The upcoming week’s new issue calendar almost triples as the municipal bond market gets back into the swing of things despite the upcoming Jewish holidays.

Ipreo forecasts weekly bond volume will jump to $6.3 billion from a revised total of $2.3 billion in the prior week, according to updated data from Thomson Reuters. The calendar is composed of $4.4 billion of negotiated deals and $1.9 billion of competitive sales.

Primary market

You can bet the market will be taking a good look at the biggest deal of the week — the Las Vegas Convention and Visitors Authority’s $500 million offering.

RBC Capital Markets is set to price the Series 2018B convention center expansion revenue bonds on Thursday.

The deal is rated Aa3 by Moody’s Investors Service and A-plus by S&P Global Ratings.

RBC is also expected to price the Poudre School District R-1 of Larimer County Colo.’s $375 million of Series 2018 GOs on Wednesday.

The deal is rated Aa2 by Moody’s.

JPMorgan Securities is set to price Indianapolis’ 358 million of Series 2018A water system first lien refunding revenue bonds on Wednesday.

The deal is rated Aa3 by Moody’s, AA by S&P and A-plus by Fitch Ratings.

JPMorgan is also expected to price the Sarasota County Public Hospital District, Fla.’s $350 million of Series 2018 fixed-rate hospital revenue bonds for the Sarasota Memorial Hospital on Wednesday.

The deal is rated A1 by Moody’s and AA-minus by Fitch.

In the competitive arena, the Shoreline School District No. 412, Wash., is selling $206.81 million of unlimited tax general obligation bonds under the Washington state school district credit enhancement program on Tuesday.

The deal is rated AA-plus by S&P.

Bond Buyer 30-day visible supply at $10.28B

The Bond Buyer's 30-day visible supply calendar increased $704.6 million to $10.28 billion for Friday. The total is comprised of $3.14 billion of competitive sales and $7.14 billion of negotiated deals.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Sept. 7 were from Massachusetts, Texas and Illinois issuers, according to

In the GO bond sector, the Massachusetts 4s of 2019 traded 66 times. In the revenue bond sector, the Texas 4s of 2019 traded 170 times. And in the taxable bond sector, the Chicago 5.432s of 2042 traded 12 times.

Week's actively quoted issues

Puerto Rico, New Jersey and California names were among the most actively quoted bonds in the week ended Sept. 7, according to Markit.

On the bid side, the Puerto Rico Aqueduct and Sewer Authority revenue 5.25s of 2042 were quoted by 106 unique dealers. On the ask side, the New Jersey Health Care Facilities Finance Authority revenue 5s of 2043 were quoted by 302 dealers. And among two-sided quotes, the California taxable 7.55s of 2039 were quoted by 21 dealers.

Secondary market

Municipal bonds were mostly weaker on Friday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields rose five basis points in the one-year and by two basis points in the two-year and as much as one basis point in the three- to 28-year maturities, fell less than a basis point in the 30-year maturity and were unchanged in the 29-year maturity.

High-grade munis were also mostly weaker, with yields calculated on MBIS' AAA scale rising four basis points in the one-year, two basis points in the two-year and as much as one basis point in the three to 30-year maturities.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation rising as much as two basis points while the yield on 30-year muni maturity increased two to four basis points.

Treasury bonds were weaker as stock prices traded mixed.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 86.1% while the 30-year muni-to-Treasury ratio stood at 100.2%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 40,749 trades on Thursday on volume of $11.56 billion.

California, Texas and New York were the municipalities with the most trades, with Golden State taking 16.014% of the market, the Lone Star State taking 12.542% and the Empire State taking 8.993%.

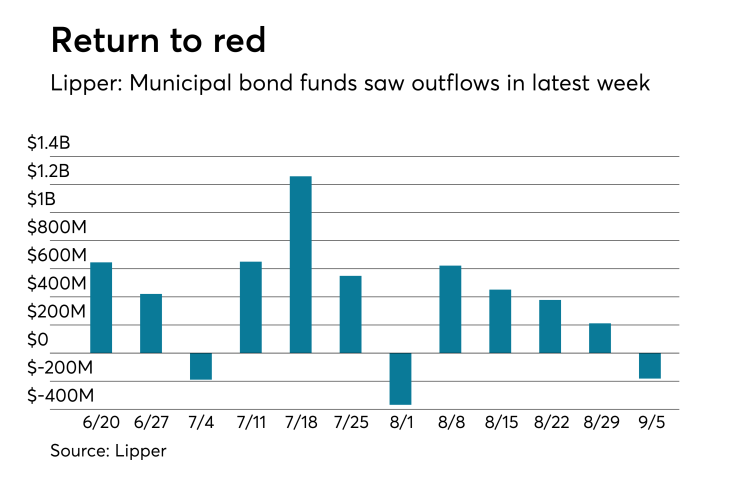

Lipper: Muni bond funds saw outflows

Investors in municipal bond funds turned cautious and took cash out of the funds during the latest reporting week, according to Lipper data released on Thursday.

The weekly reporters saw $181.441 million of outflows in the week ended Sept. 5, after inflows of $212.052 million in the previous week.

Exchange traded funds reported outflows of $43.094 million, after inflows of $57.435 million in the previous week. Ex-ETFs, muni funds saw $138.343 million of outflows, after inflows of $154.617 million in the previous week.

The four-week moving average remained positive at $215.252 million, after being in the green at $416.251 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had outflows of $127.634 million in the latest week after inflows of $368.851 million in the previous week. Intermediate-term funds had inflows of $4.958 million after inflows of $97.445 million in the prior week.

National funds had outflows of $124.108 million after inflows of $194.565 million in the previous week. High-yield muni funds reported inflows of $15.431 million in the latest week, after inflows of $222.454 million the previous week.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.