Revenue-raising options for Pennsylvania’s public school districts are limited while enrollment pressures are manageable, Fitch Ratings said in an analysis of the commonwealth’s district credits.

Fitch expects district pension costs to stabilize over the long term. While these costs have risen sharply since 2012 due to the state’s underfunding of annual pension obligations, the state has incrementally boosted its portion of the annual payment to reach full actuarial contribution as of fiscal 2017.

Gov. Tom Wolf’s proposed $32.9 billion

“As with school districts in most states, independent legal ability to increase revenue is limited under commonwealth law,” said Fitch.

Fitch rates the commonwealth’s general obligation bonds AA-minus with a negative outlook.

Districts can independently raise property tax revenues within an allowable index tied to employment cost growth, with some exemptions for pensions, special education and certain debt service. The index for 2018-19 is 2.4%.

The McKeesport Area School District, outside Pittsburgh, has petitioned the state for approval on a possible 3.42-mill property tax increase, if needed.

Property tax increases above the indexed percentage must go to a referendum except for certain conditions. McKeesport has asked the state Department of Education for a waiver.

According to Fitch, Pennsylvania school districts have stagnant of declining enrollment, but “hold harmless” provisions in commonwealth aid largely protect them from revenue losses. “Charter school competition, which requires school districts to pay charters a per-pupil funding amount, is more prominent in urban school systems,” said Fitch.

Fitch said Pennsylvania’s school intercept program, which identifies districts that need financial assistance, provides strong state oversight. It rates the commonwealth’s pre-default school aid intercept enhancement programs A-plus with a negative outlook.

“The [program] ratings are based on the mechanisms providing for the intercept of state funds due to Pennsylvania’s school districts to avert missed debt service payments,” said Fitch.

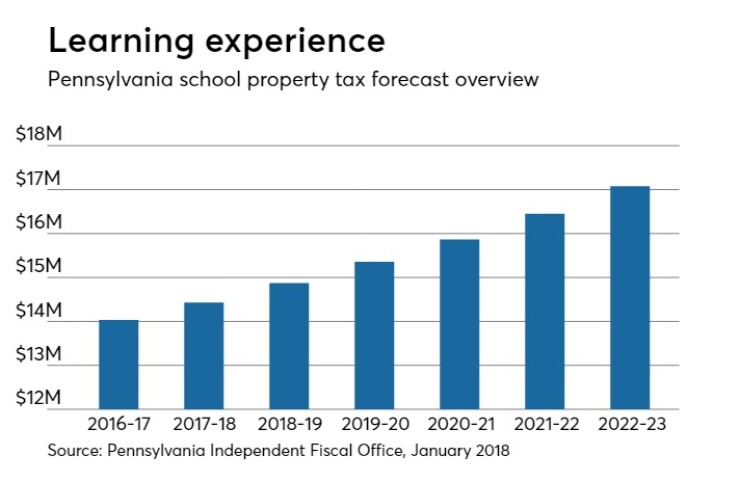

The state Senate this year could revive debate on eliminating school property taxes, which date to 1830. Such a move, however, would blow a nearly $15 billion hole in the state budget, according to a January estimate by the nonpartisan Independent Fiscal Office. That represents about half the current spending plan.

State Sen. David Argall, Rush Township, expects to reintroduce the Property Tax Independence Act, which would replace the local school property tax with higher state personal income and sales taxes. It would also expand the sales to more goods and services. His bill fell one vote shy in November 2015.