When New York’s Metropolitan Transportation Authority confirmed it would

“These funds, while important in providing liquidity, are not a comprehensive or permanent solution,” Foye said.

Earlier in the week, the MTA requested a $4 billion rescue package from the federal government. In so doing it laid down a marker.

The American Public Transportation Association on Thursday pegged the need at $16 billion to cover revenue losses from coronavirus. APTA expects a $14 billion loss in fare and sales-tax revenue, plus $2 billion for direct costs that include upgraded cleaning.

The latest MTA domino to fall came Friday when Moody's Investors Service said it would place its A1 rating of the authority's workhorse transportation revenue bonds and its MIG1 rating of transportation revenue bond revenue notes under review for possible downgrade. Moody's also changed its outlook on the long-term rating to rating under review from negative.

Moody's, which said its review would take several weeks and called the disruption unprecedented, added that recovery will require political and financial support from local, state or federal governments, which traditionally has bolstered MTA's credit profile.

"Continuation of this support is highly likely given MTA's unmatched essentiality to the regional and national economy, especially during a post-coronavirus recovery," Moody's said.

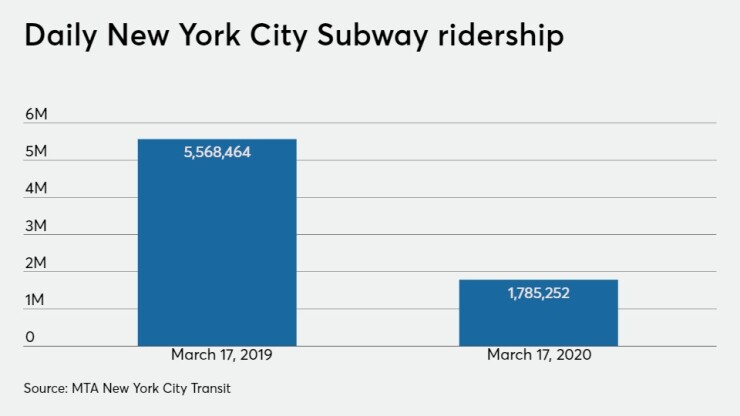

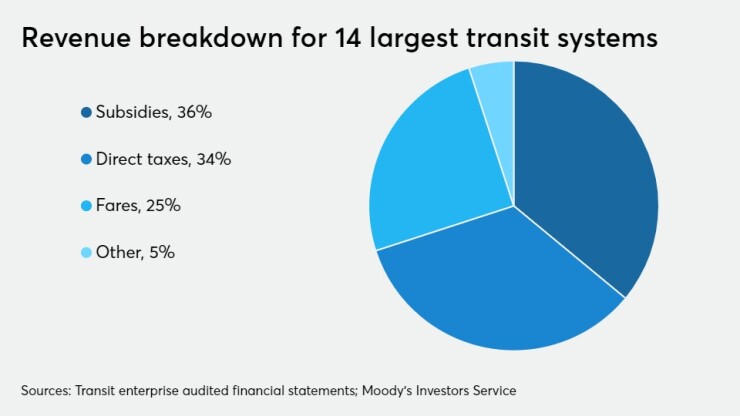

Advisories and orders to stay home have taken a bite out of transit revenue nationwide, with an immediate impact on systems with high reliance on farebox revenue.

Neighboring New Jersey Transit is seeking $1.25 billion from the feds. Systemwide revenue is down 88% since March 9, the agency said Thursday. The San Francisco Bay Area Rapid Transit Authority reported that

“If we’re going to bail out airlines and cruise ships, we have to bail out public transit, too,” said Nick Sifuentes, executive director of the Tri-State Transportation Campaign, an advocacy group covering New York, New Jersey and Connecticut.

The MTA is hemorrhaging money as the pandemic worsens and people avoid crowded mass transit. Gov. Andrew Cuomo on Thursday ordered businesses to keep 75% of their workers at home.

MTA officials confirmed Thursday night that 23 workers have contracted the virus: 19 with New York City Transit and four with Long Island Rail Road. The authority has 51,000 employees overall.

Still, Cuomo, who controls the MTA, has said keeping the system open is vital to the city as it copes with the crisis.

In an

According

In its disclosure, the MTA pegged its liquidity at about $3.86 billion, consisting of a current running cash balance of $1.398 billion; internal available flexible funds of $1.139 billion and other post-employment benefit resources of $325 million, in addition to the $1 billion credit line.

“These funds provide a temporary funding ‘bridge’ to a permanent solution to the lost revenue and higher expenses,” the MTA said. “They must be repaid or replaced.”

Kurt Forsgren, a Boston-based managing director for S&P Global Ratings, said "we're running out of adjectives" to describe the sharp decline across transportation, including transit authorities. S&P's outlook for all transportation sectors is negative; the negatives for ports and transit are affirmations.

"[There is] no real answer to two key questions: one, how steep will this decline be and secondly, how long will activities remain at these significantly reduced levels," Forsgren said on a conference call Thursday.

Longer-term options for the MTA include replacing programmed pay-as-you-go capital funds of up to $1.64 billion with long-term bonding; debt restructuring that could generate roughly $1.8 billion depending upon market conditions; and applying new Federal Transit Administration rules to use $655 million in the current year, intended for capital projects, for operating relief.

A capital-to-operating transfer, normally a questionable practice in municipal finance, might be necessary under these extraordinary circumstances, said Howard Cure, director of municipal bond research for Evercore Wealth Management.

Habitual transfers, he added, pose a red flag.

“That’s part of New Jersey Transit’s problem,” he said. “They’ve been not taking care of their capital needs by subsidizing operations that way. They’re really hurting.”

More long-term borrowing and potential delays on system improvements could loom for the MTA. High debt service is already a concern. About 16% of its $17.4 billion budget goes toward debt service, and MTA officials have warned that debt over the next few years could surge to nearly $50 billion from its current $45 billion.

The indenture for the MTA’s transportation revenue bonds requires monthly deposits of pro rata debt service requirements before operating expenses. According to Kroll Bond Rating Agency, the resulting cash flow covers annual debt service 8.7 times in 2019 and an estimated 8.2 times in 2020.

“State laws that govern the MTA allow no wiggle room to deviate from this structure,” Kroll said.

The MTA, the nation’s largest mass transit system, operates New York City’s subways and buses, Long Island and Metro-North commuter railroads, and several interborough bridges and tunnels.

Because of the public health crisis, the MTA’s board has condensed its March meeting to Wednesday under a virtual setup. The committees and full board will meet the same day rather than the standard Monday-Wednesday setup.

A huge variable, obviously, is the length of the pandemic.

According to Mitchell Moss, director of the Rudin Center for Transportation at New York University, ridership drops may continue after normalcy returns, given workforce telecommuting trends.

“Reduced ridership may not be temporary, given the changes that are happening in the workplace,” Moss said. “You’ll see a change in work habits. People who go to the office five days a week will now go two, three or four days a week.

“[City Council] Speaker Corey Johnson was premature when he said the car culture is dead. People are now driving to Manhattan. Toll revenues for the MTA may go up, actually.”

Moss said the MTA’s structure puts it in better shape than the bi-state Port Authority of New York and New Jersey, whose holdings include the battered airport sector. Port Authority operates the region’s three airports: John F. Kennedy International, LaGuardia and Newark-Liberty. It also operates a bus terminal in Manhattan.

“Port Authority is going to be clobbered,” Moss said. “It’s funded by user fees and charges. It is far more vulnerable to cutbacks to air travel. The MTA has multiple revenue streams and far more flexibility.”

Service cuts pose a dilemma for transit systems nationwide. They also pose a risk of further crowding and virus infection. In Boston, for instance, the state-run Massachusetts Bay Transportation Authority announced reduced service, then restored some of the cuts a day later after riders complained about overcrowding.

Restorations included service on the E branch of the Green Line, which runs near the Longwood Medical Area, a hospital and biomedical research cluster.