Puerto Rico’s July revenues came in 8% above budget as non-residents contributed more than expected.

Net revenues totaled $649.4 million or $48.3 million above the projection, according to the Puerto Rico Treasury Department. Net revenues were 2.4% below the July 2016 total, the department reported in a written statement on Monday.

The tax category that exceeded the projection the most in dollar terms was non-resident withholding, which rose to $52.2 million -- or 157% above budget -- from $20.7 million in July 2016.

Second was the motor vehicle tax, which brought in $18.9 million, or 363% above budget.

The biggest shortfall from projections in dollar terms was for revenues from the Law 154 on foreign corporations. This was $15 million or 7.2% less than budgeted. It was also $49.2 million less than in July 2016. At $207 million it was still by far the biggest source of Puerto Rico revenues.

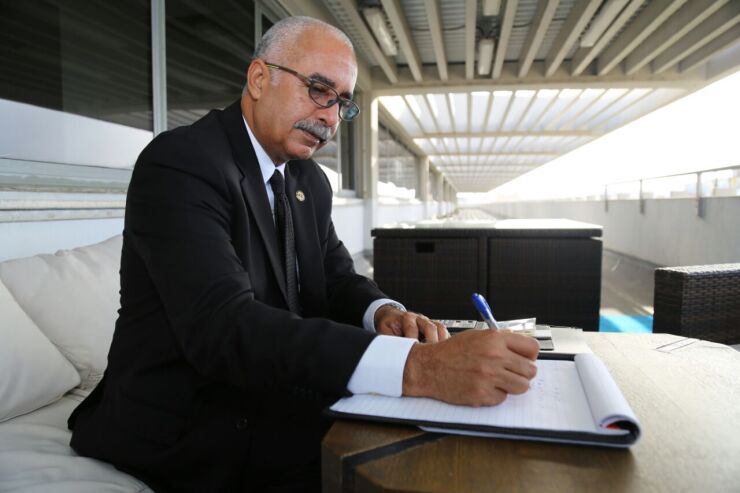

Department Secretary Raúl Maldonado Gautier said that revenues associated with consumption -- sales and use tax, cigarette, motor vehicles, and alcoholic beverages -- all were higher than projections. Sales and use tax revenues for the General Fund came in 2% above that for July 2016 and 11.1% higher than budget.