The municipal bond market will see large deals from the Northeast on Wednesday as issuers in New York and Massachusetts are set to offer negotiated and competitive bonds.

Secondary market

U.S. Treasuries were weaker on Wednesday. The yield on the two-year Treasury rose to 1.57% from 1.55%, the 10-year Treasury yield gained to 2.34% from 2.30% and yield on the 30-year Treasury bond increased to 2.85% from 2.81%.

Municipals finished stronger on Tuesday. The yield on the 10-year benchmark muni general obligation was three basis points lower to 1.93% from 1.96% from Monday, while the 30-year GO yield was five basis points lower to 2.67% from 2.72%, according to the final read of Municipal Market Data's triple-A scale.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 84.1% compared with 84.8% on Monday, while the 30-year muni-to-Treasury ratio stood at 96.3% versus 96.5%, according to MMD.

AP-MBIS 10-year muni at 2.267%, 30-year at 2.811%

The Associated Press-MBIS 10-year municipal benchmark 5% general obligation was at 2.267% in early activity on Wednesday, compared to the final read of 2.273% on Tuesday, according to

The AP-MBIS index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 37,152 trades on Tuesday on volume of $9.46 billion.

Primary market

Goldman Sachs will price the New York City Transitional Finance Authority’s $850 million of Fiscal 2018 Series B Subseries B-1 future tax secured subordinate bonds for institutions after holding a two-day retail order period.

On Tuesday, the issue was priced for retail to yield 1% with 3% and 5% coupons in a split 2019 maturity to 3.403% with a 3.375% coupon in 2045. No retail orders were taken in the 2031-2033, 2036, 2038-2041, or 2043 maturities.

In the competitive arena, the TFA will competitively sell $140 million of taxable Fiscal 2018 Series B Subseries B-2 future tax secured subordinate bonds on Wednesday.

The two deals are rated Aa1 by Moody’s Investors Service and AAA by S&P Global Ratings and Fitch Ratings.

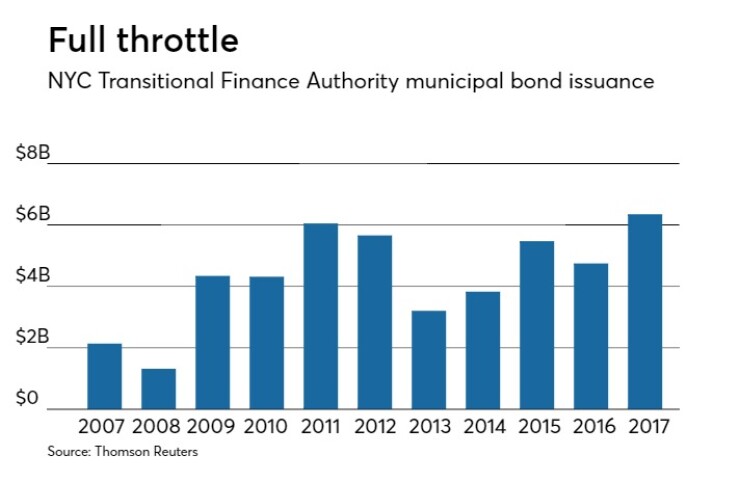

Since 2007, the TFA has sold $47.45 billion of securities, with the least issuance occurring in 2008 when it sold $1.32 billion. With Wednesday’s sales, 2017 marks the highest yearly issuance total for the authority during the past decade with $6.35 billion.

Massachusetts is competitively selling $818.125 million of general obligation bonds in three offerings on Wednesday.

The deals consist of $300 million of Series F consolidated loan of 2017 GOs, $300 million of Series E consolidated loan of 2017 GOs and $218.13 million of Series 2017E GO refunding bonds.

The deals are rated Aa2 by Moody’s, AA by S&P and AA-plus by Fitch.

The Douglas County (Omaha) Public School District No 001, Neb., is competitively selling $114.61 million of Series 2017 GOs.

The deal is rated Aa2 by Moody’s and AA-plus by S&P.

In the negotiated sector, Citigroup is set to price the San Diego Unified School District’s $500 million of Election of 2012 Series I and J GO dedicated ad valorem property tax bonds.

The deal is rated Aa2 by Moody’s and AAA by Fitch.

Citi is also expected to price West Virginia’s $219.7 million of Series 2017A surface transportation improvements special obligation notes.

The deal is rated A2 by Moody’s and AA by S&P.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $4.36 billion to $12.46 billion on Wednesday. The total is comprised of $3.45 billion of competitive sales and $9.01 billion of negotiated deals.

Data appearing in this article from Municipal Bond Information Services, including the AP-MBIS municipal bond index, is available on the Bond Buyer Data Workstation.