Nonfarm productivity slipped in the third quarter, the Labor Department reported Wednesday, on a day when comments from three Federal Reserve Bank presidents suggested cuts are done for now.

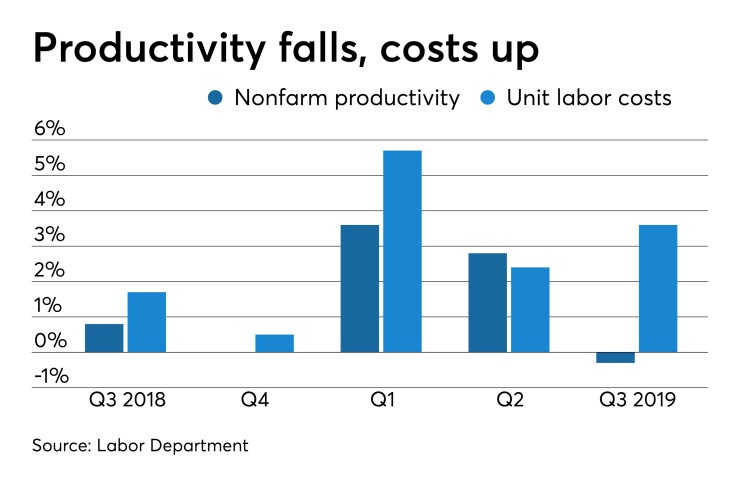

Productivity in the quarter declined 0.3% while unit labor costs grew by 3.6%. In the second quarter, productivity rose 2.8% while costs were up 2.4%.

Economists polled by IFR Markets expected a 0.9% rise in productivity and a 2.2% gain in labor costs.

Productivity had not dropped this much since the last quarter of 2015.

“The year over year change in productivity declined to 1.4% from 1.8%, a solid gain,” Mickey Levy, Berenberg Capital Markets' chief economist for the U.S. Americas and Asia, and U.S. Economist Roiana Reid write in a note. “This is the 12th consecutive quarter that productivity has increased by at least 1% year over year.”

“Healthy productivity growth is broadly positive for economic performance, supporting higher real wages and constrained increases in ULCs, and lifts estimates of longer-run potential GDP growth,” they write. “Combined with employment growth, the rise in real wages support increases in disposable personal income and consumption.”

Fedspeak

Federal Reserve Bank of Dallas President Robert Kaplan said in an interview he believes rates are “appropriate.”

“So now that we’ve got a 10-year in the 180s and a 2-year in the 160s — much more in line with the fed funds rate — I think it again reinforces to me that we’ve probably got an appropriate setting of the Fed funds rate,” he told Bloomberg News, referring to interest rates in basis points.

Separately, Federal Reserve Bank of Chicago President Charles Evans said he would be watching inflation for answers about where monetary policy should be.

"I might be a little unusual in this regard because I've previously said there was an argument for monetary policy adjustment on the basis of the underperformance of inflation alone ... I am going to be looking at inflation quite a lot," Evans told reporters, according to a Reuters report.

He called the recent rate cuts “a nice adjustment,” based on risk management, and addresses the “real risks” to the economy. “I think that it’s good for getting inflation to 2%.”

The economy, he said, “is in a good place now,” with strong consumer support, which has shown in “the most recent data.”

New York Federal Reserve President John Williams said while future moves would be data dependent, policymakers need to be proactive in maintaining the expansion, according to reports.

"We want to keep this Goldilocks economy going, not too hot, not too cold," he said. "It's a combination of responding both to what we're seeing in the data but also looking ahead and seeing where is this economy likely to be next year and the year ahead."

The three rate cuts this year have the economy prepared for the effects of potential risks, he opined. Should the economy need further assistance, Williams said, if rates were cut to zero, communication and asset purchases would be the tools the Fed uses.