Volatility continues to hang over financial markets due to COVID-19, and after a Monday that had all stocks down at least 6%, stocks rebounded Tuesday and muni yields were up as much as 16 basis points — Tuesday munis saw a correction.

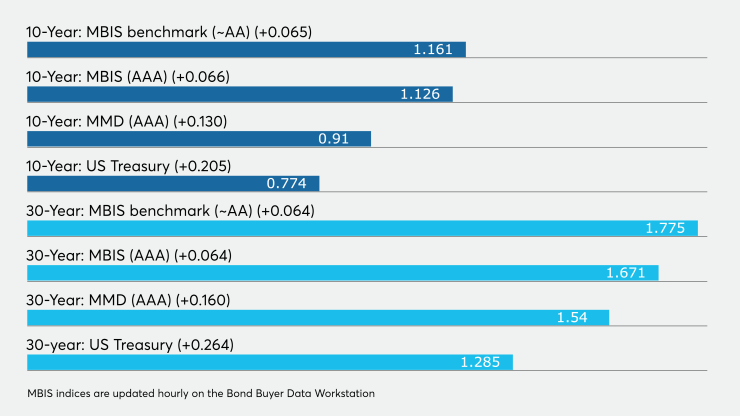

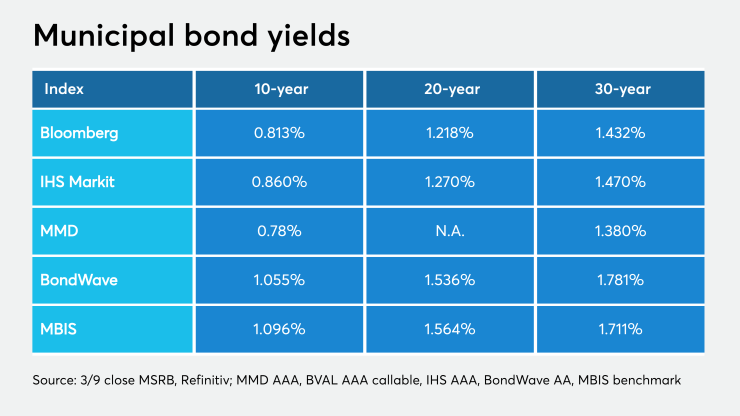

Munis were weaker on Tuesday on the MBIS benchmark scale, with yields rising six basis points in the 10-year and by six basis points in the 30-year maturity. High-grades were also weaker, with yields on MBIS' AAA scale increasing by six basis points in the 10-year maturity and by six basis points in the 30-year maturity.

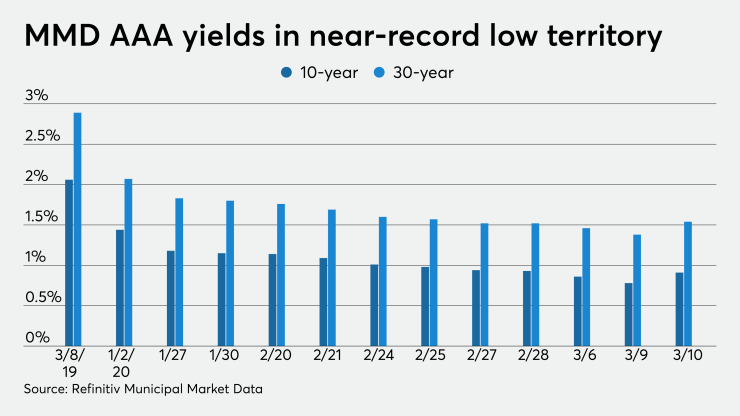

Munis weakened on Refinitiv Municipal Market Data’s AAA benchmark scale, as the yield on the 10-year muni GO was 13 basis points higher to 0.91% off of a historic low of 0.78% and the 30-year rose 16 basis points to 1.54% from a historic low 1.38%.

BVAL, ICE, IHS also cut their curves, with eight to15 basis points cuts. "All things being equal, muni benchmarks and pricing services are probably just struggling in general to keep up with the volatility in this market," a New York trader said.

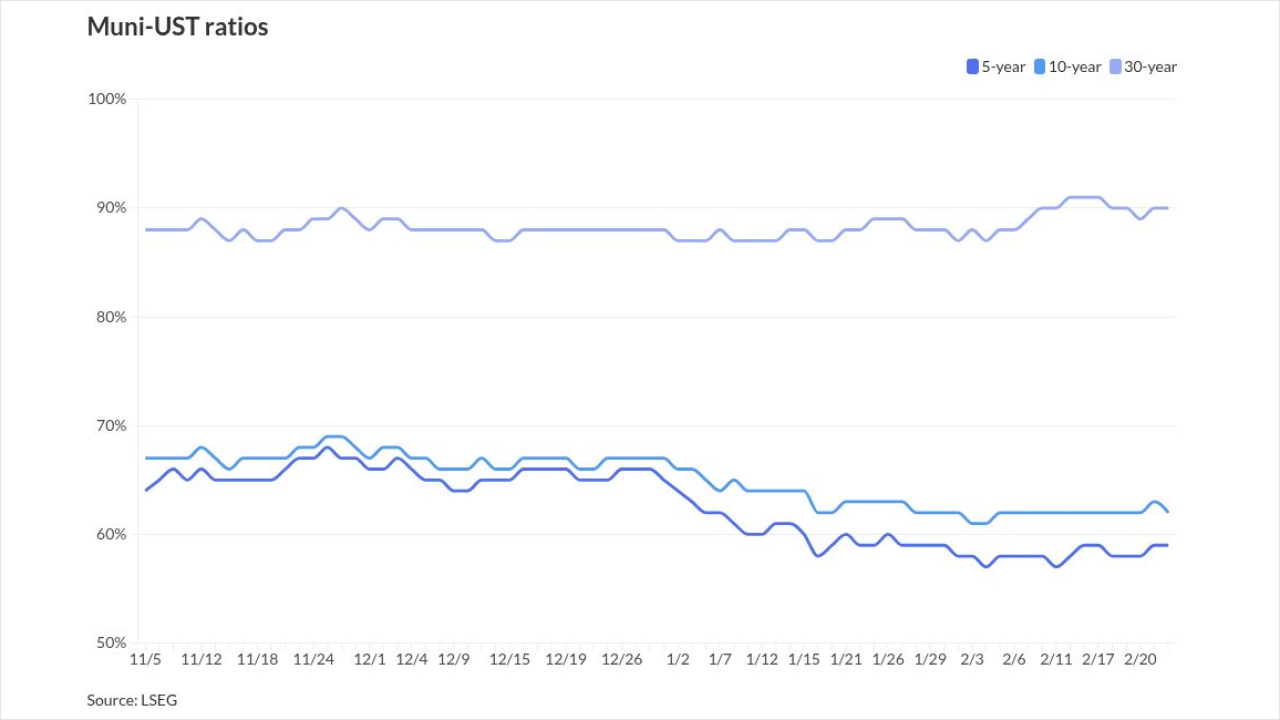

The 10-year muni-to-Treasury ratio was calculated at 121.2% while the 30-year muni-to-Treasury ratio stood at 126.1%, according to MMD.

“Muni yields are giving back everything gained yesterday and then some,” according to ICE Data Services. “The ICE muni yield curve is anywhere from eight to 12 basis points higher at midday. High-yield is up 10 basis points for choice, ex. tobaccos, which are only five basis points higher after yesterday’s underperformance. Taxable yields are seven to 12 basis points higher.”

Stocks rebounded slightly and were potentially helped by President Trump’s proposal for a payroll tax cut.

The Dow Jones Industrial Average was up about 3.35%, the S&P 500 index was higher by 3.49% and the Nasdaq gained roughly 3.54% late in the session Tuesday.

The three-month Treasury was yielding 0.440%, the Treasury two-year was yielding 0.495%, the five-year was yielding 0.639%, the 10-year was yielding 0.774% and the 30-year was yielding 1.285%.

“I am not sure what to make of this market, as the swings and extremes are like nothing I have seen before,” a trader said.

The trader added that it has created some 100 plus percentages of Treasuries across the muni curve.

“However, we have also started seeing mutual fund outflows. I have to believe munis will uncouple from Treasuries.”

Another trader also said he has never seen anything like this before.

“Now we are really going to start hearing and seeing the 'R' word and it is possible it can happen a lot sooner than people had thought,” he said. “It looks like things will be worse [with COVID-19] before it will start to get better.”

Coronavirus fears remain evident in the municipal market on Tuesday and continued to impact new-issue and secondary market pricing, according Peter Block, managing director of credit research at Ramirez & Co. in New York City.

The lower trading volumes, dislocated ratios, and wider spreads are a function of lower levels of market liquidity, he said.

At midday, Block observed trading volume down about 30% versus the average levels earlier in the morning.

“Accounts experiencing redemptions or outflows and that need to raise cash are selling more liquid names at wider spreads to compensate for rock bottom absolute levels,” he said, noting that ratios remain dislocated as MMD yields have lagged Treasuries.

“We are using this opportunity to pick up high-quality names at better levels as the dislocation is temporary and should subside as fears abate,” Block said.

“We like large hub airports, short-average life tobacco, high-grade hospitals, and anything else with solid fundamentals but tainted by fear of the virus,” he explained.

Floating rate securities also look attractive as SIFMA remains affected by dislocated short-term bank funding, Block added.

In the primary market Tuesday, Citi priced California’s (Aa2/AA-/AA/NR) $2.08 billion of various purpose general obligation bonds and refunding bonds. The deal was priced with few 5% coupons, and with more 2s, 3,s and 4s.

The premarketing scale had the 2030 maturity priced as 4s to yield 0.98% or 20 basis points above the MMD scale, while the 2050 maturity was priced as 3s to yield 2.23% or 85 basis points above MMD.

Then, the preliminary pricing saw higher yields from the premarketing, as the 2030 maturity was priced as 4s to yield 1.07% and the 2050 maturity was priced as 3s to yield 2.33%.

Going off the cuts MMD scale saw today, that would put the deal 16 basis points above MMD on the 10-year and 79 basis points above MMD on the 30-year.

If you compared today’s levels to the last time Cal came to market (Sept. 6, 2019) that deal was priced as 5s to yield 1.48% in the 2030 maturity. And while it repriced to higher yields, given how AAA benchmarks reset, the state still was getting a good deal, sources said.

Barclays priced New York City Municipal Water Finance Authority’s (Aa1/AA+/AA+/ ) $381.83 million of water and sewer second general resolution revenue bonds.

In secondary market trading, a few large block trades of note today showed wider spreads on likely COVID-19-affected credits, including the Graceland project bonds in Nashville, Las Vegas Convention Center long bonds and Dulles Metro toll road bonds, which showed yields of 2.80%-2.77%, up from 2.42% a month ago, per Jon Barasch, director at ICE Data Services.

Meanwhile, participants said that the uncharted waters that munis are facing show how illiquidity and sitting on the sidelines is confusing the municipal market.

"There are no risk takers right now. Wall Street has definitely scaled down their ability to take risks, so you add a shock to the market like this and you have violent moves,” a California-based strategist said. “Retail really has no idea yet. They'll start to figure it out. It's very easy to run short of muni funds. Psychologically, you add this element of the economy slowing and all elements of muni credit are going to come under the microscope. Higher ed, stadiums, convention centers, CCRCs — it's an amorphous credit spectrum. The impacts are going to be felt and they're going to put stress on municipalities, stress on credit and some folks are going to become forced sellers."

While it might be a bit premature to speculate about retail retreating from the market, the question still needs to be asked. Some noted that back when Meredith Whitney made the call in 2010 that hundreds of billions of munis would default it was so specific to munis that trying to compare it to current conditions doesn't work.

"Meredith Whitney was a credit scare that was isolated to munis,” the strategist said. “Right now, all the markets are under pressure and there is a lot of collateral damage getting whacked in the market. How do you hedge in this market? How do you take a position right now? We're in a completely different environment than we ever have been before."

Christine Albano, Chip Barnett and Lynne Funk contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.