Municipal bonds were stronger at mid-session as the first of the week’s new issue supply swept into the market.

Secondary market

The yield on the 10-year benchmark muni general obligation fell one to three basis points from 1.93% on Tuesday, while the 30-year GO yield dropped as much as two basis points from 2.77%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were little changed on Wednesday morning. The yield on the two-year Treasury was flat from 1.28% on Tuesday as the 10-year Treasury yield was unchanged from 2.21% while the yield on the 30-year Treasury bond was steady from 2.88%.

On Tuesday, the 10-year muni to Treasury ratio was calculated at 87.2%, compared with 86.8% on Friday, while the 30-year muni to Treasury ratio stood at 96.0%, versus 96.1%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 38,659 trades on Tuesday on volume of $8.30 billion.

Primary market

Morgan Stanley priced Connecticut’s $370 million of state revolving fund general revenue bonds for retail investors ahead of the institutional pricing on Thursday.

The $250 million of Series 2017A SRF green bonds were priced for retail to yield from 1.02% with a 3% coupon in 2020 to 3.08% with 3% and 4% coupons in a split 2036 maturity. The 2018 and 2019 maturities were offered as sealed bids. No retail orders were taken in the 2029-2032, 2034-2035 or 2037 maturities.

The $120 million of Series 2017B refunding bonds were priced for retail as 5s to yield 1.16% in 2021 and 1.46% in 2023. No retail orders were taken in the 2020, 2022 or 2024-2027 maturities.

The deal is rated triple-A by Moody’s Investors Service, S&P Global Ratings and Fitch Ratings.

Bank of America Merrill Lynch priced the Louisiana Local Government Environmental Facilities and Community Development Authority’s $249.09 million of Series 2017A tax-exempt and Series 2017B taxable hospital refunding revenue bonds for the Women’s Hospital Foundation.

The $229.12 million of Series 2017A tax-exempts were priced to yield from 1.74% with a 3% coupon in 2022 to 3.37% with a 5% coupon in 2027; a 2041 maturity was priced as 4s to yield 3.80% and a 2044 maturity was priced as 5s to yield 3.49%.

The $19.97 million of Series 2017B taxables were priced at par to yield from 2.05% in 2018 to 3% in 2022.

The deal is rated A2 by Moody’s and A by S&P.

Piper Jaffray priced the Austin Independent School District, Texas’ $219.36 million of Series 2017 unlimited tax school building and refunding bonds.

The issue was priced to yield from 1% with a 5% coupon in 2019 to 2.82% with a 5% coupon in 2037. The 2018 maturity was offered as a sealed bid.

The deal, which is backed by the Permanent School Fund guarantee program, is rated triple-A by Moody’s and Fitch.

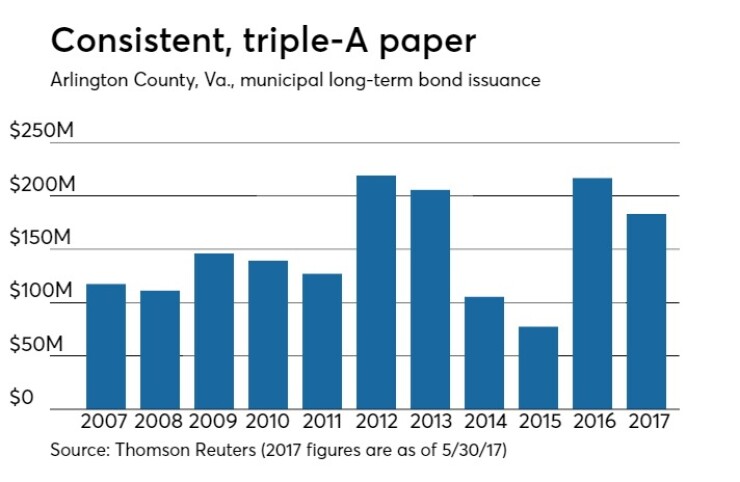

In the competitive arena, Arlington County, Va., sold $185.1 million of Series 2017 general obligation public improvement bonds.

JPMorgan Securities won the bonds with a true interest cost of 2.496%. The deal was priced to yield from 0.73% with a 2% coupon in 2017 to 2.83% with a 4% coupon in 2036.

The deal is rated triple-A by Moody’s, S&P and Fitch.

Since 2007, the county has issued roughly $1.75 billion of securities, with the most issuance occurring in 2010 when it sold $219 million. The county has been consistent the past decade, always selling between $100 and $220 million each year - with the exception of 2015 when it issued just $77.4 million.

On a smaller scale, Boston sold $59.31 million of Series 2017B general obligation refunding bonds.

BAML won the bonds with a TIC of 1.40%. The issue was priced as 5s to yield from 0.78% in 2018 to 1.01% in 2021 and from 1.28% in 2023 to 1.86% in 2027 and as 2s to yield 2.13% in 2028.

The deal is rated triple-A by Moody’s and S&P.

Bond Buyer 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $203.1 million to $12.54 billion on Wednesday. The total is comprised of $5.61 billion of competitive sales and $6.93 billion of negotiated deals.