Municipal bonds continued to show weakness on Wednesday as big bond offerings from the Port Authority of New York and New Jersey and the Los Angeles Department of Water and Power hit the market.

Primary market

Wells Fargo Securities priced the Port Authority of New York and New Jersey’s $554.275 million of tax-exempt consolidated bonds for institutions on Wednesday after holding a one-day retail order period.

The $250 million of 200th Series bonds not subject to the alternative minimum tax were priced as 5s to yield 2.27% in 2027, 2.44% in 2028, 2.66% in 2030 and from 3.07% in 2034 to 3.14% in 2037, 3.28% in 2042, 3.35% in 2047 as well as 3.60% and 3.55% in a split 2057 maturity.

The $254.275 million of 202nd Series bonds subject to the AMT were priced as 2s to yield 1.00% in 2017 and as 3s to yield 1.12% in 2018. The bonds were also priced as 5s to yield from 1.43% in 2020 to 2.01% in 2023. They were also priced as 5s to from yield 2.41% in 2025 to 3.04% in 2030 and from 3.25% in 2033 to 3.45% in 2037.

The $50 million of 203rd Series AMT bonds were priced at par to yield 3% in a 2032 bullet maturity. The deal is rated Aa3 by Moody’s Investors Service and AA-minus by S&P Global Ratings and Fitch Ratings.

Bank of America Merrill Lynch priced the Los Angeles Department of Water and Power’s $533.775 million of Series 2017A water system revenue bonds for retail investors ahead of the institutional pricing on Thursday. The bonds were priced for retail to yield from 0.87% with a 5% coupon in 2018 to 3.09% with a 5% coupon in 2038. A term bond in 2042 was priced as 5s to yield 3.15% and a term bond in 2047 was priced as 5s to yield 3.60% and 3.20% in a split maturity. The deal is rated Aa2 by Moody’s, AA-plus by S&P and AA by Fitch.

Piper Jaffray priced the Beaverton School District No. 48J, Ore.’s $282.898 million of bonds. The $76.361 million of Series 2017B DIBs were priced from 65.028 with a maturity value of 3.59% in 2029 to 49.303 with a maturity value of 4.18% in 2034.

The $32.880 million of Series 2017C CIBs were priced to yield from 2.39% with a 5% coupon in 2027 to 2.51% with a 5% coupon in 2028, and to yield 3.06% with a 5% coupon in 2035.

The $173.657 million of Series 2017D convertible DIBs were priced at 113.136 with a maturity value of 2.17% in 2024, 113.816 with a maturity value of 2.38% in 2025, 114.59 with a maturity value of 2.53%, and a yield to maturity of 3.919% in 2035 and 108.247 with a maturity value of 3.40%, and a yield to maturity of 3.980% in 2036.

The deal is backed by the Oregon School Bond Guarantee Program and is rated Aa1 by Moody’s and AA-plus by S&P.

Wells Fargo Securities priced the town of Mt. Pleasant, S.C.’s $111 million of Series 2017 waterworks and sewer system revenue bonds. The bonds were priced to yield from 1.69% with a 2% coupon in 2023 to 3.03% with a 5% coupon in 2037. A term bond in 2039 was priced to yield 3.46% with a 4% coupon, a 2044 term was priced to yield 3.55% with a 4% coupon and a 2046 term was priced to yield 3.57% with a 4% coupon. The deal is rated Aa1 by Moody’s and AA-plus by S&P.

In the competitive arena on Wednesday, the Maryland Department of Transportation sold $265 million of Series 2017 consolidated transportation bonds, which were won by Bank of America Merrill Lynch with a true interest cost of 2.64%. The bonds were priced to yield from 1.17% with a 5% coupon in 2020 to par with 3.25% coupon in 2032. The deal is rated AA1 by Moody’s, AAA by S&P and AA-plus by Fitch.

The Metropolitan Council of the Minneapolis-St. Paul, Minn., area sold two separate issues totaling $145 million. The $105 million of Series 2016C GO wastewater revenue bonds were won by BAML with a TIC of 2.87%. The bonds were priced to yield from 0.83% with a 5% coupon in 2018 to 3.34% with a 3.50% coupon in 2035.

The $40 million of Series 2017B GO transit bonds were won by Robert W. Baird & Co. with a TIC of 1.78%. Both deals are rated triple-A by Moody’s and S&P.

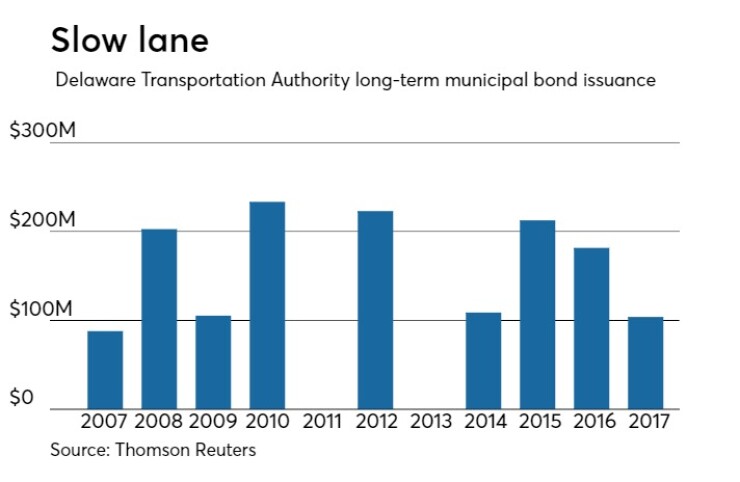

The Delaware Transportation Authority auctioned $103.86 million of Series 2017 transportation system revenue bonds, which were won by BAML with a TIC of 2.63%. No pricing information was immediately available. The deal is rated Aa2 by Moody’s and AA-plus by S&P.

Since 2007, the authority has issued $1.46 billion of securities, with the most issuance occurring in 2010 when it issued $233 million. It did not issue any bonds in 2011 or 2013.

Secondary market

The yield on the 10-year benchmark muni general obligation rose as much as two basis points from 2.13% on Tuesday, while the 30-year GO yield gained as much as two basis points from 3.00%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mostly steady on Wednesday. The yield on the two-year Treasury rose to 1.29% from 1.27% on Tuesday, while the 10-year Treasury yield was flat from 2.33%, and the yield on the 30-year Treasury bond was steady at 2.98%.

On Tuesday, the 10-year muni to Treasury ratio was calculated at 91.5%, compared with 91.9% on Monday, while the 30-year muni to Treasury ratio stood at 100.6%, versus 100.7%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 44,507 trades on Tuesday on volume of $9.01 billion.

Bond Buyer visible supply

The Bond Buyer's 30-day visible supply calendar decreased $3.02 billion to $11.68 billion on Tuesday. The total is comprised of $3.81 billion of competitive sales and $7.86 billion of negotiated deals.