Armed with a recent boost from the capital markets, New Haven Mayor Toni Harp has released a

The plan aims for $76.1 million through savings and revenue enhancements through 2024.

"Normally, when you go year-to-year, you sometimes miss what's around the corner and what's down the road. This will give us a better sense of what might happen two, three or five years ahead of us," Harp said in an interview Tuesday, one day after she briefed reporters at City Hall.

Last fall, Harp called on city Controller Daryl Jones and his staff to craft a five-year plan “to guard against a potential downfall and prepare for the potential challenges every city in Connecticut faces.”

Moody’s Investors Service last month revised its outlook on New Haven’s general obligation bonds to stable from negative while affirming its Baa1 rating, three notches above junk. Moody’s expects the city's financial position will improve slightly in fiscal 2019 and stabilize due to management's continued efforts to increase revenues and minimize costs. The outlook also reflects the ongoing growth in the city's tax base.

"This was a morale boost," Harp said. "Moody's is one of the most exacting credit-rating agencies and they've actually given us our worst news over the years. They took the time to see how efficiently we've been working and it reflects much of what we've been doing to eliminate our deficits."

S&P Global Ratings and Fitch Ratings last year

Jones said a $9 million cut in state aid in fiscal 2018 “made us take a step back and look at what we needed to do.” He called the five-year plan a proactive move that features 39 initiatives — 23 already started — in seven categories: infrastructure and capital programs; financial; revenue; economic; healthcare; cost reduction; and distributed governance. Some will need legislation.

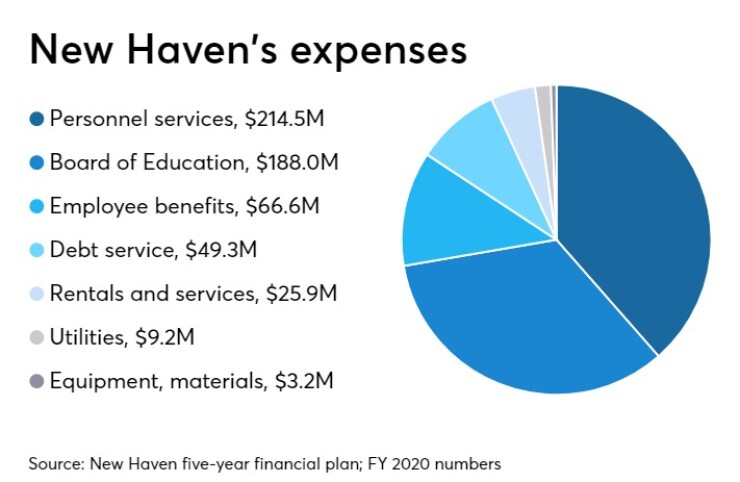

Harp said that over the past five fiscal years, city revenues and expenditures have increased just 7.6% cumulatively, or about 1.5% per year. The plan, she said, charts a series of initiatives for revenue growth, cost cutting, managing debt service and increasing pension obligation payments.

“By any standard, that’s modest budget growth and predictability for everyone paying attention,” said Harp, a Democrat serving her third four-year term. “I’m very confident about New Haven’s firm financial standing. But that's never been a sure thing."

Moody’s also warned that despite a large tax base stabilized by the presence of tax-exempt Yale University and Yale-New Haven Hospital, a “very narrow” financial position will pressure the city to maintain structural balance given limited revenue raising flexibility and elevated long-term liabilities.

“While fixed costs are manageable, pensions face depletion risk due to low funded ratios and failure of annual contributions to meet treadwater indicators,” Moody’s said.

Jones said pension contributions on average will rise 1.9% each fiscal year, with an annual payment of $66.1 million expected by 2024. While the contributions will continue to rise, both pensions by 2024 are projected to be 46% funded and by 2030 both will be nearly 60% funded.

New Haven’s mill rate of 42.98, said Harp, is lower than 12 other cities, including capital Hartford, Waterbury and Bridgeport and neighboring communities Hamden and West Haven.

Jones said the city reached out to other interests including Yale and state officials. “Most importantly, we talked to the residents of New Haven,” he said. “We held monthly meetings. This document you see here is a collaborative effort.”

Debt service over the next five years, according to projections, will remain relatively flat, peaking at $55 million by 2024. The city last year refunded $160 million of debt, moving debt on average seven years out.

In fiscal 2020, New Haven for the first time will implement a two-year capital program to lower potential borrowing costs.

Harp, who spent 21 years in the state Senate and faces a primary challenge next month from Justin Eicker, also cited New Haven’s growth as an innovation hub. Yale-New Haven Hospital recently announced an $838 million project that includes two new patient facilities with a focus on innovation in the neurosciences.

Greater New Haven, the mayor said, is now home to 31 of Connecticut’s 74 biotech, pharmacy and life sciences firms.

On Tuesday afternoon, Harp was scheduled to lead a walking tour of Union Station to encourage potential growth opportunities within the building. With the recent addition of the Hartford line commuter rail service linking New Haven, Hartford and Springfield, Massachusetts, the station now serves more than 4 million passengers annually.

"A strong vibrant retail presence there will benefit not just the passengers, but the surrounding neighborhood," she said. The replacement of the state Route 34 corridor into an urban boulevard, she said, will help connect downtown with the Hill district that surrounds the station.