Municipal bonds were trading stronger at mid-session as the largest deal of the week hit the municipal bond market.

Primary Market

Citigroup priced Massachusetts’ $767.97 million general obligation bond sale for institutions after holding a retail order period on Wednesday.

The $400 million of Series A consolidated loan of 2017 GOs were priced for institutions as 5s to yield from 2.88% in 2032 to 3.11% in 2037. A split 2042 maturity was priced as 5s to yield 3.20% and as 5 1/4s to yield 3.07% and a split 2047 maturity was priced as 5s to yield 3.25% and as 5 1/4s to yield 3.12%

The $100 million of Series B consolidated loan of 2017 green bond GOs were priced for institutions as 5s to yield from 1.81% in 2023 to 2.40% in 2027, 3.11% in 2037 and 3.25% in 2047.

The $267.97 million of Series C consolidated loan of 2017 refunding GOs were priced for retail as 5s to yield from 1.71% in 2022 to 2.44% in 2027. A 2017 maturity was offered as a sealed bid.

On Wednesday, the $400 million of Series A GOs were priced for retail as 5s to yield 2.88% in 2032. The 2033-2037 maturities were not offered to retail investors. The $100 million of Series B GOs were priced for retail as 5s to yield from 1.83% in 2023 to 2.42% in 2027 and 3.11% in 2037. A 2047 maturity was not offered to retail investors. The $277.6 million of Series C GOs were priced for retail as 5s to yield from 1.73% in 2022 to 2.46% in 2027. A 2017 maturity was offered as a sealed bid.

The Massachusetts deal is rated Aa1 by Moody’s Investors Service and AA-plus by S&P Global Ratings and Fitch Ratings.

Also on Thursday, Bank of America priced the California State Public Works Board’s $534.995 million of Series 2017 B&C various capital lease revenue refunding bonds for institutions after holding a one-day retail order period.

The $378.27 million of Series 2017B bonds were priced for institutions as 5s to yield from 0.85% in 2017 to 2.96% in 2030.

The $156.725 million of Series 2017C bonds were priced for institutions to yield from 0.90% with a 3% coupon in 2018 to 3.28% with a 5% coupon in 2035.

For retail, the $382.62 million of Series 2017B bonds were priced as 5s to yield from 0.85% in 2017 to 2.96% in 2030. No retail orders were taken in the 2028-2029 maturities. The $154.91 million of Series 2017C bonds were priced for retail to yield from 0.90% with a 3% coupon in 2018 to 3.28% with a 5% coupon in 2035.

The deal is rated A1 by Moody’s and A-plus by S&P and Fitch.

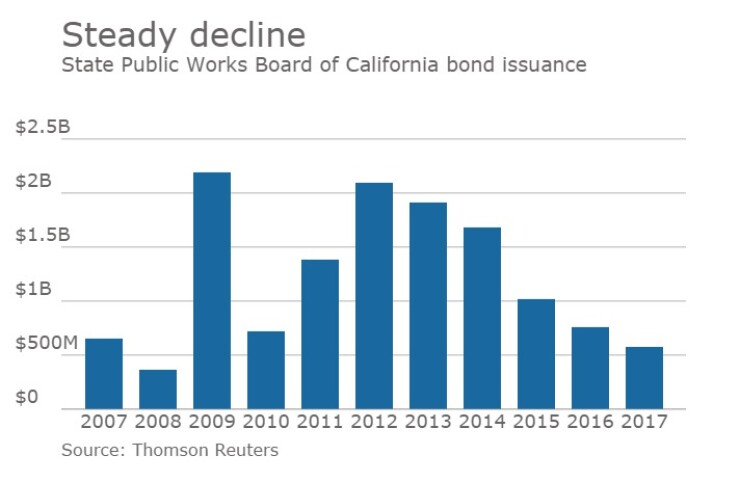

Since 2007, the board has sold about $13.4 billion of bonds, with the most issuance occurring in 2009 when it offered $2.19 billion of debt. The board saw a low year of issuance back in 2008, when it sold $365 million, one of only four times during that period when it sold less than $1 billion in a calendar year.

BAML is also expected to price the Maryland Department of Housing and Community Development’s $263 million of Series 2017 taxable residential revenue bonds.

The deal is rated Aa2 by Moody’s and AA by Fitch.

RBC Capital Markets priced the Desert Community College District, Calif.’s $125.31 million of Series 2017 crossover refunding GO refunding bonds.

The issue was priced to yield from 0.92% with a 2% coupon in 2018 to 2.81% with a 5% coupon in 2031; a 2033 maturity was priced as 5s to yield 2.95% and a 2039 maturity was priced as 4s to yield 3.63%.

The deal is rated Aa2 by Moody’s and AA by S&P.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar decreased $1.39 billion to $10.81 billion on Thursday. The total is comprised of $4.15 billion of competitive sales and $6.66 billion of negotiated deals.

Secondary Market

Top-rated municipal bonds were stronger on Thursday.

The yield on the 10-year benchmark muni general obligation fell by as much as two basis points from 2.20% on Wednesday, while the 30-year GO yield dropped as much as two basis points from 3.00%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mixed on Thursday. The yield on the two-year was unchanged from 1.25% on Wednesday, while the 10-year Treasury yield was flat from 2.36%, and the yield on the 30-year Treasury bond increased to 3.02% from 3.01%.

On Wednesday, the 10-year muni to Treasury ratio was calculated at 93.6% compared to 94.5% on Tuesday, while the 30-year muni to Treasury ratio stood at 99.9%, versus 100.6%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 46,166 trades on Wednesday on volume of $13.69 billion.

Tax-Exempt Money Market Fund Inflows

Tax-exempt money market funds experienced inflows of $92.4 million, bringing total net assets to $130.24 billion in the week ended April 3, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an outflow of $949.2 million to $130.15 billion in the previous week.

The average, seven-day simple yield for the 232 weekly reporting tax-exempt funds rose to 0.39% from 0.32% in the previous week.

The total net assets of the 862 weekly reporting taxable money funds decreased $12.97 billion to $2.489 trillion in the week ended April 4, after an inflow of $6.42 billion to $2.502 trillion the week before.

The average, seven-day simple yield for the taxable money funds increased to 0.40% from 0.38% in the prior week.

Overall, the combined total net assets of the 1,092 weekly reporting money funds decreased $12.87 billion to $2.619 trillion in the week ended April 4, after inflows of $5.47 billion to $2.632 trillion in the prior week.