Pennsylvania is set to hit the market with the week’s biggest offering — a $974 million competitive sale. Municipals were stronger, according to early trade data.

AP-MBIS 10-year muni at 2.235%, 30-year at 2.742%

The Associated Press-MBIS municipal non-callable 5% GO benchmark scale was stronger in early trading.

The 10-year muni benchmark yield dipped to 2.235% from the final read of 2.236% on Tuesday, according to

The AP-MBIS benchmark index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

Secondary market

U.S. Treasuries were unchanged on Wednesday. The yield on the two-year Treasury was flat from 1.64%, the 10-year Treasury yield was steady from 2.31% and yield on the 30-year Treasury was unchanged from 2.77%.

Top-rated municipal bonds ended stronger on Tuesday. The yield on the 10-year benchmark muni general obligation fell four basis points to 1.92% from 1.96% on Monday, while the 30-year GO yield dropped eight basis points to 2.60% from 2.68%, according to the final read of Municipal Market Data's triple-A scale.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 83.3% compared with 84.6% on Monday, while the 30-year muni-to-Treasury ratio stood at 93.9% versus 95.8%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 38,440 trades on Tuesday on volume of $11.60 billion.

Primary market

The biggest sale of the week is set to go out for bids — Pennsylvania’s $973.99 million of first refunding series of 2017 general obligation refunding bonds.

The deal is rated Aa3 by Moody’s Investors Service, A-plus by S&P Global Ratings and AA-minus by Fitch Ratings.

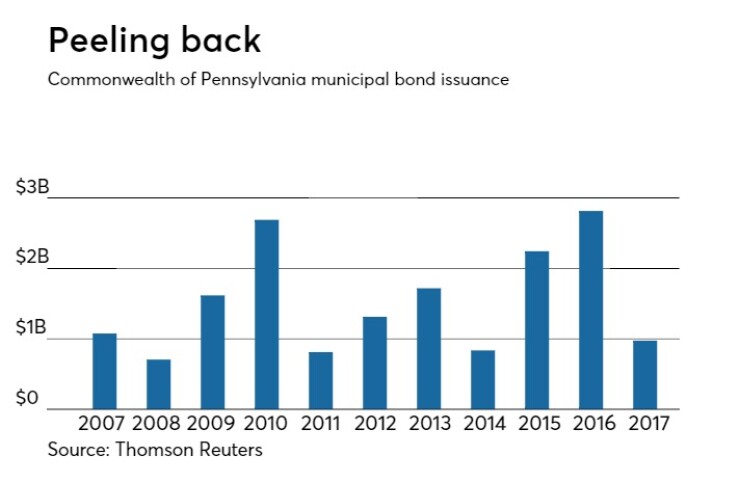

Since 2007, the Keystone State has issued about $16.8 billion of debt with the most issuance occurring in 2016 when it sold $2.81 billion and the least in 2008 when it sold $705 million.

Also in the competitive arena, the Washoe County School District, Nev., is selling $252.25 million of GOs in two separate sales.

The offerings consist of $200 million of Series 2017C limited tax GO school improvement bonds additionally secured by pledged revenues and $52.25 million of Series 2017D limited tax GO school refunding bonds.

The deals are rated A1 by Moody’s and AA by S&P.

In the negotiated sector, Siebert Cisneros Shank is set to price the New York Triborough Bridge and Tunnel Authority’s $528.02 million of Series 2017C general revenue refunding bonds for MTA bridges and tunnels for institutions after holding a one-day retrial order period.

The issue was priced for retail Tuesday to yield from 1.62% with a 5% coupon in 2023 to 2.26% with a 5% coupon in 2028.

The deal is rated Aa3 by Moody’s and AA-minus by S&P and Fitch.

Bank of America Merrill Lynch is set to price Massachusetts' $499 million of Series 2017A transportation fund revenue bonds for rail enhancement and accelerated bridge programs and Series 2017A transportation fund revenue refunding bonds.

The deal is rated Aa1 by Moody’s and AAA by S&P.

Citigroup is expected to price Harris County, Texas’ $444 million of Series 2017A permanent improvement refunding bonds, road refunding bonds, and flood control district contract tax refunding bonds.

The deal is rated AAA by S&P and Fitch.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $3.06 billion to $9.01 billion on Wednesday. The total is comprised of $4.08 billion of competitive sales and $4.93 billion of negotiated deals.

Data appearing in this article from Municipal Bond Information Services, including the AP-MBIS municipal bond index, is available on the Bond Buyer Data Workstation.