Nearly all The Bond Buyer's weekly yield indexes rose this week, as losses outweighed gains in a mostly unchanged week.

"It seems like it's been sort of a round trip, where the yield curve steepened early, and it's flattening late," said George Strickland, managing director and portfolio manager at Thornburg Investment Management.

"It looks like we're going to end up about the same place we started, but we covered some ground in between," he said. "There seems to be more demand materializing late in the week, and still a relatively light calendar, so those two factors are probably at play. Treasuries rallied hugely [yesterday], and we're moving in the same direction, but at a much lower frequency."

The municipal market was unchanged Friday, and was then largely unchanged Monday. This continued into Tuesday, when tax-exempts were again largely unchanged as the Federal Open Market Committee held the federal funds rate target unchanged at its monetary policy-setting meeting.

Munis were then weaker by about three basis points Wednesday. In the new-issue market, New York City sold about $1 billion of negotiated and competitive general obligation bonds to JPMorgan in three series. Yesterday, tax-exempts were slightly firmer, following gains in the Treasury market.

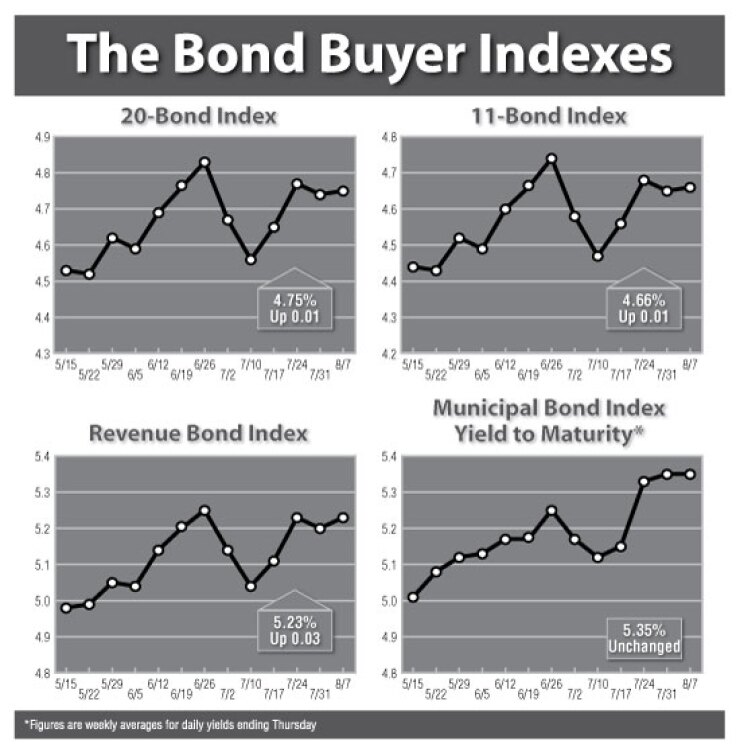

The Bond Buyer 20-bond index of GO yields and the 11-bond index both rose one basis point this week, to 4.75% and 4.66%, respectively. But they remained below their levels from two weeks ago, when they were 4.77% and 4.68%, respectively.

The revenue bond index rose three basis points to 5.23%, which is the same as two weeks ago.

The 10-year Treasury note fell four basis points to 3.91%, which is the lowest since July 10, when it was 3.81%.

The 30-year Treasury bond fell three basis points to 4.55%, which is the lowest since July 10, when it was 4.42%.

The Bond Buyer one-year note index rose four basis points to 1.63%, which is the highest since July 2, when it was 1.70%.

The weekly average yield to maturity on The Bond Buyer 40-bond municipal bond index finished at 5.35%, unchanged from last week.