Top-shelf municipal bonds were weaker at mid-session, traders said, as the market moved into a quiet, defensive mode ahead the Federal Open Market Committee's announcement on interest rates this afternoon.

The FOMC will announce its decision at 2 p.m., EST, but most policy experts are expecting the Federal Reserve will leave its fed funds target rate unchanged at between 0.25% and 0.50%.

Secondary Market

The yield on the 10-year benchmark muni general obligation rose by as much as one basis point from 1.57% on Tuesday, while the yield on the 30-year was as much as one basis point higher from 2.33%, according to a read of Municipal Market Data's triple-A scale.

Treasuries were also weaker Wednesday. The yield on the two-year Treasury rose to 0.80% from 0.77% on Tuesday, the 10-year Treasury yield gained to 1.71% from 1.69% and the yield on the 30-year Treasury bond increased to 2.45% from 2.43%.

On Tuesday, the 10-year muni to Treasury ratio was calculated at 93.0% compared to 92.7% on Monday, while the 30-year muni to Treasury ratio stood at 95.8% versus 95.3%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 33,645 trades on Tuesday on volume of $12.65c billion.

Primary Market

Barclays Capital repriced the Georgia Private Colleges and Universities Authority's $350.13 million of Series 2016 A&B revenue bonds for Emory University.

The $127.69 million of Series 2016A bonds were repriced as 4s to yield 2.92% and as 5s to yield 2.61% in a split 2046 maturity. The $222.44 million of Series 2016B bonds were repriced to yield from 0.77% with a 2% coupon in 2017 to 2.82% with a 4% coupon and 2.52% with a 5% coupon in a split 2038 maturity; a 2043 maturity was priced as 3s to yield 3.13%.

The deal is rated Aa2 by Moody's Investors Service, AA by S&P Global Ratings and AA-plus by Fitch Ratings.

RBC Capital Markets received the written award on the Pennsylvania Economic Development Financing Authority's $239.39 million of Series 2016 revenue bonds for the University of Pittsburgh Medical Center.

The UPMC bonds were priced to yield from 0.91% with a 4% coupon in 2018 to 3.10% with a 4% coupon and 3.23% with a 3.125% coupon in a split 2036 maturity; a 2041 maturity was priced as 4s to yield 3.17%. The deal is rated Aa3 by Moody's, A-plus by S&P and AA-minus by Fitch.

Bank of America Merrill Lynch received the official award on the Texas Water Development Board's $600.07 million Series 2016 State Water Implementation Revenue for Texas master trust revenue bonds. The SWIRFT bonds are rated triple-A by S&P and Fitch.

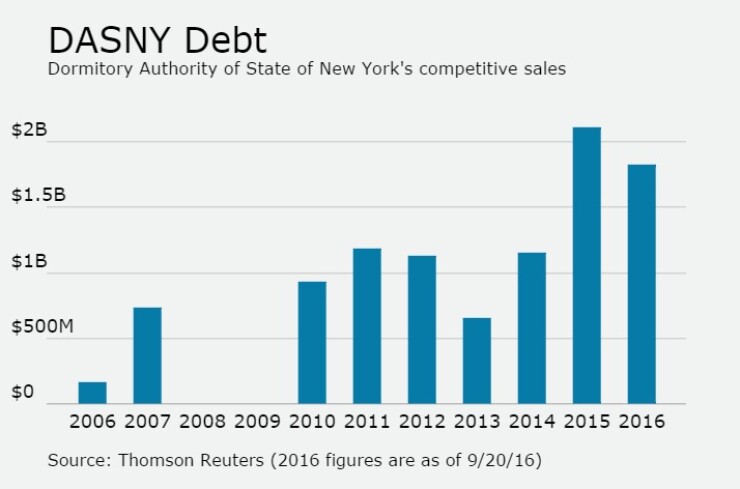

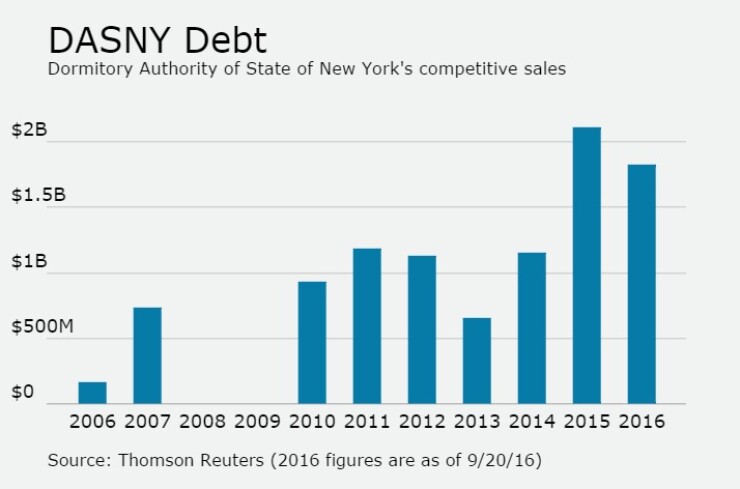

In the competitive arena on Thursday, the Dormitory Authority of the State of New York will sell over $1 billion of bonds in three separate offerings.

The deals consist of $409.16 million Series 2016A Group A state sales tax revenue bonds; $396.83 million of Series 2016A Group C state sales tax revenue bonds; and $310.94 million of Series 2016A Group B state sales tax revenue bonds.

The deals are rated triple-A by S&P.

Since 2006, DASNY has sold over $9 billion of competitive offerings. The most issuance was in 2015 when it put $2.11 billion of bonds out for the bid. It did not competitively sell bonds in 2008 or 2009.

Goldman Sachs plans to price the Pennsylvania Turnpike Commission's $649.89 million of subordinate revenue refunding bonds on Thursday.

The offering is expected to consist of $391.52 million of Subseries A bonds, $82.17 million of Subseries B taxables and $176.2 million of motor license fund enhanced bonds. The two subseries are rated A3 by Moody's and A-minus by Fitch, while the enhanced motor license series is rated A2 by Moody's and A-minus by Fitch.

Also on Thursday, Bank of America Merrill Lynch is set to price the Central Florida Expressway's $425 million of Series 2016B senior lien refunding revenue bonds. The issue is rated A2 by Moody's and A by S&P and Fitch.

Citigroup is expected to price the Turlock Irrigation District, Calif.'s $160 million of Series 2016 first priority subordinated revenue refunding bonds on Thursday. The deal is rated A-plus by Fitch.

RBC Capital Markets is expected to price the Indiana Finance Authority's $284.97 million of Series 2016D state revolving fund program green bonds and Series 2016E state revolving fund program refunding green bonds on Thursday. The deal is rated triple-A by Moody's, S&P and Fitch.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar decreased $1.09 million to $12.32 billion on Thursday. The total is comprised of $3.96 billion of competitive sales and $8.36 billion of negotiated deals.