Issuers from New York, Florida and Nebraska offered buyers notes, bonds and taxables on Thursday as a busy week in the primary market drew to a close.

Taxable munis have place in portfolios

Taxable municipals bonds are a strong diversification tool with strong credit characteristics and are another arrow in the fixed income investor’s quiver, according to Alan Schankel, managing director and municipal strategist at Janney.

"A portfolio of corporate bonds, U.S. agency securities, and agency backed mortgage backed securities in an investor’s IRA would likely benefit from the further diversification available from taxable municipal securities," he said. "Over time, in comparable rating categories, municipal bonds have defaulted at lower rates than corporate bonds."

He added that Moody’s Investors Service's annual bond default and recovery report, which this year covered defaults in the period from 1970 to 2018, compares historical default rates of municipal bonds and corporate bonds.

Schankel continued to say that municipal bonds are a particularly popular investment since interest earned is not subject to federal income tax, but not all municipal bonds are free from Uncle Sam’s tax bite. In the past decade, 13% of municipal bond issues have been federally taxable while another 2.8% were subject to alternative minimum tax consideration.

Schankel says there are multiple reasons for municipal issuers to issue taxable bonds: Build America Bonds, pension obligation bonds and advance reunfdings.

"Advance refundings is more of a recent vintage use of taxable bonds was triggered with the Tax Cuts and Jobs Act of December 2017, which among other provisions, included a prohibition on the use of tax free bonds to advance refund outstanding debt," he said. "Tax-free issues may still be used for current refundings, which are issued within 90 days of the first redemption date of the bonds being refunded."

Schankel noted that issuers with more than 90 days until the first call date are increasingly using taxable munis to advance refund older, high-coupon debt, taking advantage of low absolute interest rates.

"As rates approached cyclical low points in recent months, taxable municipal volume has grown to more than 20% of issuance (August-October), compared to 8.7% on average for years 2011-2018," he said.

Primary market

The New York Metropolitan Transportation Authority sold $600 million of Series 2019E transportation revenue bond anticipation notes (MIG1/SP1/F1+) to eight groups Thursday.

The winners included Citigroup, Goldman Sachs, Jefferies, JPMorgan Securities, Morgan Stanley, RBC Capital Markets, TD Securities and UBS Financial Services. Public Resources Advisory Group and Backstrom McCarley Berry were the financial advisors. Nixon Peabody and D Seaton & Associates were the bond counsel.

The Florida Department of Transportation (A1/AA/A+) sold $125.32 million of Series 2019A Federal Highway Reimbursement revenue bonds (indirect GARVEEs). Wells Fargo Securities won the deal with a true interest cost of 1.5720%. The State Division of Bond Finance acted as the financial advisor. Nabors Giblin was the bond counsel. Proceeds will be used to finance projects eligible for federal-aid highway funds.

Morgan Stanley priced the University of Nebraska Facilities Corp.’s (Aa1/AA/NR) $525.88 million of Series 2019A taxable university system facilities bonds.

Citigroup priced the University of Colorado Hospital Authority’s (Aa3/AA/AA) $122.785 million of Series 2019C refunding revenue bonds.

Goldman Sachs priced the Dormitory Authority of the State of New York’s (Aa3/AA-/AA) $138.065 million of Series 2019-1 revenue bonds for Memorial Sloan Kettering Cancer Center.

Citigroup received the written award on the Massachusetts Water Resources Authority’s (Aa1/AA+/AA+) $620.575 million of taxable Series 2019E general revenue bonds, taxable Series 2019F general revenue refunding green bonds and Series 2019G general revenue refunding green bonds.

Thursday’s bond sales

Muni CUSIP requests fell in Sept.

The total requests for CUSIPS for municipal securities, which include bonds, long- and short-term notes and commercial paper, fell 9.2% in September to 1,262 from 1,390 in August.

Requests for municipal bonds fell to 1,045 in September from 1,123 in the prior month as long-term notes remained steady at 33 requests and short-term notes increased to 51 from 49 in August.

On a year-to-date basis through September, total municipal CUSIP request volume was up 8.3% to 10,633 while municipal bond requests rose 8% to 8,497.

Among top state issuers, New York, Texas and California were the most active in September.

Secondary market

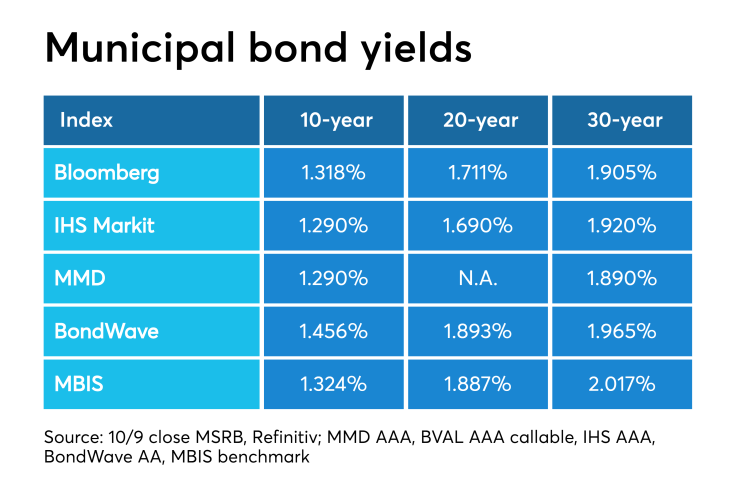

Munis were stronger on the MBIS benchmark scale, with yields falling by less than one basis point in the 10-year maturity and by one basis point in the 30-year maturity. High-grades were also stronger, with yields on MBIS AAA scale falling by less than one basis point in the 10- and 30-year maturities.

However, on Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10- and 30-year GOs rose by three basis points to 1.32% and 1.92%, respectively, and as of publication, yields on BVAL's AAA callable curve saw cuts from 2-4 basis points across the curve.

“The ICE muni yield curve is one to three basis points higher,” ICE Data Services said in a market comment. “High-yield is up two basis points and tobaccos are up one basis point. Taxable yields are following Treasuries higher, rising four to six basis points. Puerto Rico is unchanged.”

The 10-year muni-to-Treasury ratio was calculated at 79.5% while the 30-year muni-to-Treasury ratio stood at 89.1%, according to MMD.

Stocks were higher as Treasuries traded mixed. The Treasury three-month was yielding 1.677%, the two-year was yielding 1.520%, the five-year was yielding 1.469%, the 10-year was yielding 1.652% and the 30-year was yielding 2.151%.

Market pause, ahead of supply

Municipals began trading on the expensive side Thursday, as volatility from overseas trade talks with China impacted price and gave investors pause ahead of a mammoth new-issue calendar on tap for next week.

“Municipals are not cheap as Treasuries rose and it took our percentages from 94% to 90% in such a short time,” a New York trader said in the morning. But, he said that munis were hanging in as investors took pause awaiting potential stability in Treasuries, ongoing trade talks, and the expected $12 billion new-issue calendar building for next week, the trader said.

“The market is weak with the geopolitical currents and the Treasury volatility — and given all that plus the holiday on Monday, I don’t see any reason for municipals to move a lot today,” he said.

The lackluster mood Thursday was not indicative of fear by investors —but more a wait and see approach, according to the trader. “There are not a lot of block trades today. The municipal market is OK — it’s cheaper than yesterday, but there’s no panic,” He called it a “measured” concern.

“The market is waiting on headlines, so investors are hard pressed to jump in today — especially with the supply next week,” he continued. “If the market gets weaker, there will be pressure on prices because of all the supply and they can buy bonds cheaper next week.”

Previous session's activity

The MSRB reported 28,806 trades Wednesday on volume of $12.31 billion. The 30-day average trade summary showed on a par amount basis of $11.21 million that customers bought $6.05 million, customers sold $3.25 million and interdealer trades totaled $1.91 million.

California, New York and Texas were most traded, with the Golden State taking 16.092% of the market, the Empire State taking 10.084% and the Lone Star State taking 9.745%.

The most actively traded securities were the Montgomery County, Maryland, Series 2010 BAN 1.4s of 2019, which traded 14 times on volume of $63 million.

Muni money market funds see inflow

Tax-exempt municipal money market fund assets gained $1.62 billion, raising total net assets to $135.27 billion in the week ended Oct. 7, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 191 tax-free and municipal money-market funds decreased to 1.06% from 1.12% from the previous week.

Taxable money-fund assets increased $12.21 billion in the week ended Oct. 8, bringing total net assets to $3.289 trillion. The average, seven-day simple yield for the 807 taxable reporting funds fell to 1.56% from 1.62% in the prior week.

Overall, the combined total net assets of the 998 reporting money funds increased $13.83 billion to $3.425 trillion in the week ended Oct. 8.

Bond Buyer yield indexes decline again

The weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, headed south to 3.55% for the week ended Oct.10 from 3.58% in the previous week.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields was lower by three basis points to 2.59% from 2.62% from the week before. The 11-bond GO Index of higher-grade 11-year GOs also dropped three basis points, to 2.13% from 2.16% the prior week. The Bond Buyer's Revenue Bond Index fell three basis points to 3.07% from 3.10% last week.

The yield on the U.S. Treasury's 10-year note rose to 1.66% from 1.54% the week before, while the yield on the 30-year Treasury increased to 2.15% from 2.04%.

Treasury auctions announced

The Treasury Department announced these auctions:

- $17 billion five-year TIPs selling on Oct. 17;

- $42 billion 182-day bills selling on Oct. 15; and

- $45 billion 91-day bills selling on Oct. 15.

Treasury auctions bills

The Treasury Department Thursday auctioned $50 billion of four-week bills at a 1.720% high yield, a price of 99.866222. The coupon equivalent was 1.751%. The bid-to-cover ratio was 2.62. Tenders at the high rate were allotted 63.52%. The median rate was 1.680%. The low rate was 1.640%.

Treasury also auctioned $40 billion of eight-week bills at a 1.685% high yield, a price of 99.737889. The coupon equivalent was 1.718%. The bid-to-cover ratio was 2.88. Tenders at the high rate were allotted 57.55%. The median rate was 1.650%. The low rate was 1.630%.

And Treasury auctioned $16 billion of 29-year 10-month bonds with a 2 1/4% coupon at a 2.170% high yield, a price of 101.747638. The bid-to-cover ratio was 2.25. Tenders at the high yield were allotted 75.61%. The median yield was 2.119%. The low yield was 1.800%.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.