Mayor Bill De Blasio's $89.06 billion fiscal 2019 executive budget came under fire for increasing spending and doing too little to prepare for cuts from Washington and uncertain times ahead.

"As we confront the challenges ahead, we must pay closer attention to keeping our fiscal house in order,” NYC Comptroller Scott Stringer said. “In my analysis of New York City’s Preliminary FY19 Budget, our office highlighted the need to build up our budget cushion and prepare New York City for the possibility of tough times ahead. While our economy is in a solid position, with continued hostility from Washington, it is critical that we harness this year’s extraordinary inflow of one-time, non-recurring revenue to bolster city reserves.”

De Blasio's plan, unveiled Thursday, is up 0.4% from the $88.67 billion preliminary fiscal 2019 budget unveiled in February. It’s also 4.5% higher than the $85.2 billion plan the mayor and the City Council approved in 2017.

The budget includes $754 million in savings, which consist of partial hiring freezes, city agency efficiencies and debt service re-estimates. It has stockpiled an historic level of reserves; and has gotten a one-time revenue addition of $600 million.

At the same time state shifted $530 million of costs onto the city for Fiscal 2019.

“Even with the reserves, the executive budget reflects an almost unsustainable $530 million blow from Albany -- the worst the city has seen in any state budget since 2011,” the mayor’s budget message stated. “One of every four dollars, or 25%, of all new, city spending in this budget goes toward back-filling a cut or cost shift from Albany, including: $254 million to address mismanagement of State-run subways; $140 million shortfall in state aid to our schools; $108 million unfunded mandate for Raise the Age; and $31 million annual cut to Close to Home.”

However, some state cuts and cost shifts were dodged. These included $144 million for charter schools, $129 million for child welfare services, and $65 million for special education.

Adding to pressure on the city, President Trump’s proposed Federal Fiscal Year 2019 budget contains cuts to programs such as SNAP, Section 8 funding, Low Income Heat Energy Assistance Program, the Community Services Block Grant, TANF, Public Housing, and a complete elimination of the Community Development Block Grant.

The city’s budget maintains the reserves that have been built up over the past four years: the General Reserve is at $1 billion in fiscal 2019 and for every year of the financial plan, compared to the traditional $300 million; the Capital Stabilization Reserve is at $250 million in 2019 and every year of the financial plan; and the Retiree Health Benefits Trust Fund is at $4.25 billion.

Given the uncertainty from D.C. some said the reserves should be built up even more.

“New York City's executive budget for Fiscal Year 2019 increases operating spending at more than twice the rate of inflation and misses an opportunity to bolster reserves as strong tax revenue growth continues,” the Citizens Budget Commission said in a statement. “City-funded spending will grow 5.8% and total headcount is projected to increase to a record high.”

CBC vice president Maria Doulis said: “The city had to contend with cuts in state aid, but not all were unfunded mandates; the mayor also made a policy decision to replace state aid with city resources in education and for the affected service programs. Continued economic growth provided the tax revenues that allow for these and other spending increases, but they are not counterbalanced with increases in agency savings. Agency expenses and headcount continue to grow, adding to current expenses but also long-term liabilities. There were no proposals to increase reserves or give back some of these surpluses to taxpayers.”

The budget watchdog saw some positive elements.

“The financial plan takes some prudent steps,” the CBC said. “It includes a reserve for potential increases in pension costs starting in fiscal year 2021 that may be implemented after an actuarial audit is completed and eliminates anticipated revenues from taxi medallion sales that are unlikely to be as profitable as once expected.”

Observers also debated the plan's balance between spending and saving

“The mayor claimed in his speech [on Thursday] to be fiscally prudent," said Nicole Gelinas, a senior fellow at the Manhattan Institute for Policy Research. "Yet overall, the mayor continues to increase spending for new government programs, consuming record tax revenues during a boom that should be set aside for a potential recession.

"At $1.25 billion, the city’s reserves are simply not enough to avoid deep cuts in public services were a national downturn to occur," Gelinas said. "The mayor’s failure to set more money aside is especially pronounced, considering that the city still has no idea how the federal curtailment of state and local tax deductions will affect future tax revenues.”

The state mandates were noted by the city's Independent Budget Office.

“While the city budget continues to grow under Mayor de Blasio’s new budget plan, there are no new flashy initiatives,” said Doug Turetsky, IBO’s chief of staff. “Much of the new spending is driven by decrees from the state capital, such as more than $400 million for the subways, or $80 million for private school tuition for special needs students the courts have ruled cannot be adequately served by the city’s schools. At the same time, the budget plan contains nearly $1.3 billion in reserves along with $4 billion in a separate trust.”

The New York City Council also weighed in, saying programs they champion should be considered for inclusion in the final budget agreement.

“Though we are disappointed that the mayor’s proposed budget does not address all the priorities laid out by the City Council, we are encouraged by the close to $1 billion in additional revenue expected in FY18,” City Council Speaker Corey Johnson, Finance Chair Daniel Dromm and Chair of the Subcommittee on Capital Budget Vanessa Gibson said in a joint statement. “When combined with the efficiencies and savings the Council has already found in our FY19 budget response, this revenue has the potential to go a long way towards our goals of strengthening the social safety net, fighting for the middle class, and being responsible with taxpayer money.”

Observers are watching to see how Johnson inserts himself and the Council into the budget negotiations.

“I don't think he will be as cooperative as his predecessor,” one source said, referring to previous speaker Melissa Mark-Viverito, who was close to the mayor.

“We are glad the administration has reduced excess appropriations and redistributed them over a longer period of time as requested by the Council for capital funding,” the Council statement added. “The Council will continue to advocate for our priorities throughout budget negotiations and we plan to do so in a collaborative and transparent budget process.”

The Council will now hold a second round of hearings on the executive budget after which it and the mayor will negotiate adjustments. Agreement on a final budget must be reached before July 1, the beginning of the next fiscal year. The past few years, the budgets have been approved early and in record time.

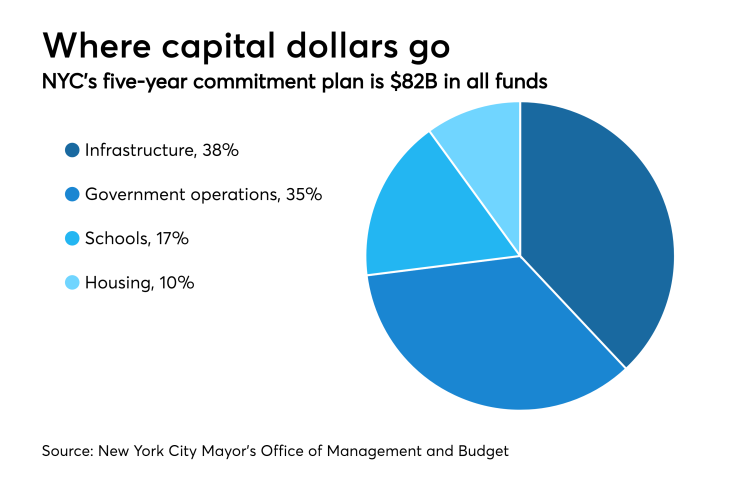

The executive five-year capital commitment plan totals $82 billion in all funds.

“As the city's debt outstanding and debt service levels continue to rise, additions to the capital plan should be treated with the same caution and scrutiny as those to the operating budget; however, little data exists to understand, track, and evaluate these projects and the performance of agencies that manage them,” the CBC said. “Reforms to the city's capital planning and budgeting processes should be part of the approval process for the capital commitment plan.”

Turning to debt issuance, the budget forecasts $50.6 billion of long-term borrowing from fiscal 2018 through 2022 to support the current capital program. The portion of the capital program that’s not financed by the New York City Municipal Water Finance Authority will be split between issuing the city’s general obligation bonds and the Transitional Finance Authority’s future tax secured bonds.

“Given the TFA is near its statutory limit on building aid revenue bonds debt outstanding, the financing program reflects BARB issuance so as to remain under the limit," the mayor’s budget message said.

The city has $37.6 billion of general obligation debt outstanding as of March 31. Moody’s Investors Service rates the city’s general obligation bonds Aa2, while S&P Global Ratings and Fitch Ratings rate them AA. All three assign stable outlooks.

Paul Burton contributed to this report.