Nearly all The Bond Buyer's weekly yield indexes climbed this week, as tax-exempt yields grew weaker in all the week's sessions.

"The calendar is fairly large, demand is soft, and there are just not a lot of people out there clamoring for munis, unfortunately," said Evan Rourke, portfolio manager at MD Sass. "On the supply side, you still have a very large calendar. On the demand side, you don't have any natural source of demand, and the dealer community is getting ready to close up their books for the year. They're not really going to step up, so you have to find some source of demand."

"It's mostly trusts and individuals, and they're not really equipped to absorb a lot of supply quickly," Rourke said. "And you're afraid of some secondary market selling by arb accounts and other leveraged buyers, too."

Following a partial session Friday, municipal yields pushed higher by anywhere from one to three basis points in each of the sessions Monday through Wednesday. On Wednesday, however, the Port Authority of New York and New Jersey pulled a scheduled $300 million offering of taxable notes after it failed to receive any bids.

"It was a little surprising, but not shocking," Rourke said of the Port Authority deal receiving no bids. "It is a taxable deal, and I think that was part of it. There's really not that many large competitive deals being done right now either. Port Authority obviously I consider a very solid credit, but taxable munis fall into a gray area in a lot of places. It's not a big market for anybody. It's easy to see how that could get overlooked."

Yesterday, the municipal market was weaker again.

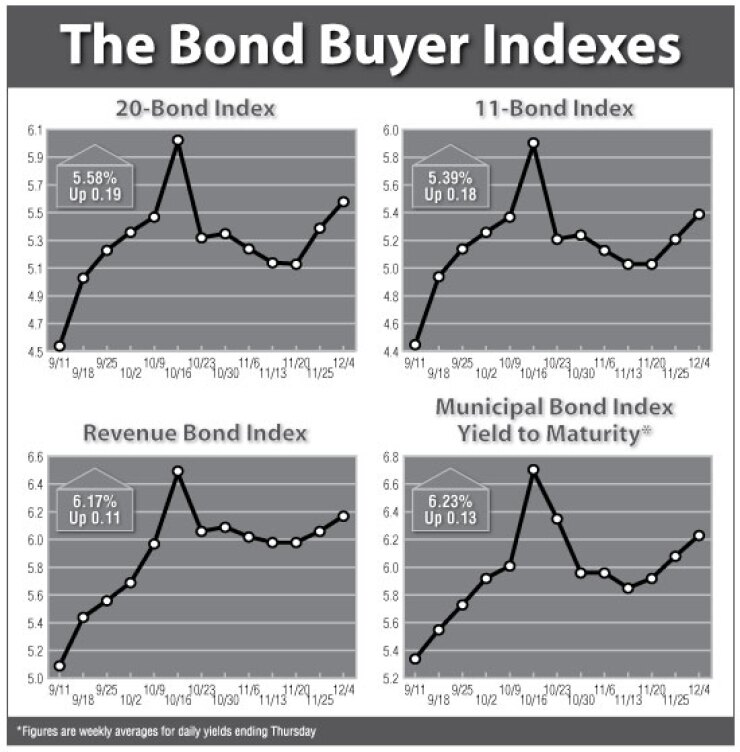

The Bond Buyer 20-bond index of 20-year general obligation bond yields rose 19 basis points this week to 5.58%, which is the highest since Oct. 16, when it reached an eight-year high of 6.01%.

The 11-bond index of higher-grade 20-year GO yields rose 18 basis points this week to 5.39%, which is the highest since Oct. 16, when it was 5.89%.

The revenue bond index of 30-year revenue bond yields rose 11 basis points this week to 6.17%, which is the highest since Oct. 16, when it reached a 13-year high of 6.48%.

The 10-year Treasury note yield declined 55 basis points to 2.54%, which is the lowest in at least 50 years.

The 30-year Treasury bond yield declined 56 basis points to 3.06%, which is an all-time low.

The 10-year Treasury has fallen 132 basis points in the past three weeks, to 2.54% this week from 3.86% on Nov. 13. At the same time, the 30-year Treasury has dropped 128 basis points, to 3.06% from 4.34% on Nov. 13.

The Bond Buyer one-year note index of one-year GO yields was unchanged this week at 1.20%.

The weekly average yield to maturity on The Bond Buyer 40-bond municipal bond index rose 13 basis points this week to 6.23%, which is the highest weekly average since the week ended Oct. 23, when it was 6.35%.