Municipals were little changed to start the week, while U.S. Treasuries were slightly weaker and equities were mixed.

The two-year muni-Treasury ratio was at 56%, the three-year at 57%, the five-year at 59%, the 10-year at 61% and the 30-year at 88%, according to Refinitiv MMD's 3 p.m. ET read. ICE Data Services had the two-year at 58%, three-year at 57%, the five-year at 58%, the 10-year at 62% and the 30-year at 89% at 4 p.m.

"Munis just went on one of the largest one-week tears this year, but the odds of an uninterrupted run don't look high to us," said Eric Kazatsky, head of municipal strategy at Bloomberg Intelligence.

When absolute rates move lower, munis "tend to lag at first (as seen two weeks ago)," he said. Then, as USTs pause or reverse, "munis can't apply the brakes and yields keep on accelerating lower," according to Kazatsky.

The latter has happened over the past five trading days, he said, "as tax-exempts left taxable equivalents in the dust."

Munis outperformed in every tenor, and "the largest margin was in the 10-year portion of the curve, where munis declined 12 bps more than U.S. Treasuries," he said. Both the five- and 30-years "had about 10 bps of outperformance by exempts," he noted.

The trend in UST yields "was higher in the back half of last week, indicating munis could finally take a pause," Kazatsky said.

Munis surged "this past week as economic data this past week indicated a softer economic outlook causing traders to move to safer investments," said Jason Wong, vice president of municipals at AmeriVet Securities.

Muni yields fell across the curve once more, "with 10-year notes falling by 16.4 basis points to finish the week at 2.11%," he said.

With the rally in munis, the 10-year muni-UST ratio was at 61% on Monday, per MMD.

"The muni curve flattened by 3.4 basis points to 93 basis points last week as traders and investors continue to favor the short end due to recent economic data that continues to revive recession fears," Wong said.

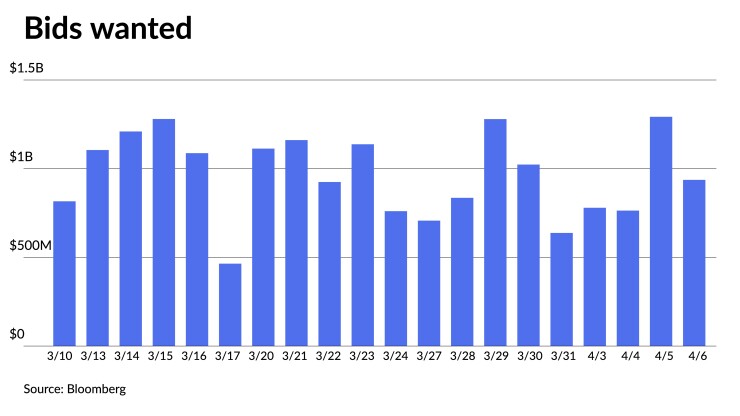

Trading for the holiday-shortened week was around $27.89 billion, while bids wanteds fell to around $3.77 billion for the week, he said.

Outflows lessened last week as investors pulled $92 million from mutual funds after outflows of $194 million the week prior, according to Refinitiv Lipper. Wong noted $1 billion has been added to muni funds year-to-date.

"Although we have seen positive inflows this year, the majority of the inflows were in the first month of the year," he said.

After another week of falling yields, ratios remain rich, more in particularly in the front end, he said.

"Ratios in bonds maturing in 10-year and in are averaging about 62%," he said.

Wong said the short end is in "extremely rich territory … as we are starting to see ratios fall closer to their record lows back in February of this year."

"From a performance standpoint, long duration has been a winner for muni investors in 2023," Kazatsky said.

The muni long bond index "has returned 5.92%, compared with just 1.26% for one-year munis," he said.

Despite this, Kazatsky said, "maximum yield might not be found in long munis, since the curve inversion still has some normalization to come."

"Dislocation in the curve has led to the MUNIPSA Index yielding 3.07% after last week's reset," he said. "This yield exceeds almost all tenors of the AAA curve, with the exception of 30-year munis."

Lower credit has also been a winner this year, with "BBB munis outperforming AAA exempts by 140 bps," he said.

However, Kazatsky said, "sector appears to have limited room to run, even if primary supply struggles to meet full-year expectations."

There was little "disconnect between municipal-bond issuance on a weekly basis and the projected pipeline over next 30 days," for a majority of the year, he said.

"Some of that stemmed from bond issuers' reluctance to issue with rates higher, and recent volatility also held some sales in check," Kazatsky said. "Now that rates have dropped, 30-day supply figures are heating up and stand at $12 billion, $4 billion above the long-term average for SPLYTOT."

Secondary trading

Maryland 5s of 2024 at 2.41%-2.26% versus 2.43% Wednesday. California 5s of 2024 at 2.46%-2.41%. DC 5s of 2025 at 2.31%.

Oregon 5s of 2029 at 2.11%. Florida 5s of 2029 at 2.10%. NY State Urban Development Corp. 5s of 2030 at 2.13%.

DC 5s of 2033 at 1.97%. Montgomery County, Pennsylvania, 5s of 2033 at 2.09%. California 5s of 2036 at 2.63% versus 2.76%-2.66% original on Thursday.

Hoover, Alabama, 5s of 2043 at 3.24% versus 3.30% Wednesday. California 5s of 2045 at 3.25%-3.21% versus 3.38%-3.30% original on Thursday.

AAA scales

Refinitiv MMD's scale was bumped up to two basis points. The one-year was at 2.39% (-2) and 2.26% (-2) in two years. The five-year was at 2.08% (-2), the 10-year at 2.10% (unch) and the 30-year at 3.18% (unch) at 3 p.m.

The ICE AAA yield curve was mixed: 2.47% (+1) in 2024 and 2.34% (+1) in 2025. The five-year was at 2.05% (+1), the 10-year was at 2.10% (-1) and the 30-year was at 3.22% (-1) at 3 p.m.

The IHS Markit municipal curve was unchanged: 2.39% in 2024 and 2.26% in 2025. The five-year was at 2.07%, the 10-year was at 2.08% and the 30-year yield was at 3.17%, according to a 4 p.m. read.

Bloomberg BVAL was little changed: 2.36% (unch) in 2024 and 2.29% (unch) in 2025. The five-year at 2.07% (unch), the 10-year at 2.09% (-1) and the 30-year at 3.18% (unch) at 4 p.m.

Treasuries were weaker.

The two-year UST was yielding 4.009% (+2), the three-year was at 3.775% (+3), the five-year at 3.523% (+3), the seven-year at 3.472% (+2), the 10-year at 3.419% (+2), the 20-year at 3.744% (+1) and the 30-year Treasury was yielding 3.630% (+2) at 4 p.m.

March jobs report redux

U.S. employers added 236,000 jobs in March, making it "another month of solid job gains, albeit at a slower pace than in recent months," said Phillip Neuhart, director of Market and Economic Research at First Citizens Bank Wealth Management.

"The decline in the unemployment rate indicates continued tightness in the labor market," he said. "With no material loosening in the jobs market, the Federal Reserve's fight against inflation remains a difficult one."

Under normal circumstances, Wells Fargo Investment Institute Global strategist Gary Schlossberg said, "a solid jobs report, close enough to expectations in its most visible points [has] a pretty muted response by the markets."

"But these aren't normal times," he said. "Investors were priced for less, in the wake of last month's banking turbulence and a series of weak labor-market releases this week pointing toward a 'soft' report."

However, Schlossberg said Friday's "report shines a light on the economy's most visible source of strength."

"With inflation still well above the Fed's 2% target rate, odds heavily favor another rate hike — a likely 25 basis points — by the Federal Reserve on May 2," he said.

Wednesday's consumer price index report for March and other data "in the run up to the Fed's early-May policy announcement [will see if a more sober policy outlook holds," Schlossberg said.

The March jobs report "shows some softening in the U.S. labor market is finally underway, but more softening will be required to completely bring labor market supply and demand into balance," said Scott Anderson, chief economist and executive vice president at Bank of the West.

Without further rebalancing, he said, "the Fed may only be partially successful in returning inflation back to its 2.0% target in a timely fashion."

The Fed, Anderson said, "will see this report as only a partial success in achieving their inflation objective and that more work on rebalancing the labor market will be needed in the months ahead."

He believes there will be "another 25 basis point hike at the May FOMC is still more likely than not," as nothing in Friday's jobs report changes his mind.

"It also means that recent market fears of an imminent hard landing for the U.S. economy and expectations for sharp Fed rate cuts before the end of this year may once again be premature," Anderson said.

Christian Chan, chief investment officer of AssetMark, said the March jobs report "gives policymakers some comfort that the economy is drifting slower but not hitting a wall," noting "there is something for everyone — team growth and team inflation."

He noted the addition of 236,000 jobs was the smallest since the COVID-19 recession but is "consistent with previous periods of economic expansion.

"The trend is clearly lower, suggesting the economy is slowing (the Fed wants to see this)," Chan said.

The inflation picture, he said, will be helped by the slowing of wage growth.

"The composition the gain reflects broader economic trends — manufacturing in decline, and services growing but at a slower pace," he said.

"The labor market remains very strong, albeit gradually slowing, largely supported by job growth in the services sectors," said Olu Sonola, head of U.S. economics at Fitch Ratings.

She noted the "report shows outright job losses in the manufacturing and construction sectors," signaling "that the Fed's aggressive rate hiking cycle is now constraining labor demand, particularly in interest rate sensitive sectors."

"The unemployment rate was largely unchanged on the back of a slight uptick in the labor force participation rate," Sonola said. "Wage growth also seems to be stabilizing at a moderate rate." Overall, she said, "this report will likely not alter the trajectory of future hikes that the Fed has communicated to the market."

Friday's jobs report suggests a softening to the labor market, said economist Sean Snaith.

"When you look at today's data coupled with February's reported job openings, there's still a lot of fat in the labor market as we approach the next recession that historically hasn't been there," he said.

"We're not going to see widespread job cuts for what's shaping up to be a mild recession," Snaith added.

The report indicates the Fed is not done hiking rates, and Snaith predicts one or two more rate hikes to fight inflation.

Chan said the probability of a rate hike at the May FOMC meeting increase from around 50% to around 70%.

"Overall, I liked this report," he said, as "it came very close to expectations [and] showed that the economy is slowing but not crashing."

Primary to come

The California State Public Works Board (Aa3/A+/AA-/NR/) is set to price Wednesday $467.265 million of various capital projects lease revenue bonds, consisting of $51.245 million of new-money bonds, Series 2023A, serials 2023-2043, term 2047, and $416.020 million of refunding bonds, Series 2023B, serials 2023-2037. RBC Capital Markets.

The Irvine Facilities Financing Authority, California (/AA//) is set to price Wednesday $434.608 million of Build America Mutual-insured Irvine Great Park Infrastructure Project special tax revenue bonds, Series 2023A, consisting of $418.360 million of current interest bonds, serials 2026-2043, terms 2048, 2053 and 2058, and $16.248 million of capital appreciation bonds, serials 2049-2050, term 2045. Stifel, Nicolaus & Co.

The Idaho Housing and Finance Association (Aa1/NR/AA+/NR/) is set to price Wednesday $368.145 million of Transportation Expansion and Congestion Mitigation Fund bonds, Series 2023A, serials 2024-2043, term 2048. Citigroup Global Markets.

The Los Angeles County Metropolitan Transportation Authority (Aa1/AAA/NR/NR/) is set to price Tuesday $238.265 million of senior Proposition C sales tax revenue refunding Bonds, Series 2023-A, serials 2024-2038. Citigroup Global Markets.

The Modesto Irrigation District Financing Authority, California (/A+/AA-/) is set to price Thursday $174.575 million of electric system revenue bonds, consisting of $126.575 million of new-money bonds, Series 2023A, and $48 million of refunding bonds, Series 2023B. Goldman Sachs.

Raleigh, North Carolina, is set to price Thursday $150.565 million of GOs, consisting of $145.835 million of public improvement bonds, Series 2023A, serials 2024-2043, and $4.730 million of taxable housing bonds, Series 2023B, serials 2024-2043. PNC Capital Markets.

The North Carolina Housing Finance Agency is set to price Tuesday $150 million of non-AMT social home ownership revenue bonds, Series 50, serials 2024-2035, terms 2038, 2043, 2046 and 2054. Wells Fargo Bank

The South San Francisco Unified School District (Aa1///) is set to price Wednesday $149.995 million of Election of 2022 GOs, Series 2023, serials 2024-2025 and 2033-2043, terms 2048 and 2052. RBC Capital Markets.

The Indiana Housing And Community Development Authority (Aaa/NR/AAA/NR/) is set to price Tuesday $148.215 of social single-family mortgage revenue bonds, consisting of non-AMT 2023 Series B-1 bonds, AMT 2023 B-2 bonds and taxable 2023 Series B-3 bonds. J.P. Morgan Securities.

The Texas City Independent School District (/AAA//) is set to price Tuesday $139 million of PSF-insured unlimited tax school building bonds, Series 2023, serials 2024-2053, Raymond James & Associates.

The Rhode Island Health and Educational Building Corp. (A2/A/NR/NR/) is set to price Wednesday $114.070 million of Providence College Issue higher education facility revenue bonds, Series 2023, serials 2025-2043, terms 2047 and 2053. Citigroup Global Markets.

The Ventura Unified School District, California (A1///), is set to price Thursday $113.000 of Election of 2022 GOs, Series A, serials 2024-2025 and 2032-2043, terms 2048 and 2052. RBC Capital Markets.

The Pleasanton Unified School District, California (Aa2///), is set to price Tuesday $100 million Election of 2022 GOs, Series 2023, serials 2024-2025 and 2032-2043, terms 2048 and 2052. Stifel, Nicolaus & Co.

Competitive

Louisiana (Aa2/AA-//) is set to sell $251.105 million of GOs, Series 2023-A, at 10:15 a.m. eastern Thursday.

Anne Arundel County, Maryland, (Aaa/AAA//) is set to sell $203.345 million of GOs, including $135.830 million of consolidated general improvement bonds, Series 2023, and $67.515 million of consolidated water and sewer bonds, Series 2023, at 10:45 a.m. Thursday.

The county is also set to sell $63.670 million of GOs, consisting of $41.405 million of refunding consolidated general improvement bonds, Series 2023, and $22.265 million of refunding consolidated water and sewer bonds, Series 2023, at 11:15 a.m. Thursday.

New Mexico is set to sell $233.320 million of capital projects GOs, Series 2023, at 10 a.m. Thursday.

Portland Public Schools, Oregon (Aa1/AA+//), is set to sell $230.775 million of GOs, Series 2023, Bidding Group 1, at 11 a.m. Thursday.

The school system is also set to sell $189.225 million of GOs, Series 2023, Bidding Group 1@, at 11:15 a.m. Thursday.