The municipal bond market was taking a rest on Friday after a hefty week of issuance as participants geared up to see next week's new issue slate.

Secondary Market

U.S. Treasuries were weaker on Friday. The yield on the two-year Treasury rose to 1.19% from 1.18% on Thursday, while the 10-year Treasury gained to 2.42% from 2.39%, and the yield on the 30-year Treasury bond increased to 3.03% from 3.01%.

Top-rated municipal bonds ended weaker on Thursday. The 10-year benchmark muni general obligation yield rose three basis points to 2.28% from 2.25% on Wednesday, while the yield on the 30-year GO increased three basis points to 3.06% from 3.03%, according to the final read of Municipal Market Data's triple-A scale.

On Thursday, the 10-year muni to Treasury ratio was calculated at 95.2% compared to 95.9% on Wednesday, while the 30-year muni to Treasury ratio stood at 101.6%, versus 102.4%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 40,094 trades on Thursday on volume of $14.37 billion.

Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended Feb. 10 were from New York and California, according to Markit.

In the GO bond sector, the New York City 5s of 2028 were traded 57 times. In the revenue bond sector, the New York Metropolitan Transportation Authority 2s of 2017 were traded 106 times. And in the taxable bond sector, the California 7.55s of 2039 were traded 17 times.

Week's Most Actively Quoted Issues

Oregon and California names were among the most actively quoted bonds in the week ended Feb. 10, according to Markit.

On the bid side, the Portland, Ore., taxable 6.046s of 2020 were quoted by 374 unique dealers. On the ask side, the Los Angeles Unified School District, Calif., 5.755s of 2029 were quoted by 73 unique dealers. And among two-sided quotes, the California taxable 7.55s of 2039 were quoted by 25 unique dealers.

Week's Primary Market

Citigroup priced Salt Lake City, Utah's $1 billion of airport revenue bonds for the Salt Lake City Airport. The deal is rated A2 by Moody's Investors Service and A-plus by S&P Global Ratings.

Citi also priced New York City's $900 million of Fiscal 2017 Series C and D general obligation bonds. The offering was increased from $800 million. The deal is rated Aa2 by Moody's and AA by S&P and Fitch Ratings.

Additionally, Citi priced the state of Oregon's $418.1 million of tax-exempt general obligation bonds for various purposes. The deal is rated Aa1 by Moody's and AA-plus by S&P and Fitch.

Also, Citi priced the California Municipal Finance Authority's $396.21 million of Series 2017A revenue bonds for Community Medical Centers. The deal is rated Baa1 by Moody's and A-minus by Fitch.

And Citi priced the Richmond County Board of Education, Ga.'s $131.79 million of Series 2017 general obligation sales tax bonds. The deal, which is backed by the Georgia state aid intercept program, is rated Aa1 by Moody's and AA-plus by S&P.

Goldman Sachs priced the Trustees of California State University's $815.31 million of Series 2017A tax-exempt systemwide revenue bonds. Goldman also priced the system's $335.16 million of Series 2017B taxable revenue bonds. The deals are rated Aa2 by Moody's and AA-minus by S&P.

Goldman Sachs also priced Ohio University's $157.695 million of Series 2017A general receipts bonds. The deal is rated Aa3 by Moody's and A-plus by S&P.

Wells Fargo Securities priced the Rector and Visitors of the University of Virginia's $123.44 million of Series 2017B general revenue pledge refunding bonds. The deal is rated triple-A by Moody's, S&P and Fitch.

JPMorgan Securities priced the Dormitory Authority of the State of New York's $239.6 million of Series 2017 obligated group revenue bonds for the Orange Regional Medical Center. The deal is rated Baa3 by Moody's and BB-plus by Fitch.

In the competitive sector, the Fairfax County Water Authority, Va., sold $201.59 million of Series 2017 water revenue and refunding revenue bonds. Bank of America Merrill Lynch won the offering with a true interest cost of 3.31. The deal is rated triple-A by Moody's, S&P and Fitch.

The state of Nevada sold $159.02 million of Series 2017 motor vehicle fuel tax highway improvement revenue bonds. Bank of America Merrill Lynch won the bonds with a true interest cost of 3.46%. The deal is rated Aa2 by Moody's, triple-A by S&P and AA-minus by Fitch.

The Dekalb County School District, Ga., sold $131.03 million of Series 2017 general obligation sales tax bonds. JPMorgan won the bonds with a TIC of 1.495%. The deal is rated Aa1 by Moody's and AA-plus by S&P.

The state of Washington competitively sold $103.13 million of Series 2017A state and local agency real and personal property certificates of participation. BAML won the offering with a TIC of 3.24%. The deal is rated Aa2 by Moody's.

The South Broward Hospital District, Fla., sold $115.18 million of Series 2017 hospital refunding revenue bonds for the South Broward Hospital District Obligated Group. Bank of America Merrill Lynch won the deal with a TIC of 3.17%. The deal is rated Aa3 by Moody's and AA by S&P.

In the short-term competitive sector, the New York Metropolitan Transportation Authority sold $700 million of notes in two separate sales.

Seven groups won the MTA's $500 million of Series 2017 Subseries 2017A-1 transportation revenue bond anticipation notes while five groups won the MTA's $200 million of Series 2017 Subseries 2017A-2 transportation revenue BANs. The BANs are rated MIG1 by Moody's, SP1-plus by S&P and F1 by Fitch.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $2.86 billion to $9.35 billion on Friday. The total is comprised of $2.88 billion of competitive sales and $6.47 billion of negotiated deals.

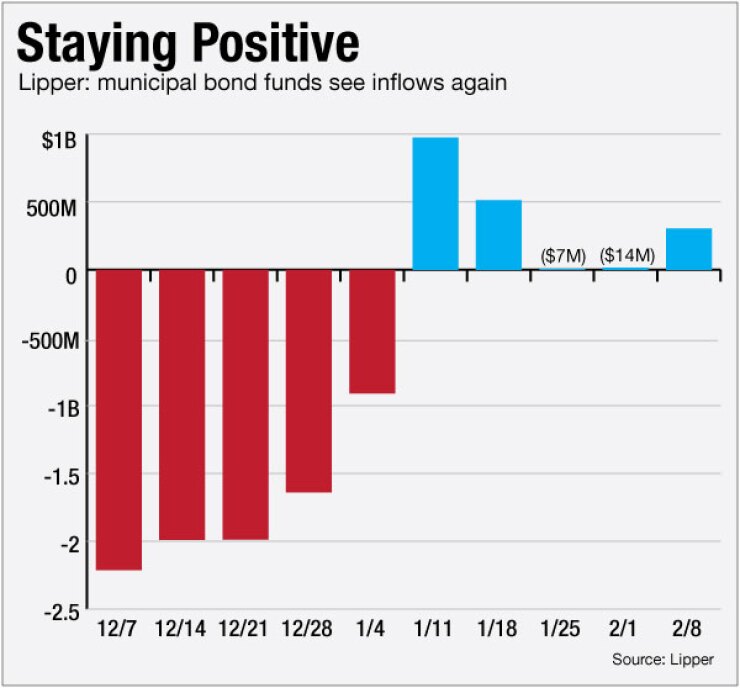

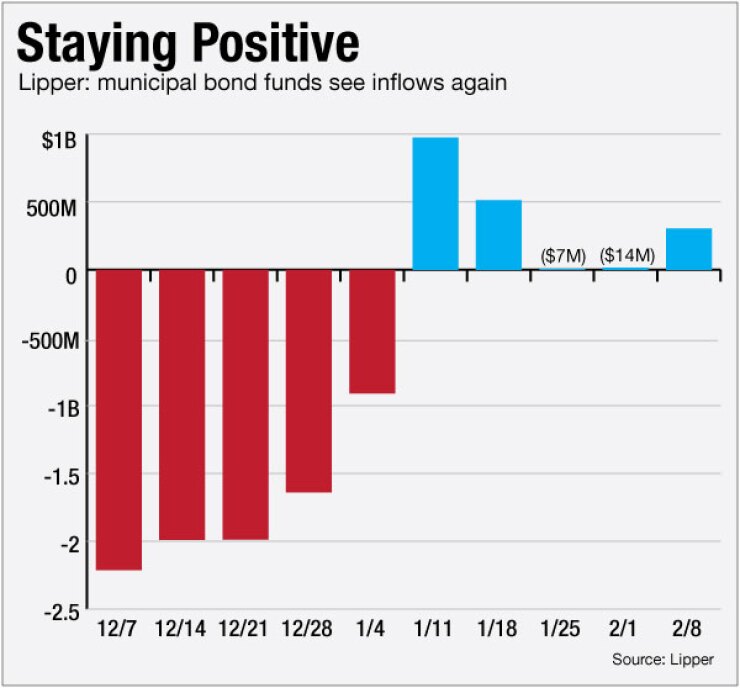

Lipper: Muni Bond Funds Report Inflows

Municipal bond funds attracted inflows again as investors continued their return to the market, according to Lipper data released late Thursday. The weekly reporters saw $304.200 million of inflows in the week ended Feb. 8, after inflows of $14.047 million in the previous week.

The four-week moving average remained in the green at positive $209.241 million, after being positive at $376.734 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also had inflows, gaining $274.984 million in the latest week after gaining $17.375 million in the previous week. Intermediate-term funds had inflows of $60.887 million after inflows of $18.018 million in the prior week.

National funds had inflows of $293.215 million after inflows of $31.490 million in the previous week. High-yield muni funds reported inflows of $286.427 million in the latest reporting week, after inflows of $187.718 million the previous week.

Exchange traded funds saw outflows of $62.055 million, after outflows of $70.187 million in the previous week.