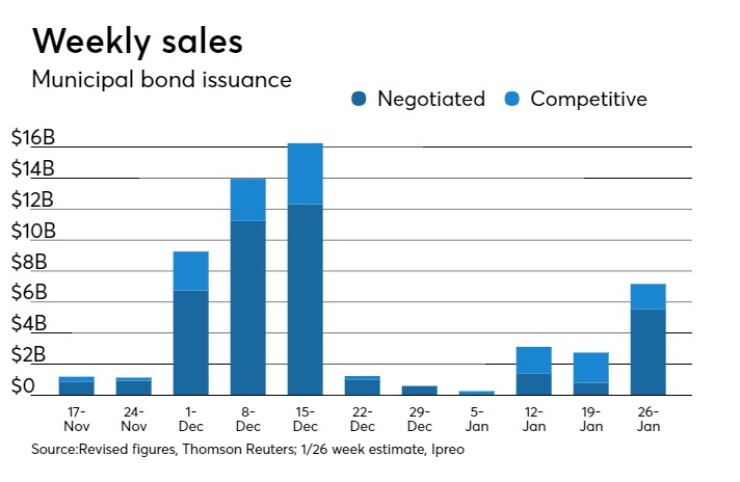

Muni volume in the last week of January is forecast to match that of the first three weeks combined.

Ipreo estimates volume will expand to $7.17 billion, up from the revised total of $2.78 billion sold in the past week and $7.18 billion since the beginning of the year, according to updated figures from Thomson Reuters. The calendar for the week ahead is composed of $5.56 billion of negotiated deals and $1.61 billion in competitive sales.

“I expect demand to be strong for next week’s larger new issue slate,” said Alan Schankel, managing director and municipal strategist at Janney. “Dealer inventories are dropping but remain elevated and the number of municipal offering items was highest since May 2013 on [this past] Wednesday , but recent strongly positive fund flows suggest there will be plenty of buyers for next week’s larger, but still limited primary calendar.”

The Sales Tax Securitization Corporation’s $898.07 billion is back on the calendar again this week,

Market sources told The Bond Buyer on Friday afternoon that Chicago is slated to come with a pre-market on Monday for $361 million of tax-exempt paper through its Sales Tax Securitization Corp., with a pricing tentatively slated for Tuesday.

The finance team is also “considering the issuance of a longer-dated, index eligible taxable bond” that also could come during the week, according to market participants. The sizing on the taxable tranche was not immediately available, so it’s unclear whether the city’s revised borrowing plans will reach the same $898 million size of the delayed issue. Taxable municipal index bonds must be $300 million. Several market participants said the addition of a taxable tranche would expand the audience of buyers and cater to current market demand.

Goldman Sachs is scheduled to price the State of Connecticut’s $800 million of special tax obligation bonds for transportation infrastructure purpose on Wednesday following a one-day retail order period. The deal is rated AA by S&P, A-plus by Fitch and AA-plus by Kroll.

Bank of America Merrill Lynch is slated to price the Port Authority of New York and New Jersey’s $843 million of consolidated bonds, featuring separate sales of alternative minimum tax and taxable bonds, both on Tuesday. The deal is rated Aaa by Moody’s Investors Service and AAA by S&P.

“One deal I will be watching is the PANYNJ to see how the larger AMT piece is priced, after tax law changes eliminated corporate AMT and bumped threshold for individual AMT,” said Schankel. “I would expect spread to tax free benchmark yields to narrow.”

The biggest competitive sale will come from Anoka-Hennepin, Minn., Independent School District No.11 on Monday. The $150 million general obligation school building bonds are rated AA-plus by S&P.

Secondary market

Municipal bonds came under pressure on Friday as U.S. Treasury yields hit three-year highs. Traders considered recent forecasts of above average economic growth and accelerating inflation coupled with the possibility of additional interest rate hikes by the Federal Reserve. Concerns over a looming government shutdown also weighed on prices Friday.

The MBIS municipal non-callable 5% GO benchmark scale was weaker in late trading. The 10-year muni benchmark yield rose to 2.366% on Friday from the final read of 2.359% on Thursday, according to

The MBIS benchmark index is updated hourly on the

Top-rated municipal bonds finished weaker on Friday. The yield on the 10-year benchmark muni general obligation rose one basis point to 2.13% from 2.12% on Thursday, while the 30-year GO yield gained two basis points to 2.73% from 2.71%, according to the final read of MMD’s triple-A scale.

U.S. Treasuries were also weaker on Friday.

“U.S. Treasury yields rose to their highest level since 2014 as fears of a government shutdown weigh on the market,” ICE Data Services said in a market comment. “While there would be no immediate impact to the bonds themselves, uncertainty in a market where rates are already rising [is] contributing to the move.”

The yield on the two-year Treasury gained to 2.06% from 2.04% on Thursday, the 10-year Treasury yield rose to 2.64% from 2.61% and the yield on the 30-year Treasury increased to 2.91% from 2.89%. The 10-year yield of 2.64% was its highest level since 2014.

“Partial federal government shutdowns have occurred in the past and this shutdown does not have a direct impact on the sovereign's AAA/Stable rating,” Fitch Ratings said in a release Friday. “The ‘x date’ when the Treasury exhausts ‘extraordinary measures’ to finance itself under the debt limit falls in late March/early April according to the [Congressional Budget Office].”

On Friday, the 10-year muni-to-Treasury ratio was calculated at 80.8% compared with 81.3% on Thursday, while the 30-year muni-to-Treasury ratio stood at 93.8% versus 93.9%, according to MMD.

Week's actively traded issues

Some of the most actively traded bonds by type in the week ended Jan. 19 were from Colorado, New York and Pennsylvania issuers, according to

In the GO bond sector, the Grand River Hospital District, Colo., 5.25s of 2037 traded 25 times. In the revenue bond sector, the New York Metropolitan Transportation Authority 4s of 2019 traded 41 times. And in the taxable bond sector, the Pennsylvania Commonwealth Financing Authority 3.864s of 2038 traded 81 times.

Week's actively quoted issues

Illinois, New Jersey and California names were among the most actively quoted bonds in the week ended Jan. 19, according to Markit.

On the bid side, Illinois taxable 5.1s of 2033 were quoted by 40 unique dealers. On the ask side, the N.J. Transportation Trust Fund Authority taxable 6.561s of 2040 were quoted by 81 dealers. And among two-sided quotes, Los Angeles Unified School District taxable 6.758s of 2034 were quoted by 23 unique dealers.

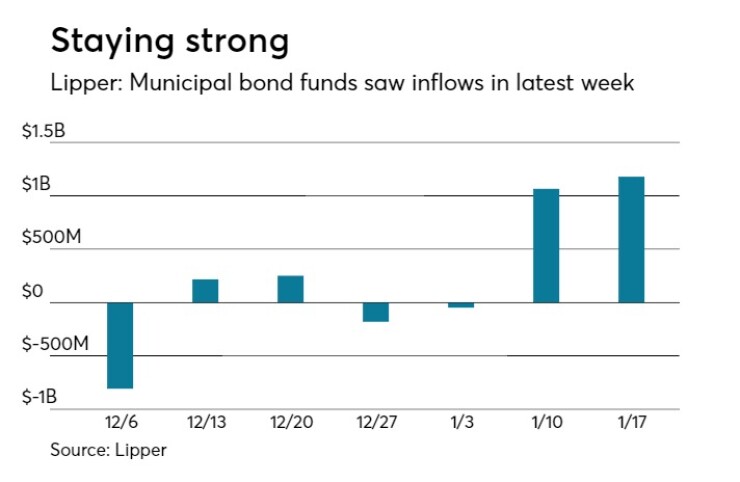

Lipper: Muni bond funds saw inflows

Investors in municipal bond funds again put cash into the funds in the latest week, according to Lipper data released on Thursday.

The weekly reporters saw $1.18 billion of inflows in the week of Jan. 17, after inflows of $1.06 billion in the previous week.

Exchange traded funds reported inflows of $118.046 million, after inflows of $22.703 million in the previous week. Ex-ETFs, muni funds saw $1.06 billion of inflows, after inflows of $1.04 billion in the previous week.

The four-week moving average was positive at $503.830 million, after being in the green at $271.840 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $1.099 billion in the latest week after inflows of $1.12 billion in the previous week. Intermediate-term funds had inflows of $178.692 million after inflows of $360.123 million in the prior week.

National funds had inflows of $1.14 billion after inflows of $988.826 million in the previous week.

High-yield muni funds reported inflows of $206.925 million in the latest week, after inflows of $365.937 million the previous week.

Treasury sells $25B of 6-day CMBs

The Treasury Department sold $25 billion of six-day cash management bills on Friday at a price of 99.979833, a high rate of 1.21%.

The CMBs, which are dated Jan. 19 and due Jan 25, had an investment rate of 1.227%.

The bills had a median rate of 1.20% and a low rate of 1.15%; 10.87% were allotted at the high rate. The bid-to-cover ratio was 5.62.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.

Yvette Shields contributed to this report.