Municipal bond traders are eyeing yields on the rise as the primary gets set to see the last of the big deals of the week hit the market on Thursday.

Secondary market

Treasuries were weaker on Thursday. The yield on the two-year Treasury rose to 1.38% from 1.35% on Wednesday, the 10-year Treasury yield gained to 2.28% from 2.22% and the yield on the 30-year Treasury bond increased to 2.83% from 2.77%.

Top-rated municipal bonds finished weaker on Wednesday. The yield on the 10-year benchmark muni general obligation rose four basis points to 1.92% from 1.88% on Tuesday, while the 30-year GO yield increased four basis points to 2.74% from 2.70%, according to the final read of Municipal Market Data's triple-A scale.

On Wednesday, the 10-year muni to Treasury ratio was calculated at 86.4%, compared with 85.6% on Monday, while the 30-year muni to Treasury ratio stood at 98.7% versus 98.5%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 45,098 trades on Wednesday on volume of $12.58 billion.

Primary market

Citigroup is set to price the New York Metropolitan Transportation Authority’s $744.95 million of climate bond certified Series 2017B transportation revenue green bonds for institutions on Thursday after holding a one-day retail order period.

The $444.95 million of subseries 2017B-1 bonds were priced for retail to yield from 0.97% with a 3% coupon in 2018 to 3.03% with a 5% coupon in 2038. A 2042 maturity was priced as 4s to yield 3.44% and a 2047 maturity was priced as 5s to yield 3.15%. The 2052 and 2057 maturities were not offered to retail.

The $300 million of subseries 2017B-2 bonds were priced to yield from 1.58% with 3% and 5% coupons in a split 2022 maturity to 2.44% with a 5% coupon in 2028.

The deal is rated A1 by Moody’s Investors Service, AA-minus by S&P Global Ratings and Fitch Ratings and AA-plus by Kroll Bond Rating Agency.

The deal was increased from an expected $500 million. Last week, the MTA competitively sold $500 million of transportation revenue bond anticipation notes in a sale that was decreased from the $700 million originally planned.

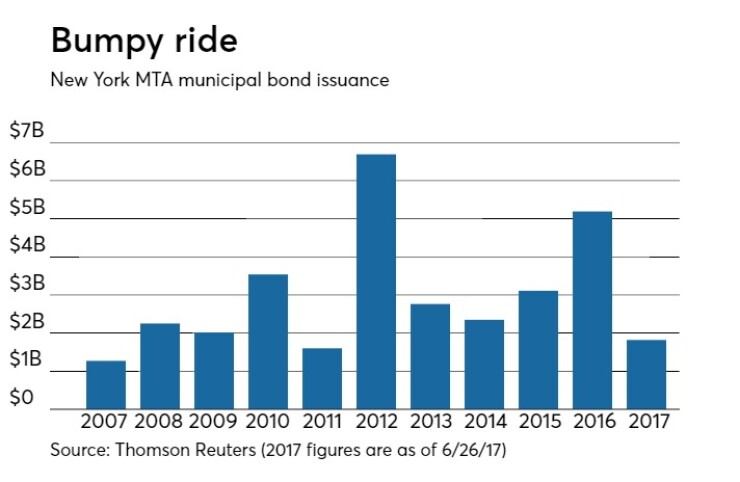

Since 2007, the N.Y. MTA has sold roughly $32.59 billion of securities, with the highest issuance in 2012 when it sold roughly $6.69 billion. The issuance was lowest in 2007 when it sold $1.27 billion.

Goldman Sachs is expected to price the Los Angeles Department of Water & Power’s Series 2017C power system revenue bonds.

The deal is rated Aa2 by Moody’s and AA-minus by S&P and Fitch.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $3.76 billion to $3.48 billion on Thursday. The total is comprised of $1.15 billion of competitive sales and $2.33 billion of negotiated deals.

Tax-exempt money market funds see outflows

Tax-exempt money market funds experienced outflows of $549.1 million, bringing total net assets to $129.16 billion in the week ended June 26, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an outflow of $41.9 million to $129.71 billion in the previous week.

The average, seven-day simple yield for the 232 weekly reporting tax-exempt funds jumped to 0.39% from 0.34% in the previous week.

The total net assets of the 850 weekly reporting taxable money funds increased $10.56 billion to $2.467 trillion in the week ended June 27, after an outflow of $39.28 billion to $2.457 trillion the week before.

The average, seven-day simple yield for the taxable money funds increased to 0.60% from 0.57% in the prior week.

Overall, the combined total net assets of the 1,082 weekly reporting money funds increased $10.01 billion to $2.596 trillion in the week ended June 27, after outflows of $39.24 billion to $2.586 trillion in the prior week.