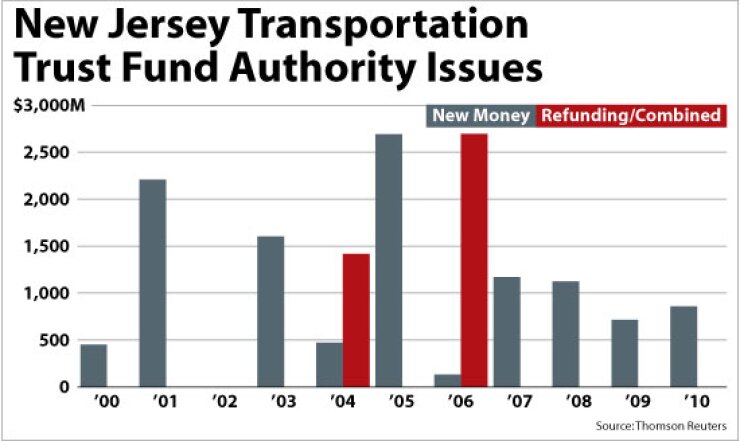

After heated debate, New Jersey lawmakers Monday approved a $1.4 billion Transportation Trust Fund Authority debt restructuring deal that also includes new-money bonds.

Democrats at the same time tried unsuccessfully to gain information about how the fund will be replenished in the future.

Treasury Department officials are looking to issue more debt as only about $50 million currently remains in the trust fund “and every cent of it is needed to cover the next debt-service payment due in December,” Transportation Commissioner James Simpson said during his testimony before the Legislature’s Joint Budget Oversight Committee.

The JBOC weighs in on all state debt-restructuring plans.

The TTFA deal will consist of about $950 million of taxable Build America Bonds and up to $500 million of tax-exempt refinancing debt that will generate net-present-value savings of $15.2 million. The refinancing will restructure debt-service payments to open up borrowing capacity for the trust fund and move the costs out to future years.

The tentative pricing date for the TTFA sale is Oct. 14, according to Treasury spokesman Andrew Pratt.

Barclays Capital is the book-runner for the deal.

Democrats control New Jersey’s Legislature. The JBOC last month held off on scheduling a hearing on the TTFA bond sale as lawmakers asked the Gov. Chris Christie administration for its proposals and ideas for replenishing the trust fund. The upcoming TTFA deal will help finance road, bridge, and mass-transit projects through April. In fiscal 2012, which begins July 1, all of the fund’s dedicated revenues will be needed to pay down existing bonds.

The commitee meeting was scheduled after Simpson last week announced that all state-funded and non-emergency transportation projects would stop as of Monday and could not continue absent JBOC approval on the $1.4 billion TTFA deal.

Simpson and New Jersey Treasurer Andrew Eristoff did not offer any ideas or proposals for funding the trust fund once the bond proceeds run out, much to the frustration of Democratic lawmakers. The question of how to fund the TTFA in fiscal 2012 and beyond has been ongoing since Christie took office in January.

Eristoff urged the panel to approve the sale as any delay could hinder the state from grabbing favorable interest rates. In addition, officials want to issue BABs before any possible last-minute BAB rush.

The BAB program is set to expire on Dec. 31 unless Congress extends it. The bonds offer issuers a 35% federal subsidy on interest costs. Congress, even if it extends the program, may opt to change that subsidy amount.

“Time is running out on the Build America Bond program as currently structured,” Eristoff said. “Final resolution of any federal legislation to continue the program remains uncertain. Consequently, the municipal market is now bracing for significant [BAB] issuance during the fourth quarter of 2010. We need to act now while the market can absorb these bonds at attractive interest rates.”

The new-money proceeds will reimburse the general fund for $393 million that it lent to the trust fund. The restructuring will increase the TTFA’s new money by $400 million, yet taxpayers will pay an additional $300 million of debt-service costs in 2024 in order to generate $15.2 million of net-present-value-savings now.