WASHINGTON – Two Senate Democrats and a former Treasury tax official voiced opposition to repealing the federal deduction for state and local taxes as part of tax reform during a Senate Finance Committee hearing on Tuesday.

Sens. Robert Menendez from New Jersey and Bob Casey from Pennsylvania, asked tax officials from former administrations about a repeal of SALT, which Menendez said is being proposed by both Trump administration officials and the House blueprint on tax reform.

Republicans claim the federal government should not be subsidizing the tax and spending policies of states, but a repeal would costs thousands of taxpayers in New Jersey and millions in the nation, said Menendez, who comes from a high tax state that would be hurt more than most other states.

Jonathan Talisman, former Treasury assistant for tax policy under President Clinton said, "I'm concerned about it."

"I think the [SALT] deduction is about double taxation, as well as the ability to pay and notions of federalism," Talisman said. He said also that there would be "collateral consequences" such as putting more pressure on states to find ways to fund infrastructure and education.

A repeal "could be viewed as an unfunded mandate because it will make it more difficult for states to raise revenues," Talisman told Casey.

State and local government groups have lobbied against eliminating SALT, but they may not have a public opportunity to officially voice their arguments in public hearings before U. S. lawmakers.

That’s because the tax reform plans being finalized by the White House and top congressional Republicans may be voted on in the House and Senate without public hearings. The House Budget Committee on Tuesday unveiled a fiscal 2018 budget resolution as a prelude to a budget reconciliation bill that could allow tax reform to be voted out of the Senate with just 50 votes, the same path Republicans have tried to go down for health care legislation.

Opponents of eliminating the deduction point out that SALT mirrors the foreign tax credit that corporations also get for their overseas profits.

“The foreign tax credit is about double taxation as well,’’ said Talisman, who noted the difference is that the tax credit is not a tax preference.

“If SALT subsidizes progressive states, one could argue the foreign tax credit subsidizes European socialism,’’ Menendez said.

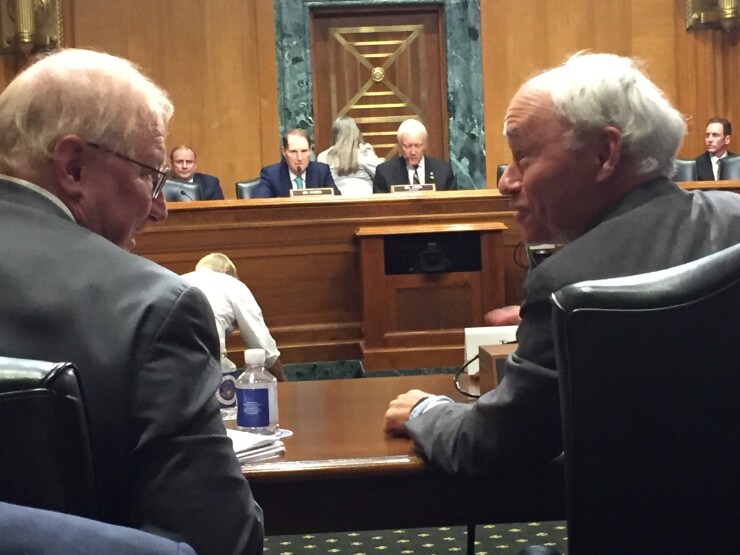

Talisman was one of four previous Treasury assistant secretaries for tax policy who testified at Tuesday’s hearing. Two served in the Bush administration and two served in the Obama and Clinton administrations.

Former Assistant Treasury Secretary Pamela Olson, who served under President George W. Bush, suggested putting a ceiling on SALT might be one way to broaden the tax base without eliminating it.

The four former Treasury officials all agreed that enacting tax reform on a bipartisan basis would provide a more enduring basis for a tax overhaul that would provide a bigger boost to economic growth.

The committee’s ranking Democrat, Sen. Ron Wyden of Oregon, pointed to the failure of Senate Republicans to gain enough support within their ranks for a health care bill is a signal that it’s time for a bipartisan approach to health care and taxes.

The reconciliation process was used for the Bush tax cuts in 2001 and 2003, but the shortcoming was that it limited the cuts to a 10-year period.

“Tax reform should not have to be a partisan exercise,’’ Hatch said in his opening statement, adding that he hopes “our Democratic colleagues will be willing to join us in this effort.’’

“I can assure that all of the Democrats want to work on tax reform,’’ the newest Democrat on the committee, Sen. Claire McCaskill of Missouri, responded later in the hearing.

McCaskill pressed Hatch on whether he will hold a committee hearing on the Republican tax reform plan before reaches the Senate floor.

“I would like to; I don’t know,’’ Hatch answered, adding, “I’m not going to say I’m going to, but I would prefer it.’’ Left unspoken by Hatch is that the decision will be made by Senate Republican Majority Leader Mitch McConnell of Kentucky.