Nearly all The Bond Buyer’s yield indexes declined this week, with two reaching 43-year lows, as tax-exempt yields plunged to record lows in three sessions during the week.

This week’s gains extended the ongoing municipal rally that has dipped 10-year tax-exempt yields below 2.20% and 30-year munis lower than 3.70% for the first time in history, according to the Municipal Market Data triple-A scale.

“The market continues to be surprised by the strength of late,” said Michael Pietronico, chief executive officer at Miller Tabak Asset Management. “It seems as if the very short end, where yields are below 1%, has hit a wall. If there’s any more to this rally, it seems likely to be on the long end, with a flattening bias.”

He said there is little potential left for price appreciation.

“In our view, people will be surprised by the length of time yields hang around these general levels,” Pietronico said, noting that it’s “hard to see a situation where the economy turns notably until at least the election.”

Radical change in the composition of Congress in November could produce a market pivot-point, he said.

“In this environment where there is no cash-equivalent alternative, selling pressure has really been lacking,” Pietronico said. “Even if the calendar would pick up, the supply would have to be timed with the economy being perceived as turning upward” to move the market significantly.

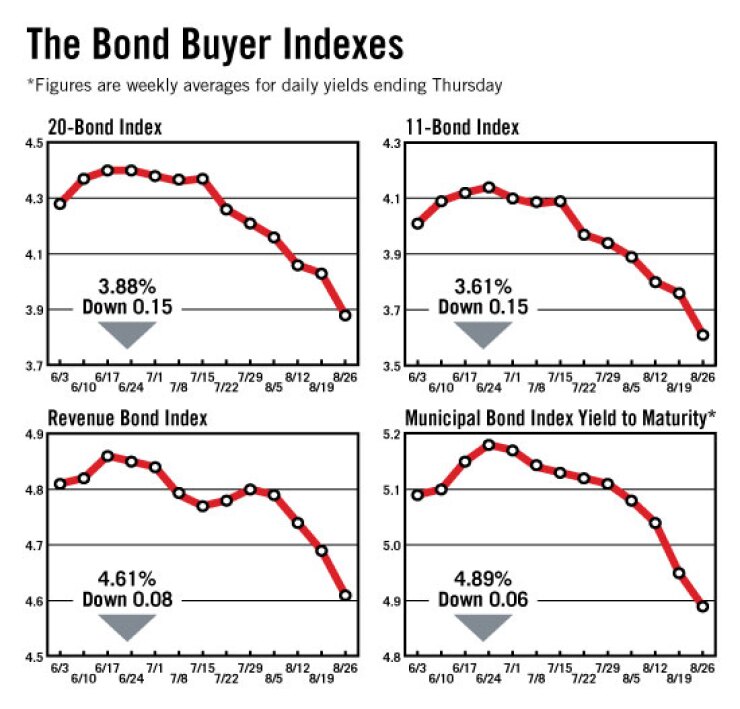

The Bond Buyer 20-bond index of 20-year general obligation bond yields declined 15 basis points this week to 3.88%. That is the lowest the index has been since May 11, 1967, when it was also 3.88%.

The 11-bond index of higher-grade 20-year GO yields also dropped 15 basis points this week to 3.61%, which is the lowest level for the index since April 27, 1967, when it was also 3.61%.

The revenue bond index, which measures 30-year revenue bond yields, declined eight basis points this week to 4.61% — the lowest level since May 31, 2007, when it was 4.57%.

The Bond Buyer one-year note index, which is based on one-year tax-exempt note yields, rose four basis points this week to 0.49%, which is its highest level since Aug. 4, when it was 0.55%.

The most recent highs for the 20-bond GO, 11-bond GO, and revenue bond indexes was April 8, when they were 4.45%, 4.16%, and 4.96%, respectively. Since then, they have fallen 57, 57, and 45 basis points, respectively. Since July 1, The Bond Buyer’s indexes have fallen 50, 49, and 23 basis points, respectively.

The yield on the 10-year Treasury note declined eight basis points this week to 2.50%. That is the lowest the yield has been since Jan. 15, 2009, when it was 2.20%.

The yield on the 30-year Treasury bond fell 14 basis points this week to 3.53%, which is its lowest level since March 5, 2009, when it was 3.51%.

The most recent highs for 10-year and 30-year Treasuries occurred March 25, when they were 3.90% and 4.78%, respectively. Since then, the 10-year has declined 140 basis points and the 30-year has dropped 125 basis points.

The weekly average yield to maturity on The Bond Buyer’s 40-bond municipal bond index, which is based on 40 long-term municipal bond prices, finished at 4.89%, down six basis points from last week’s 4.95%.