The muni market was getting stronger yet again on Thursday, as one of the week's biggest hit the screens.

Bank of America Merrill Lynch priced New York City’s $854.69 million of tax-exempt fixed-rate bonds, consisting of Fiscal 2019 Series D Subseries D-1 and Fiscal 2008 Series J Subseries J-1 and J-11 as a reoffering on Thursday.

New York City also sold $196.26 million of taxable general obligation bonds in competitive arena, with BAML providing the winning bid. The true interest cost was not immediately available.

Wednesday’s bond sales

Secondary market

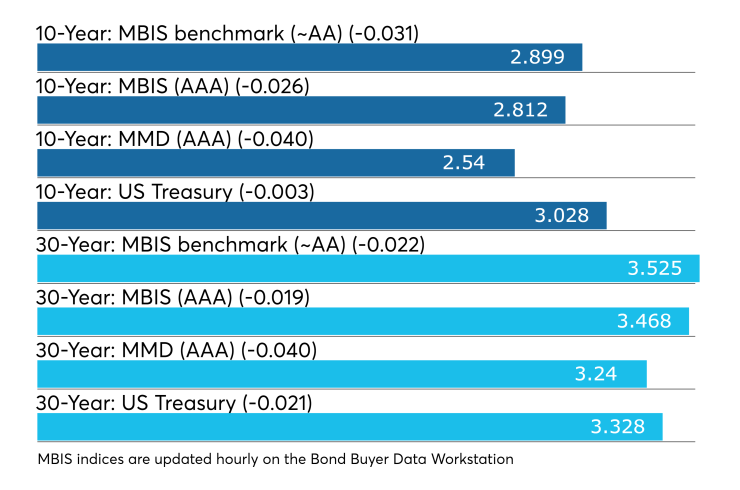

Municipal bonds were stronger on Thursday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell by as much as three basis points in all 30 maturities.

High-grade munis were stronger, with yields calculated on MBIS' AAA scale decreasing as much as three basis points across the board.

Municipals were stronger on Municipal Market Data’s AAA benchmark scale, which showed the yields on the 10-year muni general obligation and the 30-year muni maturity both two to four basis points lower.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 84.9% while the 30-year muni-to-Treasury ratio stood at 98.8%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

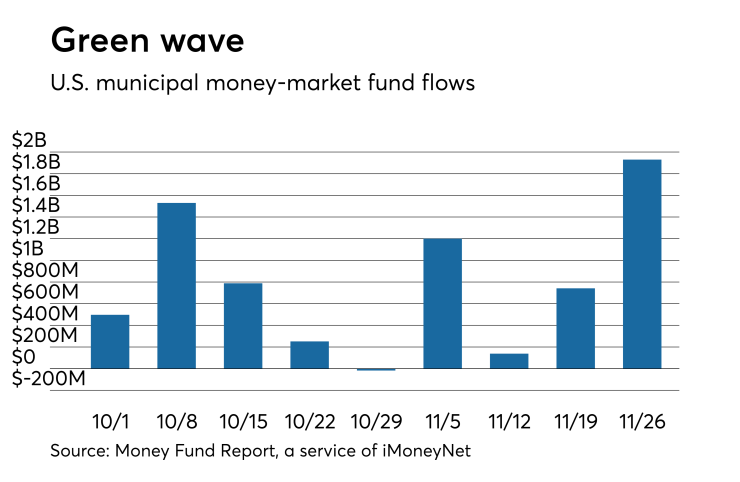

Muni money market funds sees big inflow

Tax-free municipal money market fund assets increased $1.93 billion, raising their total net assets to $138.08 billion in the week ended Nov. 26, according to the Money Fund Report, a service of iMoneyNet.com.

The average seven-day simple yield for the 190 tax-free and municipal money-market funds rose to 1.26% from 1.23% last week.

Taxable money-fund assets decreased $580.5 million in the week ended Nov. 27, lowering total net assets to $2.761 trillion.

The average, seven-day simple yield for the 816 taxable reporting funds inched up to 1.86% from 1.85% last week.

Overall, the combined total net assets of the 1,006 reporting money funds gained $1.35 billion to $2.900 trillion in the week ended Nov. 27.

Previous session's activity

The Municipal Securities Rulemaking Board reported 51,621 trades on Wednesday on volume of $13.167 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 17.303% of the market, the Empire State taking 12.175% and the Lone Star State taking 9.212%.

Treasury auctions announced

The Treasury Department announced these auctions:

- $26 billion 364-day bills selling on Dec. 4;

- $36 billion 182-day bills selling on Dec. 3; and

- $39 billion 91-day bills selling on Dec. 3.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.