DALLAS -- Ohio is selling $265 million of general obligation bonds next week to finance infrastructure improvements and the state’s research and development program.

Wednesday's competitive pricing comes in two pieces.

The$175 million tax-exempt, infrastructure improvement bond series will finance local governments' capital improvement projects. A $90 million taxable series of Third Frontier bonds will finance a program that finances research and development projects in support of Ohio industry, commerce and business.

Moody’s Investors Service rates the bonds Aa1. S&P Global Ratings and Fitch Ratings rate the bonds at AA-plus. The rating agencies cite Ohio’s timely response to revenue shortfalls in its budget and the moderate economic growth in the state. Ohio rating also benefits from its affordable debt load and the state’s significant pension reform changes and steady progress in funding other post-employment benefits. All three agencies said the outlook is stable.

“Ohio's stable outlook is based on our expectation that the state's enacted budget and proactive financial management will support a satisfactory financial position for the current budget year,” Moody’s wrote. “It also reflects our view that the state's economy will remain stable, despite relatively weak demographic trends.”

PFM Financial Advisors LLC is advising the state. Thompson Hine LLP is bond counsel.

The Third Frontier program, which is part of the development and services agency, awards grants and loans to emerging technology projects, all aimed at creating jobs. Most of the money from the program comes from voter-approved, state-backed bond sales. Ohio voters have approved these bonds twice, first in 2005 when voters approved $1.6 billion in funding and then again in 2010 when voter approved an additional $700 million. Of the total state funding, $1.2 billion comes from issuance of Third Frontier Research and development GOs.

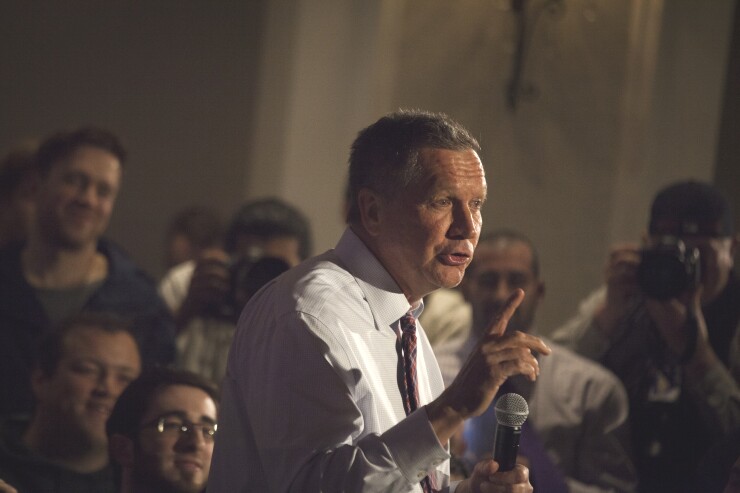

In August the program awarded $20 million to go toward the state's opioid crisis at the request of Gov. John Kasich.

Kasich signed Ohio’s 2018-2019 budget in July. The budget closed a $1 billion revenue shortfall by cutting government spending across the board, gets rid of several funds that support local governments, reduces the number of tax brackets, and spends more than $175 million to combat the opioid epidemic. The state has a rainy day fund balance of $2 billion.

The state’s tax-supported debt includes debt issued by Jobs Ohio as well as a $195 long-term liability associated with the state Department of Transportation's public-private partnership (PPP) with the Portsmouth Gateway Group, LLC to construct the Southern Ohio Veterans Memorial Highway (, a four-lane limited access highway around the City of Portsmouth, Ohio. It also has $430.7 million of variable-rate demand debt outstanding.