers, said his office is halfway through with its back-to-basics implantation. “We’re making a handful of tweaks,” he said.

“I think one of the things that we found when we were going through the process of designing back to basics was that a lot of the things that hedge funds were supposed to for us, reducing volatility, reducing risk, there are other ways to do it that are lower cost and have stronger transparency,” he said.

“And some of these alternatives to hedge funds even may have not existed five years ago, but because investors have been demanding, there are alternatives to hedge funds than we can use.”

Additionally, the state legislature recently codified a Magaziner best-practice initiative known as Transparent Treasury, which he began to implement about two-and-a-half years ago.

The policy requires the state retirement system to only invest with managers that allow Treasury publish essential information on its website. “Importantly, that’s all fees and expenses, so management, performance, carries interest, fund interest the whole deal,” said Magaziner.

Feedback has been all positive, said Magaziner.

“I can’t recall a time since we launched Transparent Treasury that anyone’s complained about it,” he said. “I think this is a direction that the world is headed. There is an understanding, particularly when it’s public dollars, that the public is entitled to a level of transparency and that managers have to be willing to accept a level of scrutiny that they haven’t in the past.”

Magaziner cited similar efforts in California, New York City and Missouri.

Former Securities and Exchange Commission Chairman Arthur Levitt Jr. said every public fund in the U.S. should follow Rhode Island's transparency model.

“Coming from a former chairman of the SEC, that was praise that we were very proud to receive,” said Magaziner.